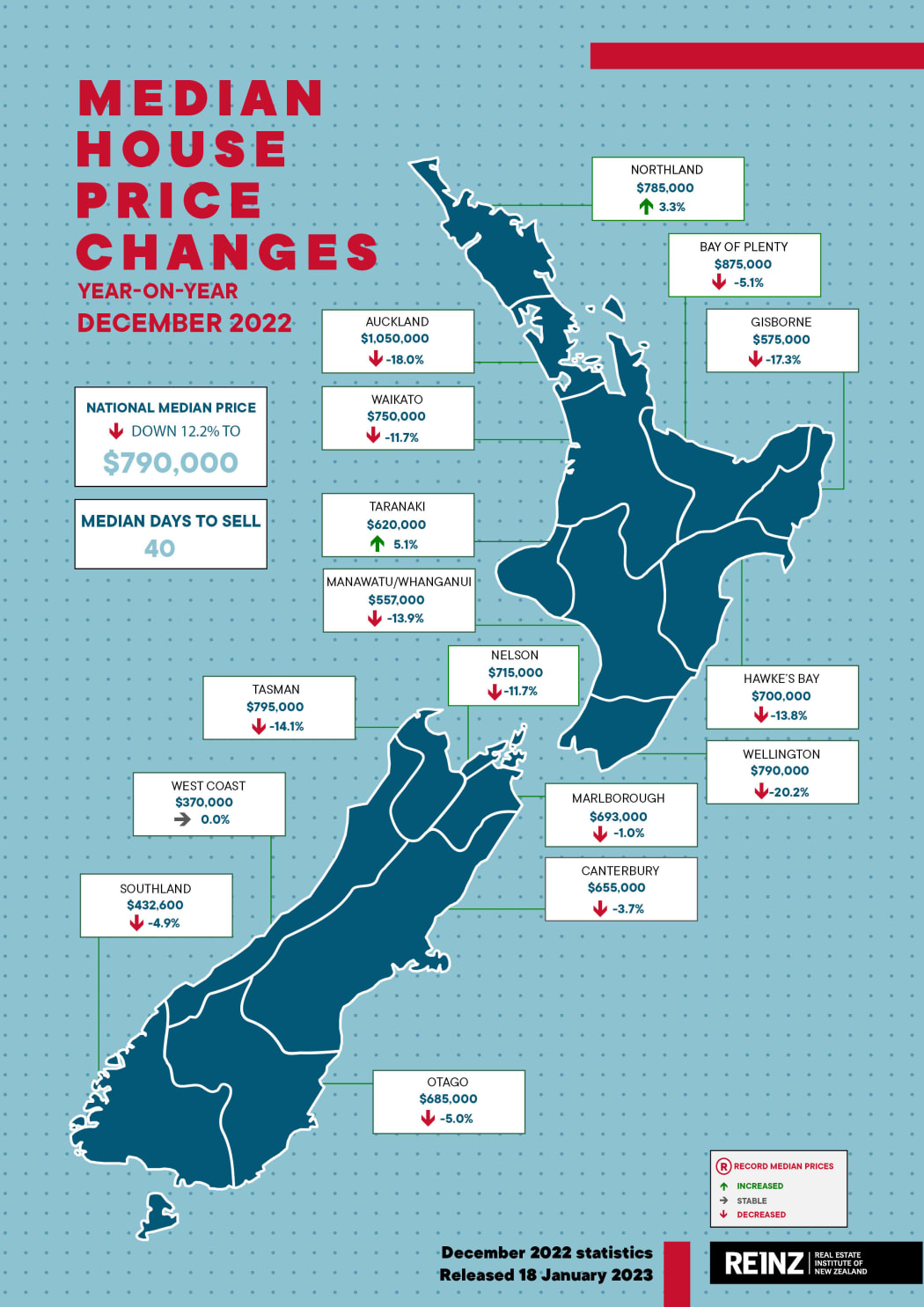

Wellington saw the biggest fall in prices - down 20 percent. Photo: RNZ / Marika Khabazi

House prices continued to drop last month, as sales fell and inventories grew.

The Real Estate Institute's (REINZ) House Price Index, released on Wednesday, showed an annual decrease of 13.7 percent in the national value of residential property in December.

The median price for residential property fell a seasonally adjusted 12 percent to $790,000. Outside of Auckland, it fell 8 percent to $700,000.

Wellington saw the biggest fall in prices - down 20.2 percent - followed by Auckland (down 18 percent), Gisborne (17.3 percent), Tasman (14.1 percent), Hawke's Bay (13.8 percent), Waikato (11.7 percent) and Nelson (11.7 percent).

In the Auckland region Papakura led the fall, the median dropping 23.6 percent, followed by Waitakere City (down 20.5 percent). This is the first time since the global financial crisis Auckland has recorded eight consecutive months of price drops.

In Wellington, Upper Hutt City and Wellington City values fell almost a quarter.

Only a couple of regions saw gains, including Northland (3.3 percent) and Taranaki (5.1 percent). West Coast broke even, the median price static at $370,000.

How house prices have changed in the past year, by region. Photo: REINZ

REINZ chief executive Jen Baird said overall, prices continued to ease but the pace of the decline was slowing, the market settling at its new pace.

Market inventory rose 55 percent to more than 26,000 properties, despite new listings dropping a quarter, while the number of days to sell increased by 11 to 40.

"Buyers' ability to secure finance and service a mortgage remains a key driver to buyers taking their time," said Baird.

The number of residential property sales fell 24 percent from November, 39 percent on the year earlier.

"If you can make the finances work, this is a good time to be a buyer," said Baird.

"More stock, less competition and prices continuing to ease, will allow those who can get all the ducks in a row to buy well."

But with interest rate rises likely in the near future, Baird said buyers are being cautious. Banks' increased scrutiny of their finances is also holding up some sales, she added.

"Cheaper prices coupled with more choice for buyers means sellers have to be realistic about their price and timing expectations."

First Home Buyers Club director Lesley Harris said the correction was welcome but there were other headwinds for potential buyers.

"People have been spending that stress tested margin more on the cost of living increases," Harris said.

"First home buyers tend to be renters so they are paying all time high rents, cost of living's at an all time high and now we're also seeing an increase of interest rates - which basically means you can lend less and you can service less. We're yet to see any really good news."

First home buyers who refixed at higher interest rates would be doing everything they could to hold onto their asset, such as getting in boarders, she said.

Kiwibank chief economist Jarrod Kerr said homeowners were aware of upcoming headwinds.

"We're hearing signs of stress but we're not actually seeing a lot in the way of defaults or mortgagee sales so at this stage people are complaining and worried about finances but they're not stressed enough that they have to sell their home."

The fall in house prices show the Reserve Bank's move to curb inflation is working but he questioned how far it needs to go Kerr said.

"The big risk here is that the central bank does too much. They did too much in the way of easing and overstimulated the economy and I now think there's a risk that they over tighten and cause too much of a slowdown in housing and the economy."