Additional Buyer’s Stamp Duty (ABSD) For Residential Properties Transferred Into A Living Trust

08 May 2022

[1] A living trust is one that is created by a person (the settlor) during his or her lifetime.

+++

ANNEX A

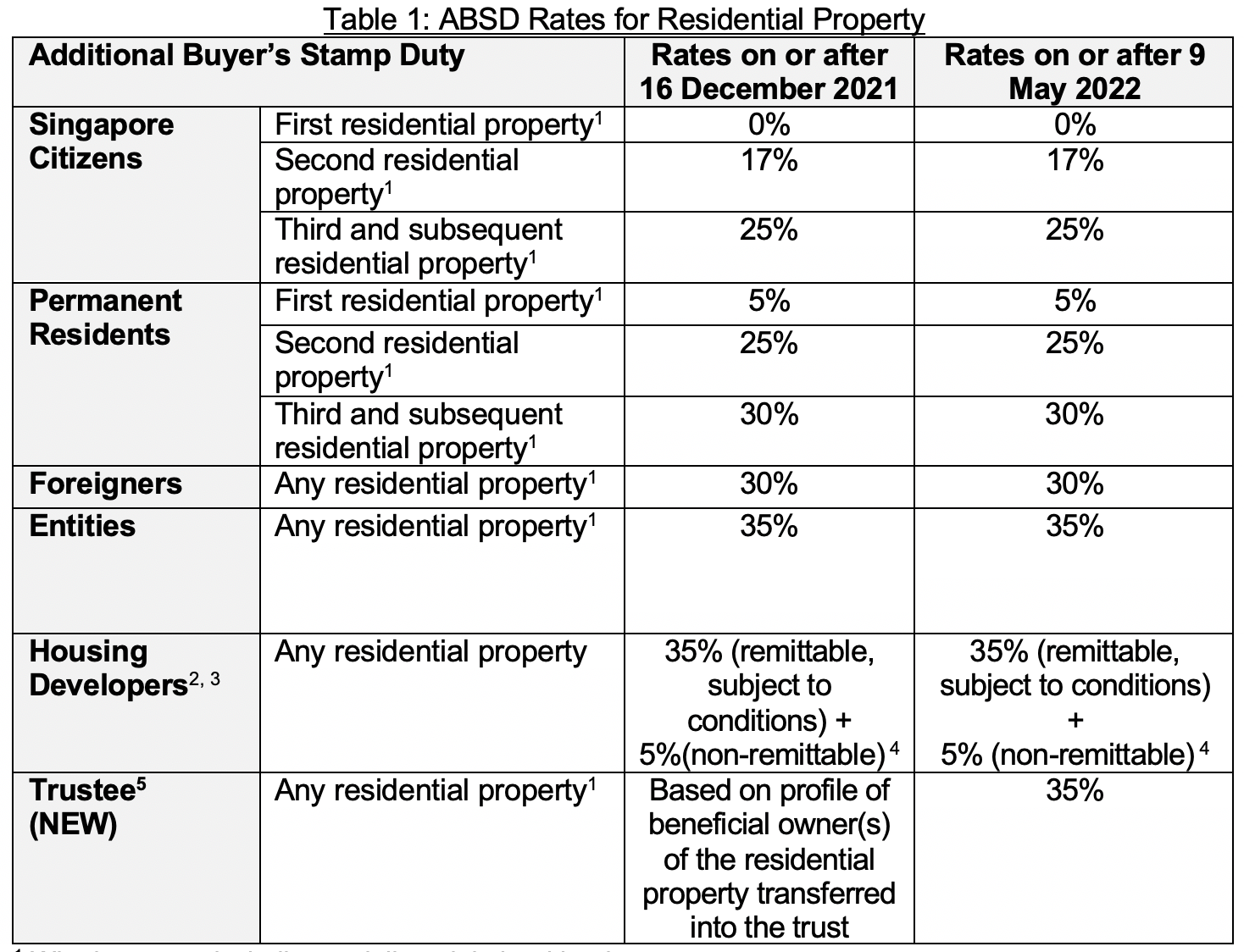

The ABSD rates on or after 9 May 2022 are summarised at Table 1:

1Whether owned wholly, partially or jointly with others.

2As entities, Housing Developers will also be subject to the ABSD rate for entities. Housing Developers may apply for remission of this ABSD, subject to conditions.

3Housing Developers refer to entities in the business of housing development (i.e. construction and sale of housing units) with respect to the subject property acquired. These include trustees for housing developers, which will continue to be subject to an ABSD rate of 40% (i.e. 5% non-remittable; plus 35% remitted upfront subject to conditions).

4This 5% ABSD for Housing Developers is in addition to the ABSD for all entities. This 5% will not be remitted, and is to be paid upfront upon purchase of residential property.

5ABSD (Trust) is payable by a trustee of any trust when acting in that capacity, but excludes the following: (a) trustee for a collective investment scheme when acting in that capacity; (b) trustee-manager for a business trust when acting in that capacity; and (c) trustee for a housing developer when acting in that capacity. (a)/(b) and (c) are already subject to ABSD (Entity) and ABSD for housing developers respectively, when they acquire residential property.

+++

ANNEX B

Frequently Asked Questions

1. What is an identifiable individual beneficial owner?

An identifiable beneficial owner of a trust residential property refers to an individual —

a. Identified in the trust deed or document as a beneficiary of the residential property; and

b. Who, because of the trust, has beneficial ownership of the residential property that is not, under the terms of the trust, revocable, variable, or subject to any condition subsequent.

2. Will ABSD (Trust) be retrospectively imposed for all Singapore residential properties that are held on trust before the date ABSD (Trust) comes into effect?

No. ABSD (Trust) is only applicable to any transfer or settlement of residential property into a trust (whether existing or new) that is executed on or after 9 May 2022.

Where there is more than one instrument effecting the transfer or settlement of residential property into a trust, ABSD (Trust) is payable based on the date of execution of the first instrument (e.g. ABSD (Trust) is payable within 14 days after the date of execution of the first instrument, if the instrument is executed in Singapore). The first instrument may be the Acceptance to the Option to Purchase, the Sale & Purchase Agreement, the declaration of trust, or the settlement agreement, where applicable.