Higher interest rates are going to be tough - but ongoing high inflation would be much tougher, economists at the country's largest bank say.

ANZ economist Finn Robinson and chief economist Sharon Zollner have compiled a comprehensive crunch of the interest rate and inflation picture in a new NZ Insight publication.

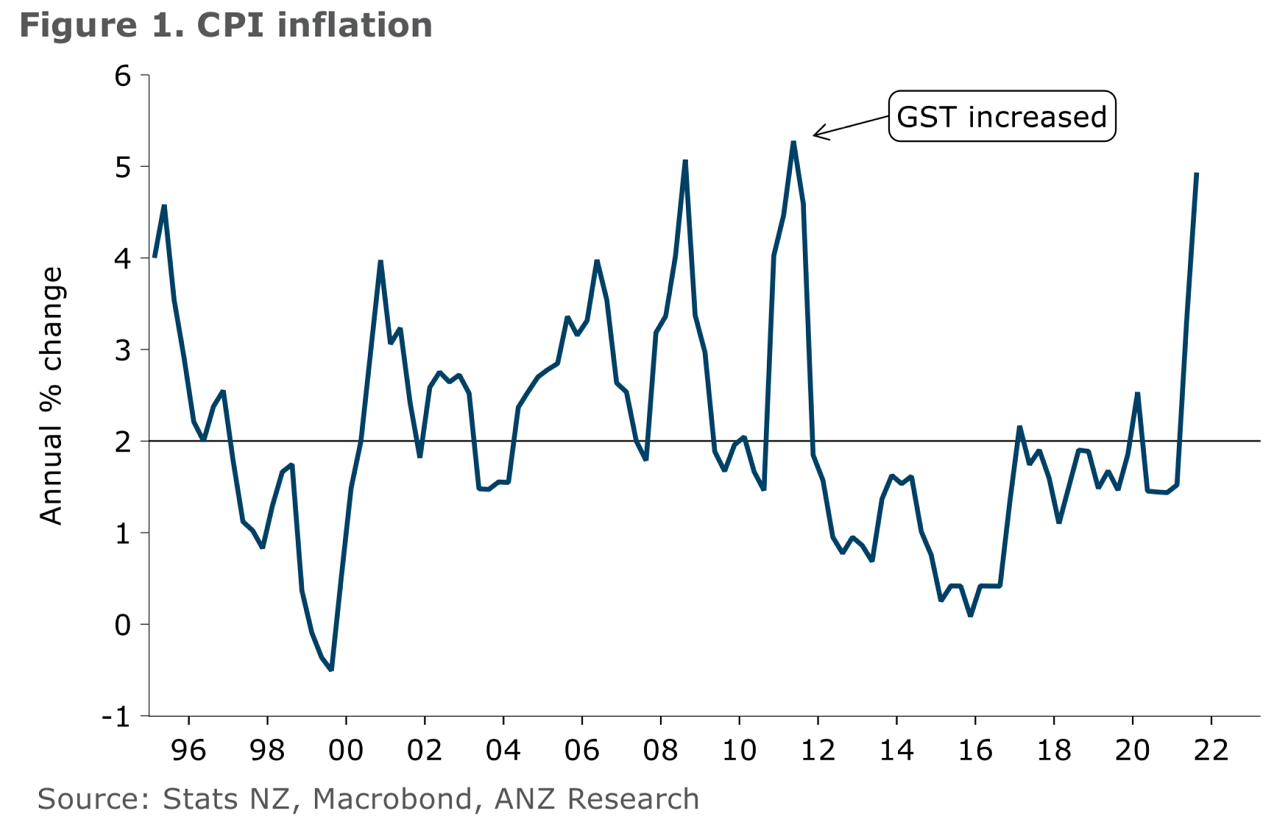

Inflation hit a 10-year high annual rate of 4.9% for the September quarter and is set to go higher yet, with the Reserve Bank picking a peak of 5.7% for the December 2021 quarter. Interest rates are on the up in response, with the RBNZ having lifted the Official Cash Rate over the past two months from 0.25% to 0.75% and with more to come. But wholesale interest rates have lifted much more and this has seen banks aggressively pushing up mortgage rates.

Robinson and Zollner say the path to low inflation isn’t easy.

"Unfortunately, the tonic for overly high underlying inflation is higher interest rates, which isn’t a barrel of laughs in a net-debtor economy either. We’re forecasting that the RBNZ will continue to lift the OCR in 25bp increments to a peak of 2% in August 2022 – and we think that will be enough to bring CPI inflation back to a more-manageable level."

One reason they think the OCR will ‘only’ need to go to 2% (the RBNZ is itself suggesting a peak of 2.6%) is that the New Zealand economy - in particular the housing market - is very sensitive to higher interest rates right now.

They say, for some context, that the one-year special mortgage rate dropped to a low of 2.21% in June 2021, and as of November, was about 130bps higher at 3.49%.

"If a hypothetical household with an $800,000 mortgage experienced the same increase in their mortgage rate, then all else equal their weekly payments would increase by roughly $115 (assuming a 25-year mortgage). That’s going to hurt – and when you multiply across hundreds of thousands of borrowers, it’s a lot of disposable income that’s suddenly taken up with increased mortgage payments."

So, how does this possibly make things better for households?

"It’ll be a rough adjustment for some for sure – especially those who have leveraged up to the hilt to jump into the frothy housing market over the past year."

But it’s worth noting, they say, that overall, interest payments are just 2.7% of expenditure for lower income households, and 6.2% for the highest earners.

"Debt servicing has gotten more expensive (and will likely continue to in coming quarters), but out-of-control inflation would deal a much more devastating blow to household purchasing power.

"And of course, some households are net savers, particularly older ones, and they stand to benefit from higher interest rates."

But overall, New Zealanders have a tendency to "spend beyond our means", as demonstrated in our persistent current account deficits, so higher interest rates "do suck income out" of the economy overall.

"High inflation is not just a theoretical problem. It’s a real problem, especially for low-income households. And while the medicine (higher interest rates) isn’t pleasant for borrowers, it’s far better than seeing living costs spiral out of control and real incomes collapse.

"We’ve spent a long time in New Zealand getting used to low and stable inflation, but it’s worth remembering that high inflation can be extremely damaging, and that’s why the RBNZ has acted (much faster than many of its international peers) to protect the value of money in New Zealand."

The two economists go into substantial detail of what Kiwis spend their money on. They say the Household Living Cost Price Indexes (HLPI) published by Statistics New Zealand show how living costs are rising for different types of households – including by differing income, and other social indicators.

"Because households have very different spending patterns, the HLPI for each type of household is weighted to reflect that. For example, the 2021 expenditure weights calculated by Statistics NZ show that 16.4% of expenditure of the lowest-income households went towards rent payments, versus just 6.7% for those on higher incomes. So when the price of renting goes up, that will have a larger impact on the cost of living (and HLPI) of lower-income households than for higher-earnings ones."

They say what’s immediately clear from the data is that households have historically had varied experiences of inflation. Over most of the last decade, beneficiaries and superannuitants saw their living costs rise at a faster rate than average.

"And that matches up with what you’d expect if we look at the data by household income – the 20% of households with the lowest incomes have tended to see the largest living cost increases, while the richest 20% have seen the smallest increases."

The cumulative impact of higher cost increases for some households is actually "quite significant", the economists say.

"If we plot the level of the HLPIs across income quintiles, it’s clearer how much more costs have increased for low-earning households. Since [the second quarter of] 2008, living costs for the top 20% of earners have risen 20%, but for the lowest 20%, the increase has been 30%. Superannuitants have had it the worst in terms of the rising cost of living, with costs up 34% over the same period."

However, in recent quarters, and in a break from historical patterns, cost increases have been of about the same magnitude for all households.

The economists say this likely reflects the fact that inflation has been very broad-based – the only component of the Consumers Price Index that didn’t rise in the September quarter was communication (just under 3% of the total basket).

"On average, households saw living costs rise 4.0% in the year to September 2021 , and we don’t expect cost pressures to moderate on an annual basis until the June quarter of 2022.

"On paper it looks like everyone’s hurting from the same strong inflation currently. But when we dig into the details, it’s clear that for poorer households, high inflation is particularly hard to deal with."

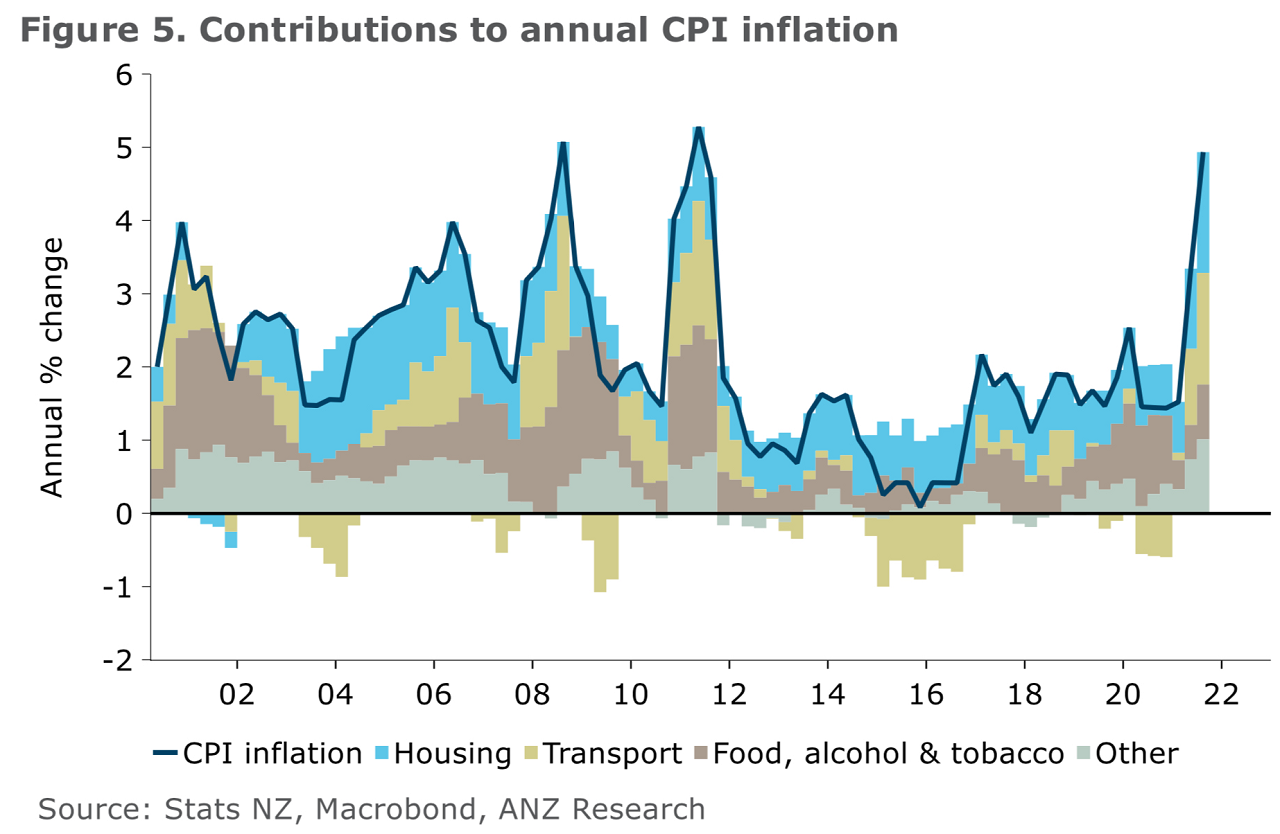

Robinson and Zollner say the biggest drivers of strong inflation in recent quarters have been housing, transport, and food. Of the 2.2% increase in consumer prices in the September quarter 2021, 0.7ppts came from housing (eg rents, building costs, council rates), 0.5ppts came from food, and transport added 0.5ppts (60% of that from petrol alone).

"These are all essential items - and that makes absorbing price rises more difficult for poorer households, since a larger share of their expenditure goes towards essential goods and services. It’s easier for higher-income households to cope with price rises because they can simply cut back on more discretionary spending (eg not eating out as much).

"But for a poor household whose budget can barely cover the essentials even when inflation is low, the choice quickly becomes: do I have lunch this week or pay the rent?"

Looking at the composition of household spending across different income groups, it can be seen that for the bottom 20% of households in New Zealand, housing, food, and transport make up a much bigger share of their expenditure than for the top 20%.

"It’s also interesting to note that for wealthier households, interest payments make up a larger share of their expenditure – because they’ll be much more likely to have a mortgage on an owner-occupied home (and/or investment property)."

So, adding up the numbers, 63.5% of expenditure goes towards food, housing, and transport for lower-income households, compared with 51.2% for the highest earners.

"And that underweights the importance of ‘essential’ spending for poor households, since they also have to fork out for essential clothing and footwear, insurance, health, education, and other items – which have all gone up in price.

"Plus, within groups like food expenditure, higher-income households tend to spend more on more ‘optional’ items, like restaurant meals and takeaways."

They say that the share of expenditure going on restaurant meals and ready-to-eat meals has increased in recent years over all income quintiles, but that it has remained broadly true that the top-income group spends roughly twice the proportion of their income on this category as the lowest-income group does. That means they have considerably more flexibility in their spending choices.

"...Even though the HLPI does a better job of showing how households are differently affected by inflation, income quintiles can still mask extreme outcomes. As an example, the New Zealand Food Network reported that the August to October 2021 period saw a 504% increase in food being given to communities compared with the same time in 2020.

"Clearly, for the very poorest people in New Zealand, life is even tougher than official data captures.

"The bottom line is that for poorer households who spend a lot more of their constrained budgets on essential goods and services, the current composition of strong inflation is particularly hard to bear. Higher-income households may be able to more easily absorb price rises by simply cutting back on non-essential spending, but for poorer households, there’s simply not much fat to trim."

The economists say that "unfortunately", hourly wage growth is now languishing behind CPI inflation, with real wages falling the most in the third quarter since GST was increased in 2010.

They say that this is to be expected, since wage adjustments are often indexed to previous outturns, and usually occur annually, "and forecasters (including us) have seriously underestimated the speed at which consumer prices would rise in the wake of Covid".

"Normally, indexing wages to inflation once a year works pretty well, since inflation is usually low and stable, meaning last year’s CPI inflation isn’t a bad forecast of the next year. But when prices are rising so quickly, such backward-looking and infrequent adjustments can actually have big impacts on household purchasing power.

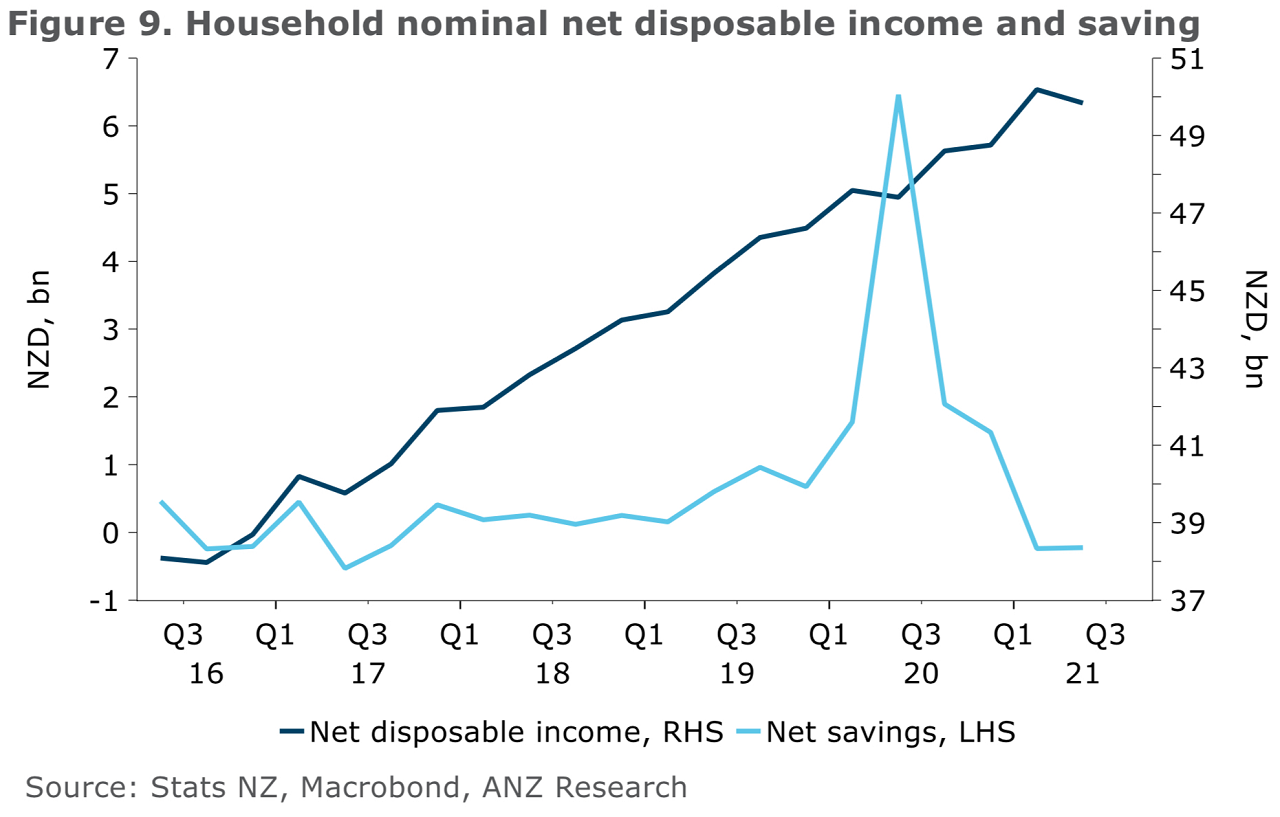

Though rising living costs mean many households are doing it tougher currently, there is reason to be optimistic about household incomes in the medium term, the economists say.

"It may take some time, but wages will adjust, and the tight labour market will give workers more bargaining power to lock in cost of living adjustments. Our forecasts for inflation and wages imply respectable real wage growth from around the second half of 2022.

"But our expectation of stronger real wage growth over H2 2022 won’t make it any easier for households who need to meet those higher prices here and now. While there are many reasons why consumer confidence may be weak right now (including higher mortgage rates and the ever-mutating variants of Covid), it’s very possible a contributing factor is that households are having to work harder just to maintain the same standard of living as inflation surges.

"Sagging confidence is a downside risk to the economy if it sees consumers pull back on spending.

"Some reduction in demand is needed for the RBNZ to bring us back to a more sustainable growth path, but it’s a delicate balance between putting a lid on a bubbly economy and pouring cold water over everything.

"High inflation is an unpleasant thing to go through – it’s eroding purchasing power, stretching the budgets of poor households, and possibly contributing to a deterioration in consumer sentiment that could weigh on economic momentum, even as Covid restrictions continue to be relaxed."

46 Comments

Easy answer.

Slash mortgage costs to 0%. "But that won't automatically feed through to rent charged. It hasn't so far!"

Quite right.

So slash the re-sale price of all property in New Zealand. Anyone who wants to 'hang on', can, at 0%, and anyone wants to sell will do so at a vastly discounted sale price to that available today. And that, will translate into lower rent as any 'new' landlord will have a much lower breakeven cost.

How do we slash property prices? Again, easy. Slash the amount of debt available to enable property transactions. We all get ONE residential mortgage registered with an IRD number at 0%. After that, it's an LVR of 0% - you have to come up with all the purchase price yourself. Maybe that's an exaggerated example, but there will be a compromise alternative that enables the forgoing.

Note also that with mortgage rates at 0%, business lending rates will be commensurately lower. They have to be, as banks make their living out of lending money, and if they can't lend it to residential speculators, they'll find the next best thing - businesses, who inturn will be able to take their produce to market at a lower price point. Inflation Dragon, slayed!

2% OCR peaking was a good forecast 6 months ago if RBNZ acted when first time inflation above 2% and with 50bps increased last week. But now, I don't think 2% would be enough unless housing price stablised or by setting OCR to 2%. The issue is that, RBNZ's slow and cautious approach gives public signal that they would rather protect housing market than fullfill their mandate therefore to push assets inflation higher. This results general inflation would go higher. The frenzy housing market has already picked up its momentum. So my theory is, unless we seen housing price stablised or fall, inflation won't come down, which means RBNZ would continue to be forced to raise OCR.

The issue with current inflation is not only a supply pulled but also demand pulled inflation.

Black Friday sales shoot up to record levels despite Covid-19 - NZ Herald

But once it becomes wage push inflation, it will become much harder to control. The window is closing fast, RBNZ needs to act fast before it's too late.

To late now I recon. They may need to hold an emergency meeting before February to try and sort the mess. I think they are just living in hope that something will come out of the blue and save them. Things are likely to get worse rather than better in the short term, I cannot see any signs of improvement on the horizon can you ?

I agree, it's too late now. Mr Orr didn't appear to realize that my keeping interest rates so low (which in turn created low term deposit rates), he created the perfect storm. Too many people have jumped into the housing market and will soon find themselves over their heads. Depositors took their $s from the banks and put it into real estate. Who would have thought?

I completely agree. Swap rates are already pointing to an OCR peak closer to 3% than to 2%. The slowness of the RBNZ will force them to set a much higher OCR than it would have otherwise been necessary. It is already almost too late.

Next year is going to be red hot for interest rates, and the market will see rates not seen in years. All savers should NOT invest in term deposits for any term longer than 6 months. This will force banks and the market to warrant even higher longer term rates and will be forced to finally appropriately reward savers, and rates in 6 to 9 months time will be significantly higher than now.

You are welcome to criticise policies or ideas (with reasons)

Look at how the banks position their brands: inclusive, community minded, there to help.

In reality, they have a privilege in society like no other business and ultimately people's lives / fortunes are affected by their behavior.

I don't see the problem with criticizing their policies or their people based on their behavior. Zollner gets to regularly espouse her views and those of her employers to the NZ public.

Repeatedly telling low income people that inflation is bad for them as they did above, they almost imply that the recipients don't notice unless repeatedly hit over the head with it. Added to that the banks being responsible for pouring money in and creating the said conditions. The red mist decends.

Wow, really? I can't point out that their chief economist is hypocritical?

To be more specific, she wrings her hands about housing affordability... while working for a bank that have been complicit in the whole debacle.

Wow, David....this is exactly the kind of reason I won't subscribe.

The comments are the most interesting thing anyway.

Talk about heavy handed.

One thing about politics, economics and finance in general is the requirement to try to forecast ‘market’ reactions to changing economic factors… Orr being head of RBNZ is tasked with this requirement… it’s not good enough to throw cash around then stand back expecting people not to indulge

"... 63.5% of expenditure goes towards food, housing, and transport for lower-income households, compared with 51.2% for the highest earners. Sagging confidence is a downside risk to the economy if it sees consumers pull back on spending."

Absolutely love this article!

When it comes to wanting to increase interest rates, banks will do anything including becoming socialists overnight. Does it occur to them where the 12.3% expenditure difference actually goes to- businesses and investments?

Sagging confidence may be a downside risk to the economy, however, reduction in disposable income for those who are able to spend and invest will be the real concrete risk to the economy.

Go through the dismal bank lending to small businesses for the same periods used in this report and reread this report for maximum amusement.

Well actually they are compounding.

My mortgage is going up $100 a week from next week.

So not only will I have less disposable income to spend, but that remaining income will indeed buy me less goods.

And If I was unvaccinated, I would ONLY be able to spend at large retailers. So small businesses are going to really feel the pain.

Its always about the money so small businesses are not going the pain unless its self imposed. If they see a noticeable drop off in business the unvaccinated will be let back in quicker than you can scan the tracer QR code. I give it 6 months before everyone is totally ignoring the monitoring for several reason including cost of checking, nobody taking the booster in 6 months, drop off in business. if you will not let me in I will take my business elsewhere.

Agreed but economics 101 tells us a normal person has clear profit motivations. We have no politicians (outside of TOP) who can with any lucidity talk about the economic policy they wish to pursue for a specific social end.

This near-complete lack of education means that the workings of our economy must be a frustrating mystery to them. It has been clear to anyone who has even picked up an economics 101 level book that all our internal markets are dysfunctional (in a sense of a normal price seeking maketplace) across the board with the possible exception of telecommunications. The near total lack of a regulatory function to establish competition and to ensure market makers exist but don't collaborate = this outcome. It's as surprising as the sun rising every day.

As for banks not lending to businesses, they would be going against the best interests of their shareholders to do so as they cannot get the multiple effect they can for house lending.

I mean in regards to the ability for their to apply higher levels of leverage to that capital. Homes are less risky in the RBNZ portfolio assessment process meaning you need to hold less capital against them than business loans. Therefore you can hold more interest bearing loans for a given amount of capital if they are made against housing than if they are against business assets.

I'm not sure the whole lot of them don't understand. Seems they have a pretty simple formula.

1. Trust in the "wealth effect" even if some point out it's a defunct idea. Consult the Treasury if encouragement needed.

2. Pay lip service to the idea of not inflating house prices.

3. Inflate house prices. Seem point number 1.

Kick the can down the road for someone else. Talk about sustained moderation etc. Talk about productivity. Talk about not wanting to see house prices come down much.

Indeed Rick perhaps I was being too generous.

I am actually more interested in talking about how the government is failing to regulate markets and allowing gross (and world leading, our banks are the most profitable (vs capitalisation) in the whole world) profits for our oligopolies.

The bleeding heart concern for the poor in the bankers' comments here is absolutely excruciating. Rich people and their bankers want interest rates to rise so that financial wealth is not devalued by inflation. But, the last thing poor people need is higher interest rates that will (a) do nothing to control prices, (b) put upwards pressure on their rents, and (c) reduce demand in an economy that is finally running warm enough to consider employing them on decent wages.

Also worth noting that banks have more than $30 billion sat in settlement accounts earning OCR - so every 25 points increase in the OCR earns them an extra $75m a year of free money from Government. They should declare this conflict whenever they share their opinion.

This will create just spiralling inflation and a never-ending loop of ever-increasing prices, where everybody loses out.

There is only one way to control inflation in the medium-longer term, a painful one for some, but the only one that can actually work - tighten monetary conditions. The OCR must be increased aggressively, and right now. The OCR should have been already 2-2.5% by now. Trying to avoid some pain now will create much more pain later on. It is time to stop burying our heads in the sand, and time to stop listening to a parasitic minority of self-serving housing specuvestors.

You will never get out of the 'covid woods'. Covid has nothing to do with an economy. NZ's Keynesian approach to the recession we are about to hit, will only kick the can down the road. Trade deficits, excessive government spending, RBNZ money creation, zero interest rates (creating more debt) is just debt fueled growth (housing bubble) of a country living above its means. America in disguise, except they have the worlds reserve currency (can export inflation) but we don't. Just how good would these Auckland property investors be if interest rates were higher (which is the RBNZ's job) than the fake reported inflation. Bring in a Paul Volker, the last true economist.

Wages are growing at a far smaller rate than inflation - the only way to ensure the lowest paid amongst our society can survive - pay their rent and feed their families - is to ensure the minimum wage and benefits grow at the inflation rate (at a minimum) to ensure they are not being left behind.

I don't think hiking the OCR and forcing mortgage holders to pay more interest is the answer - while the economy is pretty solid currently, there is so much uncertainty out there with COVID I think things will be pretty fluid for the next 1 or 2 years at least. So punishing the average Kiwi trying to pay off their mortgage and feed their family seems like a pretty tough solution to the economic woes!

Wage rises are great - New Zealand pay rates have been stagnant for years, it's great to see workers pushing hard to get the wage increases they deserve. Inflation at 5%, house inflation close to 30%, I hope they use those rates as benchmarks when talking to their bosses about their wages!

Inflation has been below target for pretty much the entire last decade so let it run above for a while.

I might add, some of this inflation is a direct result of a Net Zero policy so you pretty much signed up to be poorer so stop complaining about it. Then there is the closed border and skill shortage and supply chain issues.

The RBNZ should sit on their hands and keep the OCR here.

The PTA doesn't work like that. People need to understand that inflation is a tax, one that the government legally requires to be present, and when wages catch up, the tax rates are not adjusted for it. It is, in short, a con job on those who rely on selling their labour to survive, while blowing out the value of assets of those who can afford them.

......AND INFLATION IS TRANSITORY......

Famous word by famous people and they are suppose to be experts ......expert in lying and manipulating.....now what.......another story.....another fib.....another lie......another manipulation....

They all stand exposed yet shameless.....

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.