Table below updated with Westpac's change.

ANZ is the first bank to move its floating home loan rates since the Reserve Bank raised its Office Cash Rate (OCR) last Wednesday.

But they haven't passed on the whole +75 basis points. They have limited the rise to +65 bps enabling them to keep the headline rate below 8%. For existing customers, their new rate will apply from Wednesday, December 14.

In addition they have raised all their fixed rates by +55 bps for all terms to 3 years, +35 bps for longer terms, effective Wednesday, November 30. (This para has been corrected.)

ANZ's bonus saver account, Serious Saver, has been raised by +75 bps effective Thursday, December 1. This is the only ANZ rate to rise by the full +75 bps of the recent OCR increase.

And ANZ raised their term deposit rates by between +40 bps and +70 bps across the board with every term getting a hike. That means their new six month rate will become 4.35% pa and their new one year rate will become 5.10%. For savers, these new levels are much better than any other main bank, and only bettered by the recent rises by Rabobank.

ANZ noted that with the change in OCR and the expectation that the OCR will now have to go higher next year, there have also been changes in wholesale rates which has an impact on fixed interest rates for home loans.

And separately, ANZ economists published a report Tuesday showing forecasts of floating mortgage rates at 8.6% by March 2023 (essentially in three months) and 9.6% by June 2023 with them holding that level for the following year.

A feature of the recent wholesale rate changes has been the sharp flattening of the rate curves, even inversions as global influences drive down the longer term rates. In that context, ANZ's +35 bps and +55 bps fixed rate rises for rates 3 years and longer look somewhat overdone, so there may well be opportunities for rivals to be quite competitive in longer term fixed rates.

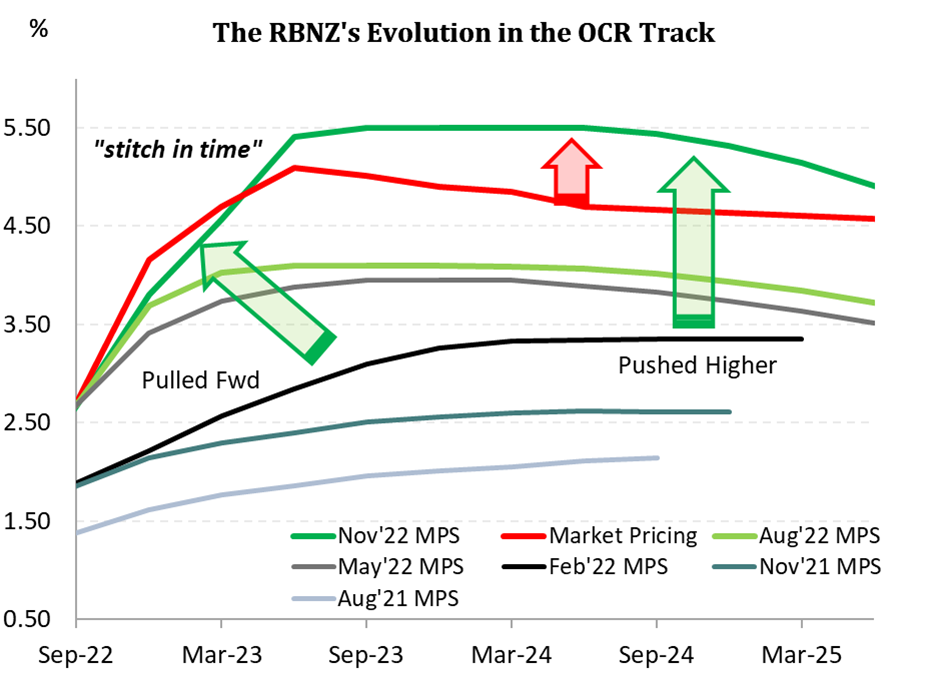

Kiwibank has a useful graphic that explains the development of the RBNZ sequence in 2021 and 2022:

This explains what has happened to the main influences on short term rates. But doesn't help much for the longer term rates and the global influences.

ANZ's pass-through of the full +75 bps for their Serious Saver account is, in the context of how banks usually handle these products, an unexpected benefit for savers.

We will have more soon on the term deposit rate changes, and the fixed home loan rate changes.

Now that ANZ has moved, we expect most other banks will now do so quickly.

Here is the running tally of bank changes to floating rates which we will update as each announcement is received.

| Floating mortgage rates | Prior rate | change | New rate | Existing customers, |

| % | bps | % | effective date | |

| RBNZ OCR | 3.50 | +75 | 4.25 | 23 November 2022 |

| ANZ | 7.34 | +65 | 7.99 | 14 December 2022 |

| ASB | 7.35 | +64 | 7.99 | 14 December 2022 |

| BNZ | 7.29 | +45 | 7.74 | 23 December 2022 |

| Kiwibank | 7.00 | +75 | 7.75 | 19 December 2022 |

| Westpac | 7.35 | +64 | 7.99 | 15 December 2022 |

| Cooperative Bank | 7.15 | +60 | 7.75 | |

| Bank of China | 6.45 | |||

| China Construction Bank | 7.34 | |||

| Heartland Bank | 5.49 | +50 | 5.99 | |

| HSBC | 7.29 | +65 | 7.94 | 15 December 2022 |

| ICBC | 7.15 | |||

| SBS Bank | 7.29 | |||

| TSB | 7.25 |

We will separately report the fixed rate increases when some arrive.

145 Comments

As we on this forum keep attacking each other on our views on housing prices, the banks are the ones who are abusing all of us left-right-centre. They are the ones who keep profiting from the backs of real workers. They always fully "pass on" the full interest rate hikes and make a nice beefy fat cushion of money being the 'middle man'.

Record interest rates only means fatter bonus payouts for them. Fair right?

-7

He's not shy of giving personal attacks, hence he'll attract them. What I said won't be far from the truth, you only have to dig up a few previous comments.

e.g. Complaining about property investors, then buying his first home near the peak of the market and bragging about how he's going to leverage the growing equity into a property empire. Hence I call out his gripes. It's hilarious more than anything. He can defend all he likes without trying to introduce race into it.

Not true Brock.

Look how much profit is offshored to Ausralian pension funds. That comes from the spread on deposit rates. Banks are certainly diddling everyone. Then we can consider the secondary societal effects of the increase in housing. NZ is being farmed by Aus and it's pretty simple to draw a line between this and the poor dairy worker in Sandringham.

There are a small number of commenters whose comments are descending into juvenile slanging matches with each other. Their comments are often little more than name calling and school yard insults. This website should not be a platform for that type of behaviour.

Repeat offenders are at risk of have their commenting privileges withdrawn.

Looks like this "7jai" character is one of the bad actors we have all been warned about.

Where did Yvil leave the banstick?

+100

Introducing crazyhorse and bitcoin

"Makes me laugh when people throw rocks at Bitcoin, when it is limited to 21,000,000 coins - while all around the world "fractional reserve banking" has been going on for decades - coupled with inflation and the consumer, at the whim of central banks for interest rates. This has enabled so much money being transferred to the 1% .....while everyday working people have to work harder just to stand still !

The property market is a classic - who really won out of the 10 years up to covid, yes the banks and people who had enough existing capital to either buy then sell property or develop it - plus all leeches clipping the ticket on the way.

Now the FHB's have a huge noose around their necks, with a big mortgage and increasing interest rates - that won't be paid off for decades...so they end up slaving away for the bank.

This property market will do way more damage to many people's pockets, than the crypto market ever will" .

Not sure if you are aware, this is just to try help. Kiwibank used that whole marketing strategy and it clearer worked if you believe it. You can look up where the profit goes for various ‘aussie’ banks. Its not really aussie, a huge chunk is to NZ kiwisavers and overseas investment funds (you can also invest in these). The only thing Aussie is that the group head office and institutional payment systems are ran out of Aus. Happy to help.

Please can we respect each others opinions and cut the tit-for-tat nonsense initiated by yourself today 7jai. Nothing against you personally, simply a reminder that we come here for intellectual discussion and to broaden our views, not flinging verbal dung at each other like those down the evolutionary chain.

Record interest rates only means fatter bonus payouts for them.

Nah. It's quite simple math really - lower interest rates encourage higher loans. Higher interest rates encourage lower loans. As interest rates rise, peoples ability to service the debt decreases. Though you will notice that in both scenarios the banks margin is similar, that is their rates rise and fall in a fairly linear fashion compared to swaps and the underlying OCR.

That said, given the full increase has not been passed on to borrowers, the banks margin has shrunk and the borrowers serviceability has shrunk meaning the bank is getting a smaller portion of a smaller pie for new loans.

The nice beefy part is all of the money that was thrown around over the last two years now has to be serviced at a higher rate - and this has nothing to do with the major banks, this is the housing economy and RB.

Let's say that one wanted to live in this tremendously well priced and so-called "prestige family home" in Massey.

https://www.trademe.co.nz/a/property/residential/sale/auckland/waitaker…

By my calculations, using the rates above, it would only cost $140,000 p.a. or $2692 a week in interest charges to rent the money from the bank.

Prices have clearly found their floor. There is plenty of room for upwards valuation!

Unlike the Interest.co.nz comments section, I really do believe that spelling standards should be maintained in Real Estate Ads.

Rather then saying - built on the mall carpark, it states "quick walk to countdown".... 1.7 for this pretty much sums up what the issues are with Auckland Prices.

These houses are not constructed, sold, or purchased by people that speak English as their first language.

It's cute that they think there's a hefty premium to be charged for being near Countdown.

To be fair, the overhead power pylons are currently being disassembled.

The street is still littered with abandoned shopping carts though.

There are two sets of 220kv lines. Mr and Ms. GV 27 have a commanding view of one of them heading towards the city. One of them is slated for removal, the other is staying put with no suggestion it might ever be undergrounded.

One day, we saw a man in a little cart wheeling along under the power lines conducting an inspection. This concludes my powerlines yarn.

I'll not have bad things said about Massey. Notable incidents such as 'some dickhead across the valley lasering aircraft on approach to Whenuapai' and 'man firing wildly into the air at 1am' really bring the community together on the Facebook groups.

I will however note that a huge amount of development, all because the central city suburbs don't want to. Miles from the CBD, no rapid transit, massive intensification and pretty powerlines. Frankly it's paradise.

Funny you mention that - it has rendered access to the shopping centres on both sides of Westgate impossible on weekends. Not helped by Fred Taylor Drive being closed in one direction for a month longer than was initially suggested by roadworks signs when it was first shut - a week after Costco. So all local traffic that gets on the motorway north of Lincoln Road now has to rat-run the North West area with all the Costco traffic to get to Kumeu/Huapai/Riverhead.

"How bad is the traffic around Costco" is the new "Where were those sixteen cop cars, five ambulances, fire engines and the helicopter going this afternoon?"

Well, it was obvious that rates would rise quickly and again the moron NEVER said WHICH interest rates would be over 7.

It's a common trick.

the soothsayer told him he would die at sea, so he sold his boat and moved into the forest where he was attacked and killed by a bear. When his friends confronted the soothsayer she said "he died in a sea of trees"

"Well, it was obvious that rates would rise quickly and again the moron NEVER said WHICH interest rates would be over 7.

It's a common trick"

Looked last night and all of ANZ's rates from 6 months to 5 years were above 7% and ANZ is NZ's biggest residential property lender.

It's quite possible that the other major banks will match ANZ.

A number of influential housing commentators in New Zealand, a lot of agents and a number of commentators on this site have a lot to answer for. They collectively created a lot of FOMO through their thinking they knew it all. Quite simply they all got it wrong and a number of people since Covid started are going to have to sell their homes and if they don’t the Bank will. The cost of living increases and the upcoming refinancings from 2.? percent to 6.? percent will be hard to cope with. Some are going to lose jobs as the recession bites. All because some inflated egos thought they knew better. Throw in greed to earn commissions, fees and bonuses. It was so simple. We were on emergency interest rates. They had to go up. But egos and greed prevailed. New Zealanders to their detriment are so trusting. This set of circumstances has some distance to run. Mortgage rates will continue to rise next year, some jobs will disappear as businesses struggle to maintain sales and some businesses will simply fail. The people responsible for this upcoming disaster will not admit any complicity. They will be simply too gutless to man up.

Well said ex agent.

"New Zealanders to their detriment are so trusting"....exactly.

This is going to be horrid for many.Just saw Luxon on a herald video.What a dishonest prick.....blame labour for overspending but doesn't mention every man and his dog including himself piled in for the tax free gains.

Time for a magnifying glass over the banks, Business NZ and the National party.

How did we end up with two ex westpac staff running Business NZ for fifteen years.Why?

Why do we have an ex National party board member chairing the EMA and an ex National Mp running the chamber.Why?

Greed, corruption and big f'ing egos...and double lashings of greed.

God defend NZ...we are going to need all the help we can get!

Media, bankers, politicians,... the all piled in a sang the same song. Some of us could see it and got rubbish for pointing it out, however it was a bloody disgrace by the lot of them. An orchestrated campaign of self interest - just look at the houses these people all own.

You mean the banks that 12 months ago were using a test rate of 5.8%? Today you can't even find a fixed rate of any duration below 6%.

I didn't know FHB need a Finance Degree when taking out a mortgage. It's the bank's job to make that assessment. Hence $2b profits per year to provide a service/expert advice. No different than hiring a sparky to install an appliance and your house burns down. Maybe the home owner should accurately assess the risks and know a 10 amp appliance shouldn't be installed on a 20 amp breaker.

Quiet now dan there is no need to scare the women and children, the band plays on, nothing can really be wrong. (Suggest you move your family closer to the lifeboats_),

Meanwhile in a lights out data centre the lights still flash, your wealth is safe on a magnetic disk pack.

People complain when banks lend them money, people complain when banks don't lend them money.

Im not sure one needs a finance degree to use a free calculator on any number of sites that says if interest rate reaches XX then my payments are YY. My 10 year old could google that in a minute.

I'm not a bank apologist, but it was actually the RBNZ signalling lower interest rates for longer (even suggesting need for it to go negative). It was the RBNZ that removed prudent LVR limits on >80% lending. These were financial policy decisions, any bank that didnt play along would not only bleed market share, they'd also have Fair Go complaining about how little Tommy couldnt get a loan. Hypothetical? Perhaps. But look at all the crying over CCCFA.

Agreed. But at the end of the day, those who are ultimately qualified to make these lending decisions are the banks. That's where the buck should stop, but unfortunately unlike the US we have recourse mortgages, and maybe that's why we're in such a pickle.

Except how high does one set the interest rate on those websites your 10 year old frequents? I mean, you could set it at 22% and never buy a house. I assume your 10 year old has made sound investment decisions using those websites too?

It's much easier to blame it on someone else isn't it? Im not sure what you're saying should have been done differently?

The lending decisions banks made was based on the info customers provided and a forecast of interest rates based on RBNZ and market signals. What would you have Banks do? Test rate at 15% and then have people crying to the media about evil banks?

Surely borrowers need to have some idea about how what they might need to do in future scenarios. Remember too that >50% of loans in the NZ market are via brokers.

The recourse v non recourse argument is a red herring IMO, because it's not like having non recourse mortgages made any difference to the GFC and sub prime crisis. Everyone pays in the end.

For context - arrears rates remain super low in NZ.

The recourse v non recourse argument is a red herring IMO, because it's not like having non recourse mortgages made any difference to the GFC and sub prime crisis. Everyone pays in the end.

Being able to fix for decades at massively low interest rates gives you a massive safety valve - again, not something we have in our markets.

Arrears in NZ remain low because we have huge amounts of loan books on fixed, but big portions of that rolling over in the next 12 months. Households will be looking at what they owe vs. what their house could be worth when they come off fixed, and whether they sit the next 24 months out as a means of avoiding being left holding the bag.

I'm not sure why some people think it is reasonable for individuals to defray this kind of swing in OCR and base lending rates through their own actions, given it wasn't something that banks or indeed central banks saw coming either. But if we're saying that asking questions about why organisations making billions of dollars a year couldn't pick or price higher rates into their lending models is 'blaming it on someone else', then sure, why not.

"Being able to fix for decades at massively low interest rates gives you a massive safety valve - again, not something we have in our markets"

Not so much if you have to move etc. Killer cost to unwind those positions. It is not in the NZ market because the funding isn't there and no one wants to pay the rate it would need to be.

"Arrears in NZ remain low because we have huge amounts of loan books on fixed, but big portions of that rolling over in the next 12 months. Households will be looking at what they owe vs. what their house could be worth when they come off fixed, and whether they sit the next 24 months out as a means of avoiding being left holding the bag"

The vast majority of current loan holders first obtained their loans prior to the 2021 madness, so will still be up in equity value and likely have been paying more than minimum payments during the 2.x% heyday. It's terrible for those who suffered FOMO and jumped on at the peak, as they will be most affected. But whether that spreads to wide arrears rates I guess depends on the extent of job losses

"I'm not sure why some people think it is reasonable for individuals to defray this kind of swing in OCR and base lending rates through their own actions, given it wasn't something that banks or indeed central banks saw coming either. But if we're saying that asking questions about why organisations making billions of dollars a year couldn't pick or price higher rates into their lending models is 'blaming it on someone else', then sure, why not."

Missing the point - what I am asking is what would you have had the Banks do? To say "no, you cant borrrow because the rates may trend back to 8%"... imagine the furore of media complaining people were getting locked out of ownership, imagine the RBNZ response "we told you muppets to lend lend lend"

Missing the point - what I am asking is what would you have had the Banks do? To say "no, you cant borrrow because the rates may trend back to 8%"... imagine the furore of media complaining people were getting locked out of ownership, imagine the RBNZ response "we told you muppets to lend lend lend"

It's more what the banks do from here, and RBNZ for that matter too. They are on very thin ice from a social license perspective, if they want to pretend to be both the victims and geniuses for posting multi-billion dollar profits. There's a much higher obligation on banks to play ball with things unwinding if the retail rates overshoot the stress-test rates by some considerable margin. Flexibility around breaking, transferring of loans and longer fixing periods are probably not unreasonable expectations, unless banks are somehow a protected class who get to have their cake and eat it too.

Missing the point - what I am asking is what would you have had the Banks do? To say "no, you cant borrrow because the rates may trend back to 8%"... imagine the furore of media complaining people were getting locked out of ownership, imagine the RBNZ response "we told you muppets to lend lend lend"

The banks should have never gone down the track of dropping their test rates, as these are the benchmark for long term serviceability. They should have always been at 8% or 10% or whatever. If borrowers are expected to have known, then the banks definitely should have known that interest rates would be over 6% this year.

It is about blame. You know, Liability. Every other business can be held liable for the decisions/actions they make for their clients, but for some reason taking out a mortgage is different? The action of testing a borrower in my view puts the liability onto the banks, because they've taken the lead and made the informed assessment. If instead the borrower decided their test rate, then the liability would be on them.

Maybe the banks should be testing at 15% if those rates are a probability in the medium to long term? What would house prices be today if the test rate was 15% since the 1980's?

For the record, I'm not overleveraged so this isn't a personal issue, just my view.

You make a good point. But isnt the liability already currently with the bank though? If a borrower defaults, while they might owe money at the end, wont they just declare bankruptcy and the bank wears it anyway. That's why they make loss provisions. Or am I missing something?

Yeah the bank has liability in that regard sure. But declaring bankruptcy is not just "oh well let's move on" is it?

The borrower loses their deposit, their credit score, their home. The bank with only 16% of shareholder capital on the line?

While you're bankrupt, you can keep:

- tools needed for your work (up to a certain value)

- necessary household furniture and effects (up to a certain value)

- a motor vehicle worth up to $6,500

- money up to a maximum of $1,300

- items on hire purchase — but you'll have to continue making payments.

The bank would surely lose whatever the shortfall between loan, sale price (always lower in mortgagee sale), costs etc. Could easily exceed 16% of the loan.

Are you proposing that a borrower who did not keep up payments should get back their deposit, keep the home and a good credit score. Hmm. That's some slippery slope stuff.

What I am saying is the banks are more culpable than the borrowers if...say...the borrower defaults not due to a change of personal circumstances e.g. job loss but because the banks were reckless in the risk assessment. What if the banks were proven 100% to know ahead of time a 5.8% test rate is inadequate but still dished out mortgages? What if instead of 5.8% it was 2%?

Maybe the banks, like Landlords with rent, should be limited to how much they can increase rates on existing loans? E.g. max of 20% on last rate. So someone on 2.5% refixes at 3%.

Pure scaremongering. One just needs to ignore the RBNZ's deliberate but baseless doom and gloom hyperbole and look through this only slightly inconvenient transient period, to see the next round of house price increases is just around the corner. Just ask the experts.

https://www.oneroof.co.nz/news/tony-alexander-falling-prices-rising-fea…

Be quick!

These increases, and the next ones coming early next year, will take mortgage rates above the "test" levels adopted by banks. The housing Ponzi has its months numbered, and a halving of house prices from the peak, in real terms, in a very distinct possibility. The overdue big rebalance of the NZ economy, away from parasitic house speculation and into more productive activities, is going to be the main economic story of 2023.

Unfortunately, this will initially impact the real economy too, but thanks to the huge policy mistakes of the RBNZ this is now unavoidable and the sooner it happens the less long term structural damage is going to cause.

The overdue big rebalance of the NZ economy, away from parasitic house speculation and into more productive activities, is going to be the main economic story of 2023.

Bit late for that now. Housing stock value to GDP is approx 4x. 60-70% of credit creation has been allocated for the bubble and consumption. You can't just turn on a dime.

The reason people mocked the moron was that he spammed his "prophecy" on every page.

He never specified which interest rates (so he could claim he was talking about credit card interest rates if housing interest rates didn't increase)

You going to make another alt to start spamming again champ?

Property Investors Facebook p0rn on the latest interest rates news.

Watch the others... won't be able to help themselves... pure profiteering. Shame we can't borrow overseas against NZ properties... there the banks are kept honest.

Swap rates haven't gone up that much

What f***ers. I presume swap rates have come down too.

Would love a bank to give decent discounts for sub 50% LVR and DTI of less than 2.

Very interesting move by ANZ to hike the 1-5 year fixed mortgage rates at a time when the underlying hedging interest rates (Interest Rate Swap curve) is falling as are the NZ Government Bond yields. Could it be out of step with the market and need to reverse this move in 1-2 weeks? Could it be coming off the Nov-Dec 2021 housing peak where many had fixed their mortgages just out a year at the now very attractive one year levels around 4.20% and now need to contemplate the ANZ's new 1 year fixed rate of 7.14% (whereas yesterday it was a slightly more palatable 6.59%)? Also interesting to see some market leading term deposit rates out there by the same organisation that this time last month said they don't have to offer market leading term deposit rates...plenty to think on

Quite a few seem to think banks are benevolent societies. The RBNZ overseas banks through the Reserve Bank Act. A govt passed the Act and there will be amendments over time. Through a remit the finance minister can steer the RBNZ in a particular direction. Look to the govt of the day to vent your anger about banks on so called excess profits. There's also a difference between excess and windfall profits.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.