In future years, what we are going through at the moment might become known as The Monetary Policy Experiment of 2020-22.

It's an interesting word that. 'Experiment'.

The Cambridge Dictionary describes it as: "A test done in order to learn something or to discover if something works or is true." Hmm. 'Discover if something works'. IF.

I confess to back in the day being a fan of the thing known as Rogernomics. But I did start getting chills when I saw that learned overseas literary sources were describing its as 'New Zealand's economic experiment'.

Er, hang on, you're telling me this might not work? I don't want to hear this.

Now, you might not have thought we were currently in the middle of a monetary policy experiment in New Zealand. And I'm sure the Reserve Bank (RBNZ) would probably bridle at the suggestion.

But the fact is we are doing things with our monetary policy that are - certainly in the New Zealand context - experiments. And we don't really know if they will work.

There's been two phases, the first being the 2020-21 QE (quantitative easing) response to the onset of the pandemic. Money printing if you will, although that's again an expression the RBNZ would not enjoy.

I'm going to focus here on phase two of the experiment, which is the current Official Cash Rate hiking cycle.

But as phase one has done a lot to make phase two necessary, I will just say again that I hope there will be thorough reviews of what was done and its impact.

As I've touched on previously, I think much of the problem - with the benefit of hindsight - was that the stimulus was continued and added to after the initial measures, and there was seemingly no quick way of assessing that it had done 'the trick' and that the stimulatory monetary conditions needed to be removed. So the economic engine started running hot. Very hot.

There's plenty that needs to be discussed there for when we face such a crisis as this pandemic again. Experiment, yes, maybe. But be quick to assess what worked and what did not.

Anyway, I'll deal with what's in front of us now, which is an interest rate hiking cycle the likes of which we have not seen in New Zealand - certainly not in the modern era of inflation targeting. The speed with which things are being done is, in my view, most certainly experimental. And we can not be sure what the outcome is going to be.

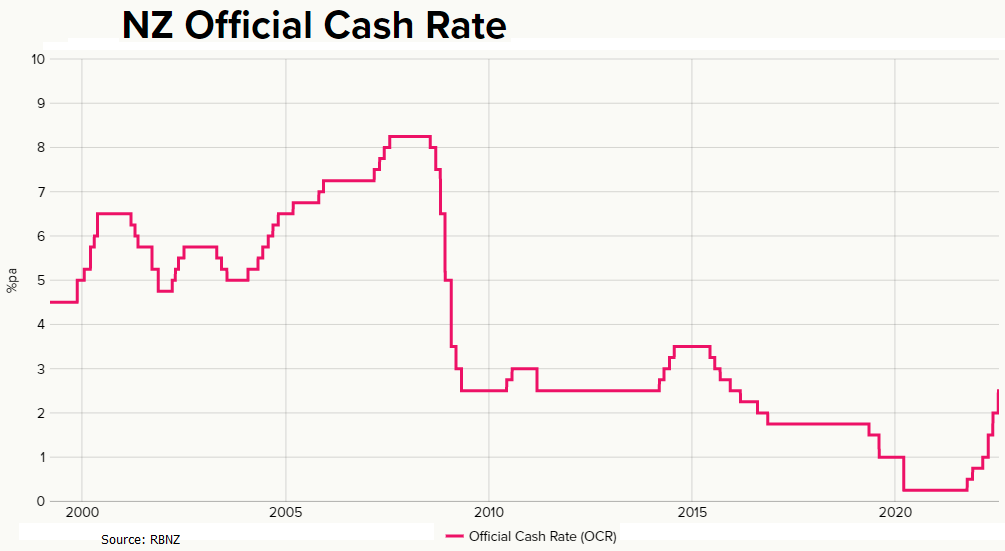

The Official Cash Rate, the OCR, was introduced only in 1999 as a more direct influence on interest rates.

The below, courtesy of the RBNZ, is a visual representation of what's happened to it in that time.

The most noteworthy bits are right at the beginning, the steady but long rise in the mid 2000s, the massive fall in the 2008-09 period, and right at the end. Plenty more on the latter shortly.

The very helpful list of individual OCR announcements the RBNZ website provides tells us that the 'record' for the biggest rise of the OCR in a calendar year was way back in 2000 when it rose by 150 basis points.

Now, in July 2022, we've already beaten that record for a calendar year, with 175 basis points of hikes. It's probably a reasonable assumption that the RBNZ is in effect committed to hike by at least another 100 points by the end of the year.

That would give us a whopping 275-point rise for the year, taking the OCR to 3.5%. Bear in mind though that the wholesale interest rate markets are currently 'pricing in' an OCR of 4% by Christmas, and economists at the largest bank, ANZ, reckon 4% will be the go by the end of the year as well. We could see 325 points worth of rises.

So, it's a massive, unprecedented, hiking cycle we are in. But that's not the half of it.

The real point is we are coming off such a low base. If the OCR 'only' rises to 3.5% by the end of the year it will be FOUR TIMES what it was in January. That's incredible.

If we go back to the 150 basis points of increases in 2000, these took the OCR from 5% to 6.5%, so, proportionately, not a massive increase.

Yes, after the GFC we did see the OCR dropped by as much as 350 basis points in a calendar year (2008), but we've got no means of comparison in terms of what hiking this far this fast in 2022 is going to do. From such a low base. It's an experiment.

It has to be stressed that, of course, we are not alone. Other countries are ramping rates up just as quickly.

Also, in the New Zealand context, the RBNZ may be mindful of the up-and-up-and-up, slow-grind hiking cycle in the mid-2000s just before the GFC, which saw the RBNZ struggle to get traction against a rampant housing market (familiar theme there).

That was different. Plenty of people had fixed at long-term mortgage rates and were impervious to OCR moves.

If we look at the one and two year fixed mortgage rates between the start of the millennium and mid-2008 they ranged between 6% and 9.5%. So, only a 350-basis points swing in that whole time.

Since just June of last year the one and two year rates have risen by circa 275 basis points, if not a bit more. In a year. And from a virtually non-existent base of 2.3% for the one-year rates. As I've said before, while the RBNZ is conscious of being able to get 'bang for its buck' with the current rises, I'm not sure its fully aware yet of how much bang.

It might be six to 12 months before we really see the impact of these OCR hikes.

Recall that last year the raging housing market was hit by everything, from tax changes, to loan to value ratio limits. And nothing appeared to work. Then just before Christmas came the tighter new credit rules for banks and this was the proverbial straw.

As I opined over a year ago now, when likening our housing market to a runaway rhino being shot up with tranquilising darts, there was a risk that we did one dart too many and grind the whole thing to a halt. Things will keep seemingly travelling along okay and then suddenly freeze up.

Well, the risk is the same with the economy at large now and the rising OCR. We keep swinging the mallet not knowing yet how much of an impact each swing is having on the economic foundations.

The chances are that these OCR hikes could all 'catch up at once'. And the impact could be far greater than anybody currently anticipates.

If that happens, what then?

The worst case scenario would be an economy grinding to a halt, but with inflation still pervasive.

Notwithstanding that inflation might remain though, I still believe there's a not insignificant chance that the RBNZ may have to go into full reverse, possibly as soon as early next year, taking the OCR back down again.

That's pure conjecture on my part, because I really don't know what this rapid hiking of rates will ultimately do. But the point is, the RBNZ doesn't either. Not really. It didn't pick what QE was going to do. It was an experiment.

This jumbo OCR hiking cycle is an experiment.

The Monetary Policy Experiment of 2020-22.

65 Comments

The force with which the pendulum is swinging means economic depression of unseen dimensions is at hand. The author rightly describes the massive interest rate swings by our Reserve Bank as "experimental". Unfortunately, our Reserve Bank is not experimenting with their own stock market portfolio or with the flowers in their green house - they are experimenting with the livelihood of all New Zealanders.

First, they experimented with ultra-low interest rates of 0.25% (unheard of). This led to sky-high property prices. Shortly thereafter, they raised interest rates quickly, tenfold, to 2.5%. Are they really that ignorant, unable to foresee what this experiment will cause? Mass insolvencies, unbelievable hardship. People trapped up in a dilemma of negative equity and rising interest rates on their high mortgages.

God defend New Zealand!

Yeah but houses will be cheap!

In all seriousness, this will be an interesting experiment. Businesses (i.e. the "real" economy), like home owners, have enjoyed a decade or two of ultra low lending rates, which has had a flow on to cheaper and more plentiful goods and services. In an environment where the reverse is happening, there doesn't seem to be many alternatives to rough times ahead.

We'll pretend it's capitalism at work, but it's not really when you have central authorities pushing and pulling so many levers.

Let's say there is reduced money supply, What changes, really?

I have a diverse investment portfolio. Without high levels of debt. Solid companies still do productive stuff and will continue to pay me dividends.

I will still have to go to work cause I haven't won lotto (yet!)

Still have to pay taxes.

Quality of life will still be about the fun stuff I can fit in after working is done.

And global warming is still an issue.

Times like this Only really hurt people who live outside thier means, or tie all thier wealth to one or two tricks. Nz property, bitcoin etc.

The gfc when I was in London taught me the lesson of holding cash reserves, not going crazy on debt and planning to take advantage of the next market crash.

Times like these can hurt everyone, the Great Depression of 1929-1932 is an example. Our economy is property-dependent (like it or not - I don't like it), and this means a property collapse would trigger economic depression in NZ.

You say that you will still have to go to work. I say this may not even be possible in a true depression, for lack of jobs.

We are now at a crucial divide, where it is in the hands of the Reserve Bank whether they wish to continue the course of total collapse via massive OCR hikes.

As an investor this will be my forth recession. Just need to have the confidence to dig in for a few years. Don't panic. Back the truck up at the right time to exploit the situation. The recessions are what make you. I'm not concerned about global warming, only associated damage by do good govt initiatives!

Markus you just sound disgruntled because when the music stops you are worried about finding a chair.

The time to make sensible changes was ten years ago. Wheeler warned about the risks of a housing bubble ten years ago. He bought the LVRs in to the banks in 2013. But no we just partied on. National said it was a good problem to have.

blaming this or that is too late now.

did you ever think about the savers that lost out when interest rates were dropped…continuously for years?did you ever think about the people locked out of decent housing for years?did you ever think about the many manufacturing and exporting businesses lost due to over valued dollar and lack of capital?

if we don’t raise rates aggressively then our dollar will fall and put more pressure on imported inflation….you can’t run away from the problem

If houses go back to 3 times income then that will good for the next generation of nurses, teachers, police and many other kiwis

Tough for property investors. They might have to sell the home and the rental…and rent. It’s going to brutal and sad.That is why so many warned about going down this path.

I am concerned as we seem to be heading for economic depression. This is caused by sharp OCR hikes coming from the Reserve Bank, who had previously created a house price frenzy with ultra-low ORC levels. Thus, they are leading New Zealand into a massive boom-bust cycle.

I am concerned about total collapse of the NZ economy vs. soft landing. I believe it is not too late to engineer soft landing - for example, by reducing the OCR back to say 1%, or so.

This should lead to property price stagnation (rather than collapse), paired with mild to high consumer price inflation (which is inevitable after years of quantitative easing and outright money-printing by our current government). Stagnating property prices would make property more and more affordable via inflation.

However, the current course of steep OCR hikes will lead to a deflationary asset price collapse, causing a depression and Weimar-style collapse of the economy. All the wile, consumer price inflation can still not be avoided - a double whammy. I hope the Reserve Bank will correct their course.

Better than more handouts to property speculators "for the good of everyone" would be a monetary reset like the Australian New Liberals have proposed. Addressing the need to protect wider society, while not unduly bailing out the speculators who've helped cause the biggest mess and already benefited the most from monetary welfarism.

Your proposed approach is simply more wealth transfers from wages and savings to asset speculators. "But it's for your own good". Ridiculous.

In a year’s time, I would far prefer to be sitting here… thinking, ‘Wow, inflation expectations might be getting away on us’…That’s a much nicer challenge to have in monetary policy than doing too little, too late. (Orr.2019)”

It's 'Nice Challenge' time, and I hope Mr Orr is up for it.

Orr said “low global interest rates” had contributed to rising house price but played down the impact of its own low official cash rate, saying it had only played a “bit part”.

If lowering interest rates isn't the main driver of house price increases. One can feel assured that raising interest rates will not cause house prices to collapse. Yet somehow I think that is going to happen. Hmmmm

If lowering interest rates isn't the main driver of house price increases. One can feel assured that raising interest rates will not cause house prices to collapse. Yet somehow I think that is going to happen. Hmmmm

Well that's a logical assumption. But the pointy heads never discuss that in public for some reason. We're not privy to their research and thinking on this.

I think one reason why the hoi polloi doesn't get to see their mechanics might be posed as "Well you wouldn't be able to understand it anyway."

Haha yes. But its ok i looked up the definition of 'experiment'..

'a scientific procedure undertaken to make a discovery, test a hypothesis, or demonstrate a known fact

So maybe Orr has simply been demonstrating the 'known fact' that printing too much money and dropping the OCR too far leads to unmanageable inflation.

Perhaps he is also experimenting (demonstrating the known fact) how rapidly raising interest rates will crash a massively overcooked housing market.

Good stuff. But perhaps he would have been better off at junior science school.

The Romans devalued the denarius by dropping the silver content in the coins around 200 AD. This enabled to add more coins into the economy. By 210 AD, soldiers wages started to spiral upward as silver content in coins continued to drop. Emperors started to be eliminated in quick succession once galloping inflation could not be stopped. We have been here before, only this time it's happening 5 times the speed.

I really hope RBNZ will learn a hard lesson through this and review how they use OCR as tool to support our economy in future. I think anyone smart enough can see what decade of endless stimulation and cheap debt can cause to our economy which is this inflation. It would be stupid to do this "experiment " all over again in future.

Personally, I think they should be very careful with lowing OCR in future as we wont see OCR impacts until12 months later, which means if GDP is flat, unemployment rate is high, it could be the impact of the OCR decision 12 months ago. They should hold OCR for at least more more than half year even if there are signs of recession to avoid future inflation.

Or... It just removes some of the most recent asset price inflation.

And only people holding high debt are materially affected.

I hold a diverse portfolio and maintain cash reserves for exactly this scenario.

Are you going to lose your job? End up living in a cardboard box sustaining yourself in some salvation army bread line?

The 1930s crash was an altogether different situation.

That's a somewhat absurd comment.

There will be a wide variety of impacts on risk takers as well as average people.

Your comment implies that much more often than not risk takers are better off. I call BS on that. We don't hear the stories so much of the risk takers who did badly. But there are plenty.

How about the speculative 'risk takers' who bought properties in the second half of 2021, because they believed everything their gods Alexander and Church said.

They could be in real strife.

The average person will include many people without mortgages or with manageable mortgages who won't be that affected by soaring interest rates. The average person will include all the people who work in healthcare and education, the police etc whose jobs are unlikely to be affected by a recession.

3.5% OCR is inevitable, now the question is how much will be passed on to interest rates by bank. Looking at above chart we have 3.5% OCR in 2015 and the inflation was pretty much in control.

Also how much the interest rate can be pushed to tame the animal (inflation), 4.5% or 5%?

I can only repeat what I stated multiple times before, there is a major problem with the DELAY between the OCR being raised (or dropped) and their effects on the economy (GDP, CPI, unemployment, housing etc...).

It's refreshing that David is adressing this too.

"The chances are that these OCR hikes could all 'catch up at once'. And the impact could be far greater than anybody currently anticipates."

This is not just a possibility, in my opinion its a high probability.

Some measures, like GDP, have to be released much sooner in NZ to be of any use but in general, with a lag of 6-18 months, we are flying blind as to the effects of OCR changes for far too long. This is the reason why the RBNZ overshoots its OCR response so much in both direction.

Agree the OCR lever is like steering the Titanic, it takes a long time to have any effect, either hard one way or hard the other way. The results will be felt in about 1 years time, and for the landlords this will be just as the next step in interest deductability kicks in.

Yep, and why it's absurd to hike the OCR any further. As Rodney D said yesterday, there should be a pause.

The hikes over the past few months are starting to flow through a bit now, and they will continue to flow through progressively with a lag over the next 6 months, whack the economy and destroy demand.

Further aggressive hiking will create a 'lagged and progressive devastation' of the NZ economy, which is absolutely unnecessary and uncalled for.

The current OCR setting will destroy enough demand in the economy to deal to inflation.

Of the many blunders the RBNZ have made, the worst was keeping the OCR so low after the GFC when things were fairly rosy. Many people commented that this meant the RBNZ had nowhere much to go if another event happened, and then sure enough we got Covid and they had to go unconventional.

I think the govt should mandate that rates below 4% can only be enacted in a dire /emergency situation, not during the good times.

https://www.youtube.com/watch?v=GJ4TTNeSUdQ

Grant and Adrian Orr must have been away the day that inflation was explained at economic school.

More vested interest comments and articles about not increasing the burden of debt and avoiding risk taking speculators realise their position. What happens when Chinas Trillions sized ponzi fails....

One more black swan approaching...

https://www.zerohedge.com/markets/we-decided-stop-paying-all-loans-chin…

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.