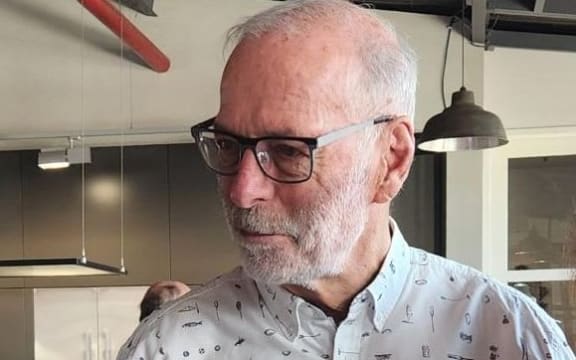

Mayor Wayne Brown says the council is paying $88 million a year to service the debt associated with the airport shareholding. (file picture) Photo: RNZ / Samuel Rillstone

Auckland Council will discuss whether it should sell off its ownership in the city's airport next week, with the public set to give input next year.

Mayor Wayne Brown said the sale of its 18 percent stake would raise nearly $2 billion, and slash the rate-rise slated for next year by almost a third.

The council was paying $88 million a year to service the debt associated with the airport shareholding, Brown said.

Mayor Wayne Brown Photo: RNZ / Lucy Xia

"Over the last three years, ratepayers have paid $240m in debt servicing costs to hold a bunch of shares that haven't paid a cent in dividends," he said.

"The cost of holding these shares exceeds any return, and forecasts suggest this situation will not be reversed for Auckland Council as a shareholder in the foreseeable future."

Craig's Investment Partners head of research Mark Lister said the council needed to take a ruthless look at its investments.

"It could be a sensible move for them given they need the money, to be honest," Lister said.

"With the cost of debt rising, it could well be a sensible option to sell down some or all of that holding."

The council's airport ownership stake did not give it much influence over the company, which would truck along fine if the council did sell up, he said.

In 2008, the government effectively blocked a partial takeover of the airport by a Canadian pension fund.

Lister doubted any council sale would make the airport more vulnerable to a similar attempt.

"The likelihood of them being approved to purchase or take over Auckland Airport is very low, so I would see that as quite a low risk."