The Reserve Bank (RBNZ) is "hell-bent on hiking [interest] rates to hurt households", Kiwibank economists say.

In their weekly First View publication, Kiwibank's chief economist Jarrod Kerr, senior economist Jeremy Couchman and economist Mary Jo Vergara say they believe the interest rate hikes already delivered "will have a huge impact on households".

Last week the RBNZ hiked the Official Cash Rate by a record 75 basis points to 4.25%, its highest level since 2008. The RBNZ indicated a new peak OCR of 5.5% next year. And it signalled a recession to begin from the middle of next year, with Governor Adrian Orr conceding the central bank was deliberately engineering a recession.

The Kiwibank economists say discretionary income "will evaporate" for many mortgagees, especially those that are relatively new to home ownership, and have entered the housing market in recent years.

"Some households will suffer significant financial stress as relentless rate rises push above the ‘test’ interest rates (around 6%) banks have used in recent years. RBNZ rate rises are testing the limits, and consumption will ease.

"We’re wary the RBNZ may overtighten and cause a sharper correction, or a deeper recession, with a greater pull back in house prices."

The RBNZ is now forecasting a peak to trough fall in house prices of 20%.

"In order to meet its inflation mandate, the RBNZ is hell-bent on hiking rates to hurt households. Demand must be restricted to meet supply. Inflation must return to the 1-to-3% target band," the economists say.

"On top of the current 4.25% cash rate, the RBNZ is signalling a further 125bps of hikes to come. The consequence looks likely to be a shallow but protracted recession from mid next year.

The economists say mortgage rates "will be forced higher" in response to the OCR increases.

"And these rapid-fire rate rises are coming at a time when many indebted households are rolling off fixed rates. Previously fixed 1- and 2-year rates, locked in between 2% and 3%, are rolling off onto much higher rates between 6% and 7%. That’s a huge burden being lumped on top of households. For an $800,000 mortgage, the interest expense will rise from around $20,000 to $50,000."

However, the economists say the impending end (December) to the funding for lending programme (FLP) - through which banks can access relatively cheap funding, at the same rate as the OCR - means "more tightening over and above" that signalled by the RBNZ’s forecast OCR track. (At time of writing the banks have accessed $18.7 billion through the FLP, with the programme being closed off on December 6).

"The total impact could be between 15-50bps above the OCR projection," the economists estimate.

They say early in the pandemic, in 2020, the RBNZ moved "swiftly and aggressively" to keep the financial system afloat.

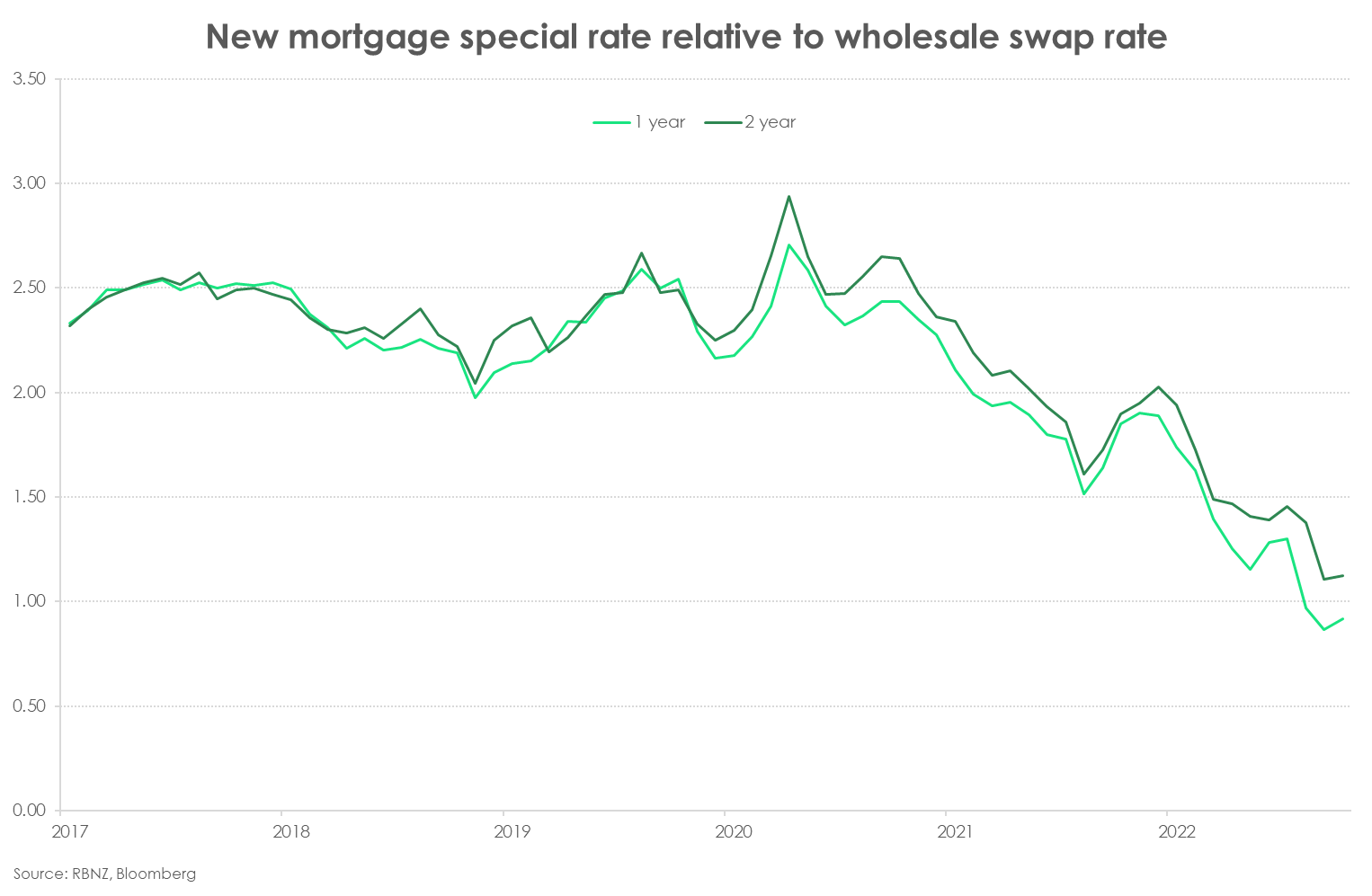

"The OCR was slashed, billions of dollars of bonds were purchased under the LSAP [large scale asset purchases] programme and the funding for lending programme (FLP) was introduced. The FLP was especially effective in holding down bank funding costs. Both mortgage rates and term deposit rates fell during the introduction of the programme. The announcement of the FLP came in over August and November 2020, with the implementation in December. The success of the FLP was most pertinent when wholesale swap rates rose into 2021, and bank funding costs were held down.

"In the period after the GFC and before the pandemic, the spread between mortgage rates and wholesale swap rates was around 200-250bps. With the FLP, the spread compressed ~50-100bps," the economists say.

However they say once the programme ends next week, this will put upward pressure on wholesale bank funding rates.

"That is, raising funds will become a relatively more competitive and therefore expensive exercise for banks. Term deposit rates are expected to rise. And that means more tightening above and beyond the projected 125bps of additional hikes to the cash rate.

"The exact impact of the FLP on wholesale funding rates is incredibly difficult to gauge. The total impact could be between 15-50bps. But there’s potentially a lot more to come through if we return to pre-Covid levels.

"If total spreads were to return to pre-Covid levels we would see a lift of around 80-100bps – above the RBNZ’s forecast of 125bps in OCR hikes."

The economists say their focus is now turning to the RBNZ's next OCR meeting on February 22.

"And the RBNZ’s forecasts imply another 75bp hike in the cash rate.

"However, given that other central banks have, or are about to, slow the pace of rate hikes we expect them to moderate their language. We suspect the RBNZ (along with every other inflation fighting bank) will be in a position to ‘pivot’, and slow rate hikes, with weakening growth and improved inflation expectations. We hope…"

119 Comments

Kiwibank economists believe the interest rate hikes that have already been delivered will have a huge impact on households and discretionary income will evaporate for many mortgagees. When wasn't this the global plan?

The Rentier Economy is a Free Lunch

You’ve had, for the last – really since the 1980s, but even since World War 1 – this movement to prevent industrial economies from being low cost. But the objective of finance capitalism, contrary to what’s taught in the textbooks, is to make economies high cost, to raise the cost every year.

That actually is the explicit policy of the Federal Reserve in the United States. Turn over the central planning to the banking system to essentially inflate the price of housing, with government guaranteed mortgages, up to the point where buying a home is federally guaranteed up to absorbing 43% of the borrower’s income.

Well, you take that 43%, you take the wage withholding for social security and healthcare, you take the taxes; the domestic market shrinks and shrinks. And the finance capital strategy is exactly what it is in the United States today, in Europe. Shift all of the money away from the profits of industrial capital that are reinvested in making new means of production. To expand capital into a shrinking economy where the financial sector intrudes more and more into the economy of production and consumption and shrinks the economy. Link

Also NZs economy is largely a housing market, so a lot of the media was about pumping up house prices and creating FOMO. To be fair to the Reserve Bank Governor, he did warn about all this during the FOMO period. IMO there should have been far more in the media about these interest rates being emergency low rates.

Interest rates were dropping to help the entitled old property owners maximize the amount of capital they can squeeze out of the property ("Nest eggs") when they go to sell. Those who have sold in the last few years can now continue to benefit from this process as interest rates are now going up.

Meanwhile the next generation are saddled with that debt, AND funding their pension out of their taxes.

Older obviously as they have more time to accumulate.

Something Bernard Hickey wrote back in 2015.

Maybe the astonishing valuations of Auckland houses have nothing to do with the fundamentals of supply of housing and demand of incomes. Maybe they're all about the ability to borrow more money to bid up prices.

The cheaper we make money the more we pay rather than saving for a larger deposit with decent interest rates so we don't have to borrow so much.

The public doesn't get a say over who is in the various Government departments/ministries either. These are the departments responsible for gross wasteful spending of taxpayer funding. The Government can only direct the taxpayer funding to these outfits, which is why the waste doesn't change when a different political party is in power.

But we appoint the representatives who make these appointments. That's how representative democracy works. We basically vote for people who have the role of appointing others to carry out the actual work. As the representatives themselves are too high up the food chain to make operational decisions.

So the NZ public in a round about way does get to decide who is in the various govt department/ministries.

While we do appoint representatives, but we don't clear out the various senior leadership teams at each election.

Each department ends up with a new Government representative at each party change or election but it's more or less the same crowd in the engine room, spending it up on the tax payer.

a big problem here is the flip flops from the Reserve Bank - made worse by a govt. saying its all fine and they have everything under control

So as individuals its hard to plan if you dont know if rates will go up down or sideways - or last for weeks months or years. One minute the governor is saying that rates are likely to peak then next OCR its up again -and the messages that come with this regarding exporters or builders income and forward workloads just adds to the confusion giving a clear impression that the RB doesnt have a plan, hasnt done its homework and doesnt actually know what to do

Thats quite funny, The RBA said rates would not rise until 2024.......

Reserve Bank of Australia governor Philip Lowe has admitted the central bank’s pandemic guidance that interest rates would not rise until at least 2024 was an “embarrassing” error and it “should have done better”.

Not funny for the borrowers who are Up Shites creek despite still having an Orr.

Funny that anyone believes too much of what a central bank says, or what Economists predict, but one thing never lied, the price of hosues in NZ relative to income and the Debt-to-Income ratio's being allowed by the RBNZ and retail banks.

Accountants know the cost of everything, as I was reminded the other day, many were shaking their heads re the valuations.

So, lets march the house prices back down the hill, too where this disater started in January 2020, then we can reaccess their sustainability based on global economic activity.

This bit from Kiwibank is ouchy ouch if it comes to pass, we may not need much more OCR, still see terminal 2year fix about the same place though.

"If total spreads were to return to pre-Covid levels we would see a lift of around 80-100bps – above the RBNZ’s forecast of 125bps in OCR hikes."

Funny that anyone believes too much of what a central bank says, or what Economists predict, but one thing never lied, the price of hosues in NZ relative to income and the Debt-to-Income ratio's being allowed by the RBNZ and retail banks.

This is the key point - The banks we complicit in the housing bubble growth. Knowing that at some stage cheap money had to end, they allowed people to take on more debt than they could reasonably afford to repay at more normal interest rate levels.

first the allowed 30 year mortgages (from 15 years) which added about 40% to what people could borrow, then reduced the amount of deposits thereby adding a multiple of borrowing amount. you have 10% deposit requirement and $10,000 you can borrow $90,000. Drop that to 5% and you can borrow $190,000.

To this you add the influencers in the media who said that this was a sure thing - prices always go up..

Now we have the situation where we have rising rates, and peoples debt levels at record levels in terms of how much they have and what % of their income it represents. There is no way back for anybody with too much debt - you cant unwind this without significant pain.

We may see prices off 25% from the high, but that only removes the covid bubble - My prediction is 40% - 50% decline to be affordable at the new rates, or 25% decline and 10-15 years of housing stagnation. Either way the bull market is over and we have people who are stuck paying the banks for a long time....

Pa1nter,

I have no debt and a lot of cash, so i should be ecstatic over every hike in the OCR, right? But I'm not and have written to the RB to tell them why. I know that hindsight is a wonderful thing, but I believed at the time that the RB was too quick to slash rates when it quickly became obvious that the economy was doing ok. FLP should only have been available to the banks for business loans and then we would not have had as big a move upwards in house prices and now, would not have as far too fall.

I believe that Orr has been a failure and would like to see him and his board replaced. The government is also at fault for broadening the Bank's remit.

"FLP should only have been available to the banks for business loans and then we would not have had as big a move upwards in house prices and now, would not have as far too fall"

Property investors are businesses apparently (when it suits then but also not when it doesn't), so are you saying that the FLP should have been provided to landlords but not to owner occupiers/FHBs?

FLP was provided to banks that securitised their best performing mortgages and sold them to the RBNZ under the conditions of a repurchase agreement - floating rate resets, collatetal haircuts and margin calls.

A good friend in the market responded to this question from me as follows:

Is there an internet source tabling NZ public counterparty (say banks etc) repurchase agreement interest rates for AAA securities collateral?

Thanks for your email.

As far as I am aware no such database exists. The closest is the RBNZ B2 table but that is an aggregate rate across secured and unsecured rates. The only other proxy is the RBNZ Standing repo facility at OCR minus 15bps, however we know the market trades inside that level, typically somewhere between OCR and OCR minus 10 bps.

That actually made me phyisically shiver to imagine myself in a plane with Orr as a pilot. He would purposefully tail crash the plane killing the passengers in the back who bought too many bags of peanuts. And then claim it was the path of least regrets, he did nothing wrong. And then he would be backed by the airline company who would extend his contract for another 5 years. Would anyone want to fly?

Around 2/3 of households don't have a mortgage, i.e. they're renting or own a home mortgage free, and their spending money will be largely unaffected by the increase in rates unless they lose their job.

Recent buyers will become envious of their renting peers. Mortgage free households, particularly retirees, will finally see a decent (nominal) return on their savings accounts.

“Tell me, WellingtonSpeculator: if landlords can just increase rents on a whim, why haven't they already raised them as much as possible? I find it hard to believe most landlords intentionally keep rents below what they could charge out of some sense of altruism.”

As a landlord I can tell you we haven’t raised the rent on all our properties between 2013 -2020, why ? Because we see our tenants as people, families instead of money trees. As long as the number works we see no need to up the rent annually, we believe in long term relationships between us and good tenants.

Hardest thing is to write to our tenants about rent increase and explain to them why, Blame interest rate and tax changes. Lucky for us all of or tenants have been very understanding.

It is refreshing to hear that Small Kev, thank you for your comment. Not all Landlords are horrible, but many focus too much on the financial aspect and forget the human aspect of the relationship between landlord and tenant. I would argue that having property managers can accentuate this as there is a disconnect between the landlord and the people they house, removing the human connection.

NZdan, maybe you don't understand Market Forces.

If a product is above the current market price such as a rental property rent the tenant will most likely move.

If a widget with the same specs is dearer in one shop it will remain on the shelf.

I'm sure a landlord will not in most cases exceed the market rent for the region or locality and risk having to look for another tenant on a regular basis.

Except that tenancies are still more illiquid than a normal purchase.

It costs tenants money and time to move - a not insignificant amount, and until recently it could be at the landlord's behest (and still can in the right circumstances).

Tenants are nowhere near as free to up sticks and move to somewhere cheaper as you make out. And landlords have been behaving like a cartel for the last decade - especially when property managers are clipping the ticket and 'maximising returns'. Plus the law allows a landlord to nudge the rent up, but the tenant can only force a review if it's nudged significantly too high.

I have long lobbied [unsuccessfully, landlords rejoice!] for a rent cap that prevents tenants from outright paying for their landlord's asset (since if a tenant can afford the mortgage+rates+insurance, then the only differentiating factor between the landlord and the tenant is who had the deposit first - which skews heavily in favour of those born earlier - I proposed 2% of CV/pa, or half the principle on a 25-year mortgage, would be fair).

Of course, at the moment even the most well-off tenants probably can't afford the mortgages on the houses they live in (if purchased recently), and so like us are probably quite happy to sit on their fixed-term tenancy eating popcorn.

If interest rates rise, then the rent has to rise to cover that extra expense.

No, WellingtonSpeculator, the rent does not have to rise due to higher interest rates.

https://www.interest.co.nz/property/118513/rents-auckland-close-flatlin…

It does if the owners outgoings are higher than their incoming. Otherwise they have to cover this themselves. So if they only have a mortgage on their rental, and not on their own home, they are going to then have less disposable income themselves. SO it is going to have the same effect as if they had a mortgage on their own home. Otherwise they will be forced to sell and possibly for a loss if they purchased recently. Or they could turn it into an airbnb if they think they can make more that way, which is how many rentals in my area are now being used.

It is another sign to me that we could be in more crap than we want to acknowledge.

This is a similar type theme on the property investor pages on facebook. They loaded up with debt to buy a rental because they were encourage to do so, but have no idea what they are doing.

WellingtonInvestor - if you put rents up, then those renters need to ask for an increase in wages, and if wages go up then this is going to drive CPI even further up, and if CPI goes even further up then interest rates go even further up, and if interst rates go even further up, landlord mortgage expenses go even higher. Do you see how dangerous that feedback loop is?

Good for them - and the reserve bank as a result has been measuring inflation around 7- 8 % and now as a result have lifted the OCR from 0 - 5% (close enough) in response. Next year landlords will now reap the sweet reward of higher interest rates for their investments as a result of (and in combination of the rest of the economy) lifting the price for their goods and services.

I've run the net present value of cash flows growing at 8% (e.g. for a rental) for a 20-30 year term, and changing the discount rate from 3% (2020-2021 mortgage rates) to 8% (the possible interest rate used to combat 8% inflation) and the discount price of the asset falls by about 40%.

So if landlords think they are being smart by raising rents to cover their losses - what they don't understand is just how badly asset prices get smashed by rising discount rates.

If anyone can point out to me how landlords can raise rents at a rate that is so far above a discount rate required to maintain the current net present value - I'd love to hear what numbers you run to get there.

The Problem is, the dream that was sold was never based on rental yield, but the certainty that there would be a massive CG windfall in a couple of years, I guarantee you that was a big part of the purchase spreadsheet.

This is gambling, a business relies on a return on the asset base, not a magical increase in value of said asset base. The fundamentals are so far out of whack there is nothing for it but to take the leaveraged gamblers down in flames. Most probably had no idea they were playing poker, the bank always wins...

Not sure why it has hit such a nerve with you. I am just looking at the numbers and thinking out loud. If interest rates rise, then the costs for a landlord increase. Someone has to pay that. I don't own any rentals myself and don't think I ever would because I don't want to have to deal with all that goes with it.

Actually rents will fall.

Renters are experiencing inflation and have no more money to give for accom. Soon they will start to experience layoffs and potentially less working hours offered from employers all with continued inflation.

Landlords will start to lose tenants who cant afford to pay or who see a cheaper rental and will move to cheaper accom (there is an increasing supply of rentals now). or landlord can neg. And accept a lower rental price from current tenant. Or landlord can sell at a loss.

So we should expect to see more and more new and existing houses for sale at a fraction of last years cost as landlords and homeowners cant afford mortgages amd cost. Their sell price will be dictated by what a landlord or fhb can and will be willing to pay in a falling recessionary market .. with less job security. my guess is a 50-60% drop from peak..but might be more.

Orr has for sure overcooked it by starting to slow then rushing to catch up.

In our market of long fixed rate mortgages we needed to start early and have gone higher faster.. to catch as many mortgage holders as possible in a defined time frame.

Think ireland but messier. Be one for the history books.

It's not that simple. If increase in rates = a $50 per week, and the Landlord can pass it on, what was preventing the Landlord from charging that prior to the rates increase? Almost all Landlords claim they're charging well below market rent (largely a lie).

Let's say the rents are jacked up. There will be a point where tenants cannot absorb the increase and will vacate. People at the bottom will be displaced by those above lowering their expectations inline with incomes and the result is homeless "renters" and empty rentals marketed at too high a price point.

Yea nah that’s the investor who will need to fork out. They likely can raise rent a little in line with the market, but they can’t raise rent due to interest rate increases outside of market rent. A quick trip to the tribunal would sort that out and there have been a couple of commented stories on interest.co about this recently.

If you buy a $1m townhouse that’s costing $1600pw on mortgage payments, and market rent is $600 in the area… then you aren’t coming in hot listing for $1800pw to cover mortgage rates maintenance and insurance. $1200pw would be a hell of a negative gear in a falling market.

Some of us on here have been saying the investor bid is now a LOT LOWER. But we get attacked by people who criticise our spelling, or font use, or ... anything but the facts around how you value a cash flow asset. Even got told over the weekend that accountants know the price of everything but the value of nothing.

Having purchased assets off liquidators in the past, I know the secret of making money is to buy the asset when no one else has the cash.

Do you have an account? Are you a regular bidder?

by WellingtonInvestor | 28th Nov 22, 4:36pm 1669606563

It does if the owners outgoings are higher than their incoming. Otherwise they have to cover this themselves. So if they only have a mortgage on their rental, and not on their own home, they are going to then have less disposable income themselves. SO it is going to have the same effect as if they had a mortgage on their own home. Otherwise they will be forced to sell and possibly for a loss if they purchased recently. Or they could turn it into an airbnb if they think they can make more that way, which is how many rentals in my area are now being used.

The market sets the price of rent, not the expenses of the investor who has paid too much for the 'investment'.

The market can be changed by increasing immigration settings, to create more demand for rentals. Likewise the government can make changes to change the market.. A lot of rentals were removed from the rental market as a result of changes, and turned into airbnbs or left empty. The town I live in has a lot of empty houses, and quite a lot of them are now coming on the market for sale.

Sure you can increase demand via immigration and put rents up (and if that happens, see my comment above about wage/price spiral). You've pretty much answered your own question there.

Putting rents up the last 10 years (or even 30 years) has been great for landlords because their interest expense was simultaneously decreasing as we imported deflation.

Now we are importing inflation so the opposite is playing out.

Greedy people who levered up their own home to release equity to buy rentals and circumvent the Investor LVR limits in 2021. Loans to owner occupiers that also had investment property as collateral with a DTI >9. 1.46 billion to 1552 borrowers. That 940k average debt on the house they live in.

940k needs $65,800 per year to service interest at 7%. That means you need $86,000 per year of gross salary just to pay the interest.

At least half of those are either retired or just poor. Some will be fine and continue spending freely but many will need to curb their habits. There's still rates and insurances and car costs etc.

Very few under 50 will have paid the mortgage off and just as they felt wealthy as houses went up, the opposite will occur over the next year.

I'm envious of the youngsters who most likely have no idea what's going on. Have a job if they want it and Mum and Dad are meeting most of the bills

Yeah.

But most kids without their own houses who rely on parental support will experience the pain through the anxiety and budgeting from their parents. Or those that are recent entrants to any form of work will experience it through the layoffs etc.

That is a good thing so the next generation understands the economy has serious downward cycles. It would have been better if it were the usual 5-8 year shallow downturn tho.

I watched my house go up in "value" by 200-300k from 2019 to the peak in 2021. It didn't make me spend any more as it's just paper wealth. It did sorely tempt me to lock in those paper gains and move offshore again.

If you're staying in NZ the values are essentially meaningless unless you're downsizing or moving to somewhere cheaper like Southland or the coast. Otherwise you're just going to buy and sell in the same market. It seems many don't understand that.

Well I guess the "lose their job" is a possibility if businesses start to fold as spending liquidity dries up.

I am trying to figure out what the effect on rent will be. Will landlords swallow the entire cost of the interest rate increases, with cash flow losses for years to come with no tax relief?

Imagine the average FHB is paying say $70k a year in mortgage interest, while the average rent for that house is $35k. There has to be some arbitrage for that cost of housing - as if the landlord increases rent, its not like the tenant can leave and buy a house to get a better deal.

It is a concern that the only set of the population being charged with bringing inflation under control is borrowers, the whole country benefitted from the stimulus and although depositers may benefit they then have more cash to spend so that negates some borrower cost burdens. The extra costs is passed on to groups who rent and they have less disposable income and that triggers poverty and crime to some degree. I think far more balanced approach is to increase taxes accross the board to reduce peoples discretionary income - even for a time like 12 months to reign this monster in and share the load.

Bringing Inflation under control is the Excuse. ('Never let a good crisis go to waste')

The Reason - is to rebalance our economy away from Property Speculation and towards Productivity. Making money from our day-jobs, in other words, not from the 'guaranteed' capital gains from in our house. Hence, those with property related Debt will pay. They still have a choice, though - to try to exit now and lessen their Debt by substantially discounting their prices (as they should have done many months ago). But they still believe, "Property always goes up!", so chances are they'll hang on, until they have run out of options.

The RBNZ has the market moving. It should keep going, as this is likely to be their last chance to get the job done.

The Reason - is to rebalance our economy away from Property Speculation and towards Productivity.

Lol, that's not it at all. The government still wants private landlords, it actually wants more, just owning newer houses.

They want to kill off any marginal market players, be it landlord, business or private individuals, over-reliant on cheap debt, and take the wind out of the economy.

Ironically productivity will likely increase when there are mass layoffs, less people doing more work.

Building new stock.... is Productive?

Private Landlords have been, and always will be, part of the mix. I don't have a problem at all with that. But that should be based on 'productivity' as well. i.e. The financial calculations should stand on their own (without wholly relying on capital gains to justify the enterprise) - which is also 'productive', in that it makes money in and of itself, and not be reliant on the speculative gains from a change in price.

Is there a place for Speculation in an Economy or Society? Yes. But neither of those should be wholly reliant upon it, which is pretty much where we find ourselves today. Or, why are we so frightened of a 'correction' to the property market, otherwise?

Productivity is simply $ earned per employee.

People tend to take a simplistic view that it's just a case of less dollars for housing and more dollars for businesses to invest in plant and machinery, i.e. more produced per worker.

This is actually rarer than you would think, because if there's a business case for more productivity investment, it usually already happens. More often productivity gains are from a shifting from one industry to another, or changes to legislation. Ireland has come to lead Europe in productivity, but not because they invested in better production methods, instead they lowered corporate tax so attracted more multi nationals to use them as a corporate base.

The RBNZ are going to kill off any marginally profitable, debt based enterprise. This will be some landlords, some businesses and some individuals.

If they kill off a few landlords, I honestlydon't think that anyone (apart from the landlords) will care at all.

Landlords are mostly just glorified ticket clippers who have lost all public sympathy and good will... because of their shameless greed in continually hiking rents past the pain point for renters... even as interest rates fell, and as they made windfall capital gains.

Luxy might care, but I think we will find that 90% of voters don't give a toss about lords of the land.

It was you, only a couple of days ago on here when you were embarking on another tirade about how morally bankrupt others are.

Either you're talking mistruths, there was no mother or baby, or you're oblivious of your own moral deficiencies of ignoring that situation by not checking on them to see if they're ok, or even better offering them refuge.

Instead of expending energy trolling property forums you'd get a much better return on investment by sorting your act out.

Pa1nter, you are writing mistruths about me and I am asking you now to stop. Of course I helped that woman!

You are making those strange, angry, personal, and non-investment related posts that the site moderators have asked people to stop.

I am not sure how to go about reporting things to the moderators, but hopefully they are keeping an eye on the comment streams now to monitor this kind of overly personal tirade.

So, please stop now. Stop replying to my posts,and stop with all the angry personal stuff.

It is a concern that the only set of the population being charged with bringing inflation under control is borrowers" Its not like anyone forced them to buy a ranger or put in that pool... but they did

I didnt borrow any money. In fact over the covid period, some of the people who did borrow money donated it to my staff and business. Bit smug, but Im feeling on the right side of the ledger with that one.

My opinion is the current rate (4.25%) should be sufficient to drag inflation down . I see no value in hiking further and believe our dollar has some bounce in it to counter Fed ideals. Now is the time for banks to step up and say they dont want to carry the added exposure /volatility of any more rate hikes. If these banks have an unwritten social contract with larger NZ society then it is their influence that could bring some peace of mind to those that find or will find the going too much. Stress tests are just that ,but consistently hiking for the sake of an ideal could turn it all into mushy custard and why would you want to do such? There are other ways of attacking house values without hanging the mortgage prisoners out to dry. In many ways rate hikes just add inflation to the marketplace as nobody wants to buy sell or trade without adjusting to what the markets doing. These hikes will make themselves shown in higher rents , higher service costs and product values. Way I see it is you reach a point where it just becomes an enabler for more hikes. The savers might rejoice at the higher TD's but much of that is a falsity because that extra money earned buys less. If the goal is to attack house values then hiking the costs of building and lending will not help with the need to produce the sort of numbers than can knock the value out of the market (oversupply) . Its all a temporary delusion because if the RB thinks its going to bring affordability back to housing by crashing and burning a segment of the current players (lets not forget these folk will still need a place to stay) doing so will not assist those aspiring to climb on the ladder when rates are rising and projected to go even higher next year . Good Luck with the OCR 5.50% plus plan for next year I cant see it going anywhere fruitful. I'd let the dust settle for at least 6 months to get a more accurate picture of the situation, Id ignore the Fed and focus on local (I dont see anything over 5% on the Fed's Sept dot plot) . Fools rush in where ?....lol

Nominal Interest Rates should always be above the rate of Inflation in an efficient market. Interest rates incorporate a commercial return to the Lender and a Premium to justify the Risk of making the loan commensurate with the existing economic environment. Central Banks, including the RBNZ, have removed the Risk Premium, and in effect transferred the Risk to the community (we'll have to bail out any failure as the Lender of Last Resort, as we did with AMI). The words "Moral Hazard" are used frequently.

If Inflation is 7.2%, the OCR should already be 8%. And that's not an improbability by any means.

An 8% OCR might sound fantastic but when you go from having ultra low rates, the players in the ultra low market get burned adjusting and couple that with the way house values have peaked in NZ and the banks that put the bank on the housing market...an 8% OCR would bring the nation to its knees....Different story if upper and lower ranges were closer but unfortunately the regulator(s) overcooked it.... and truth be known other global regulators did the same...

It's more than just houses. Many businesses are funding their operations on a low interest rate environment that has been around for over a decade now. Some will be able to weather that but some won't.

Hence this is going to be more about entities' marginal abilities to service debt than any one sector.

Rates have been higher, and the economy did fine. The only ones that will be on their knees are speculators and realies. Sounds like 'if you do this to us we'll take you all down with us'. It's what the banks cried in 2008 and that worked for a while, until, well, now.

Rates have been higher, and the economy did fine.

Rates have been systemically dropped across developed economies for nearly a couple of decades specifically because they weren't doing fine. Growth stalling, margins dropping, development curtailing.

So any entity relying on debt to help fund their existence and productivity will be adversely effected by higher interest rates.

Just as much chance that if 'they' start the presses, again, the OCR will go through the roof. Think mortgage rates of 30% or more. Why? Because everyone now knows the result of QE. Its outcome is now guaranteed, and the only defence will be to return 'value' to money in its price.

(Will you want to hold onto money next time, if they're printing it free again? You've seen that happens, and you and everyone else will want to ditch it as soon as you get paid, unless it has an attractive price)

They'll keep trying to stimulate the economy with money printing till it doesn't work any more.

It's already occured in parts of the world, most of Europe, Japan, etc. Most of the colonies seem to have remained receptive to cheap debt for the time being, why hard to say but demographics may be a factor.

It doesn't work! If it did, why are we here? (And, no. It's not Ukraine!)

Would we have a CPI print of 7.2% if we'd raised the OCR to 3% when the CPI hit 2%, or an OCR at 4.25% when CPI hit 3.5%?

We'll never know, but I'll suggest it wouldn't have hurt.

But waiting to see if it hits 13%, like the UK is looking at, and have to ramp the OCR to 15%, which as we all know has happened in time gone by across the Globe, is a frightening concept.

Why are we where? High inflation and raising interest rates?

Should be pretty apparent now, there was the perfect storm of cheap money chasing even less supply. The cheap money is gone but he supply side issues, particular labour availability are still there, and will likely remain for 12-24 months. That's such an extenuating circumstance that the central banks in many countries are prepared to crash economies in order to resolve it.

Presumably things will get so bad/flat that at some point central banks will need to reverse course to balance out economic activity.

Hah, I'm not much of a soothsayer.

I just like the naivety of theory that someone else is going to invest in productivity, and that's going to translate into more money into your pocket.

If someone else makes a capital outlay to increase revenue and profits, that person is going to receive the lions share of the windfall, the worker will get cents in the dollar.

If productivity is measured in terms of hours worked to dollars generated, by far and away an individual's best way to profit from increased productivity is to make a direct investment in the value of their own time, and pocket 100% of the upside. Faster and better than waiting for someone else to do that for you.

“Get ready in 12 months to start those printing presses boys because the next cycle is going to see the OCR go negative”

This is what they don’t talk about, and I agree it is quite likely we might be able to witness history (negative rates) in our lifetime. They were so close last time….very very close.

Seems to me the only thing keeping us going now is the lag effect from the consenting process taking 6 months + for new builds, then construction delays etc so only now are we seeing houses being built that were being sold when rates were very low. Word on the ground is very few builders are selling anything and it has been that way for months already.

So, what will happen in 6 months time when all of the current projects are completed? At this rate, there will be no work. Builders, plumbers, plasterers, concrete, etc will be left with very few projects to compete over. So yes, demand will reduce, but I think supply will likely FAR outweigh demand.

Orr is not engineering a recession, he is engineering a full blown economic collapse. At least in construction. They should have kept the rates static for the next 6 to 9 months and wait for the effects of the rates increases to show on the ground before making the call on further increases. I anticipate another apology in a year's time when they admit they raised rates too high and too quickly.

Best of luck everyone, we'll need it.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.