ANZ economists estimate it would take 37 years and low house price growth for the house price to income multiple to return to 2019 levels; They expect small rate hikes to go a long way towards cooling the economy

by Jenée Tibshraeny

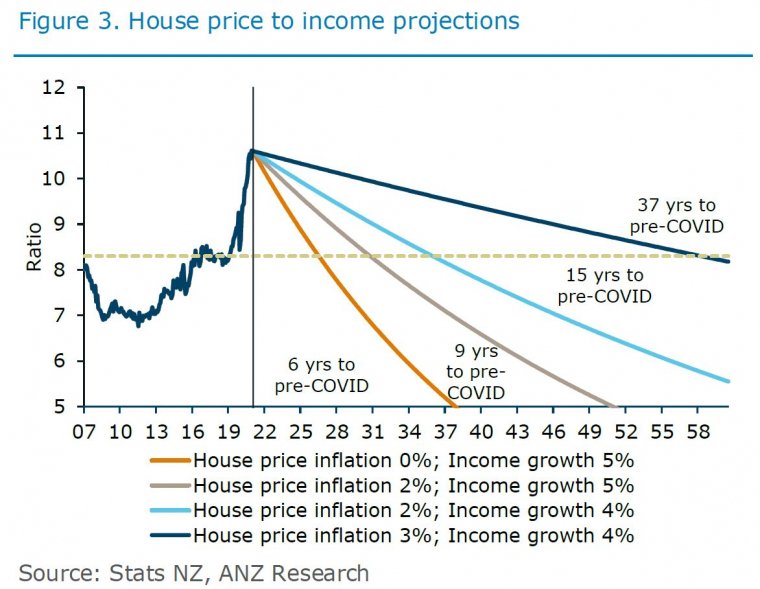

ANZ economists estimate it would take 37 years of low house price growth for the house price to income multiple to fall to 2019 levels.

They say it would take annual house price growth of 3% and income growth of 4% over 37 years for the median house price to be 8.3 times larger than the median disposable household income.

Currently, house prices are 10.5 times larger than disposable household incomes. 8.3 was the already elevated multiple in June 2019.

ANZ’s senior strategist David Croy, chief economist Sharon Zollner, and senior economist Miles Workman said: “It’s still early days of course, but the experience to date suggests policy changes [IE reintroduction of loan-to-value ratio restrictions, removal of interest deductibility, extension of the bright-line test] so far are not on their own going to bring about different, and more equitable, housing outcomes.

“House price inflation is still running at an elevated monthly pace...

“Properties available for sale remain very low, and the only real solution to this madness in the longer run is to build more houses…

“However, we just don’t think it’s feasible for growth in house prices to significantly outpace income growth for much longer, as at the end of the day someone has to pay the rent or service the mortgage sitting behind such exorbitant house prices.

“Further, while the picture might change, on current forecasts, the multi-decade tailwind of low interest rates is probably finding a bottom.”

More debt = more sensitivity to rate hikes

Croy, Zollner and Workman expanded on the view Zollner shared with interest.co.nz in early-July; that all the mortgage debt racked up will see Official Cash Rate (OCR) hikes have a particularly large cooling effect on the economy.

They estimated all New Zealand’s debt, including central government, local government, housing and personal, business and agricultural, and corporate debt was $692 billion as at April. This was more than twice the value of New Zealand’s entire economy/GDP.

They estimated $99 billion of that debt had been accumulated since the end of 2019.

It’s worth noting the Reserve Bank (RBNZ) owns most of the new government debt issued, and business and agricultural debt is the only category that didn’t increase.

“In per capita terms, total debt by this measure rose from $118,000 per person at the end of 2019 to $135,500 in April,” Croy, Zollner and Workman said.

However, average annual household incomes only rose by $3,000 over this time.

“No matter how you cut it, the more debt there is in the economy, the more sensitive the economy is to rising interest rates, with more pressure on indebted households, businesses and the government to either cut back on spending or increase prices or taxes, and that will have knock-on impacts on the wider economy,” Croy, Zollner and Workman said.

Debt growth not matched by productivity growth

ANZ economists accordingly “only” see the OCR peaking at 1.75%. It’s currently at 0.25% and is expected to be hiked for the first time in seven years on August 18.

“It’s worth thinking about the bigger picture - which is one of an economy that has taken on another $100 billion of additional debt since the end of 2019 (an increase of around 17%), yet the number of filled jobs only rose 1%,” Croy, Zollner and Workman said.

“Had they also been up by a similar amount, and there were perhaps 17% more cows on farms being milked, or 17% more orchards producing fruit, or perhaps 17% more manufacturing output, that extra debt might not be a problem.

“But the productive capacity of the economy hasn’t grown by anything like that amount. That doesn’t mean interest rates can’t rise - it just limits how far they can rise without becoming a serious drag on economic activity in New Zealand.”

This story was originally published on Interest.co.nz and has been republished here with permission.