There's opportunities and threats contained in the emerging trends in the monetary system, according to the Reserve Bank.

The RBNZ has released two issues papers on which it is seeking public views by December 6.

In the first of these, which focuses on the RBNZ's new, recently legislated, role as "steward" of the country's money, the central banks says the monetary system and the environment that surrounds it are ever-changing.

It cites three key trends in the monetary system.

- A continuing decline in the use of cash in transactions.

- Digital innovation in money and payments.

- Opportunities to stimulate innovation in the wider payment systems.

"In the Reserve Bank’s view these trends pose both opportunities to stimulate innovation to enhance the prosperity and wellbeing of New Zealanders, and credible threats to the stability and functioning of the monetary system," the bank says.

It intends to expand and seek to "formalise" its system stewardship role in respect of money and cash issues.

"Our objectives as steward are to ensure, now and in the future, that the money we issue as a central bank (‘central bank money’) is a stable value anchor for the monetary system; is available as a fair and equal way to pay and save; so ensuring that New Zealanders have access to money in forms that suit them and their changing needs."

It says preliminary analysis "suggests that we may need more powers if we are to fulfil our stewardship responsibilities".

The RBNZ aims to prioritise work in the following three areas:

1. Optimising the lifecycle management of physical cash – and therefore New Zealanders’ access to it – by redesigning the system that makes cash available around New Zealand (actively or by supporting private sector initiatives).

2. Exploring the opportunities and threats posed to the monetary system by a form of private sector digital asset – stablecoins.

3. Assessing the potential case for a New Zealand central bank digital currency.

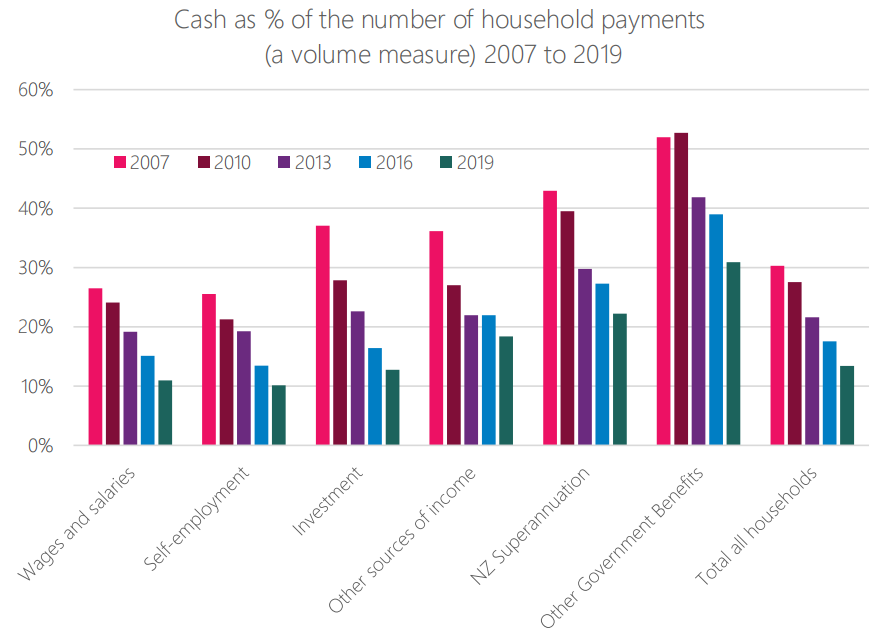

The RBNZ says the use of cash for everyday transactions by individuals and households has been declining. Data from Stats NZ's Household Economic Survey shows that this trend has been underway for more than a decade and is common in all the household types defined in the survey. On average, cash was used for just 13% of household transactions in 2019, down from 30% in 2007.

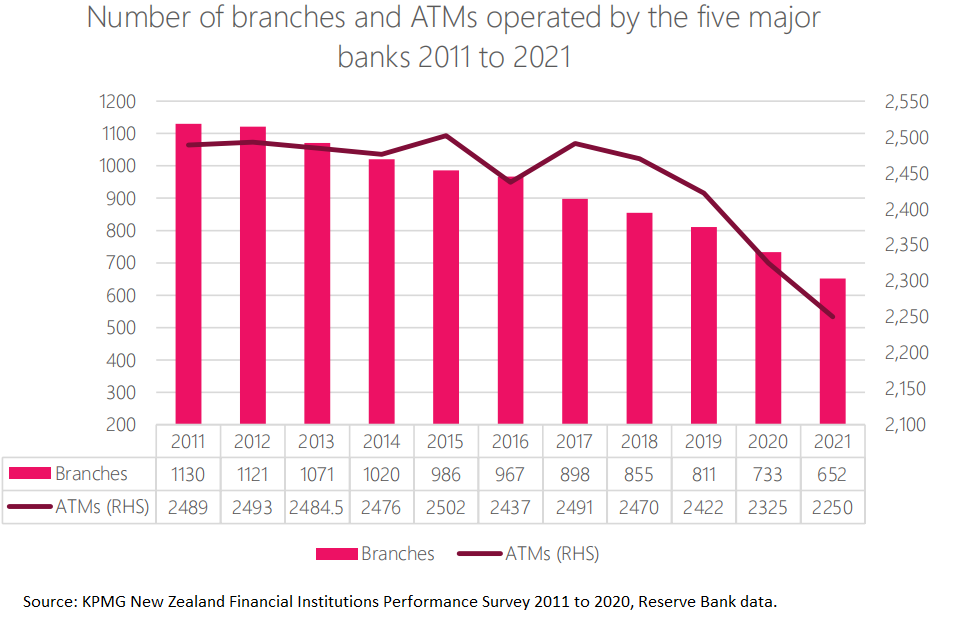

The RBNZ says a decline in cash use in transactions is a common trend globally. There are likely to be many contributors to the decline, such as the convenience of digital payments, a growing consumer preference for online shopping, which typically requires non-cash payments, reduced cash availability as bank branches and ATMs are closed (or operate on restricted hours) and, more recently, the Covid-19 pandemic.

"As cash use declines, the average cost of providing cash increases," the RBNZ says.

"As a result, banks, which are a key part of the cash system, see little incentive to invest in maintaining the availability of cash. They may instead prefer to invest in payment methods that compete with cash (such as Visa- and Mastercard-branded bank-issued credit cards), as these appear to be significantly more profitable for banks. As a result there are fewer bank-owned ATMs than there once were, fewer bank branches and reduced bank opening hours."

But the RBNZ says it is the transactional use of cash that effectively determines the overall cost of the cash system.

"Declining transactional use leads to higher average costs. In the face of declining transactional use, and given the importance of cash remaining available as a means of payment in New Zealand, there is a need to explore ways to make the cash system more efficient and resilient.

"For this reason the Reserve Bank has committed to a fundamental redesign of the system that distributes cash. Digital innovation in private money and payments New technologies are emerging to facilitate digital payments, enabling businesses to pursue new strategies."

The RBNZ says there has already been noticeable innovation in recent years – for example, in phone-based payment apps and digital wallets (an example is Apple Pay).

"Now the focus of innovation appears to be on private money itself. Potential ‘disruptors’ are seeking to offer private money outside the conventional commercial bank account model. This private money offers the prospect of more efficient and innovative means of paying but in some cases may also pose significant risks."

The RBNZ talks at some length about so-called ‘stablecoins’, as one notable example of innovation in private money that raises policy issues.

"One relevant policy issue is the risk that private innovation could pose to New Zealand’s monetary sovereignty. An important question is ‘what new regulations (if any) may be required in order to deliver monetary sovereignty and financial and price stability in a world of new payments technology, new types of private money, new participants and new business models?’"

7 Comments

Sure but what military is going to fight for its dominance?

It would need to have taxes paid to it in order fund an army to fight it to become the 'global monetary network'. Without that, China will squash it.

'But you're just unedcuated about bitcoin and the network...go educate yourself about the technology'....well all I can say about that is go educate yourself about history.

The globally distributed mining facilities are Bitcoins army. And you will never get a global ban on mining. El Salvador is now mining their own Bitcoin

https://twitter.com/nayibbukele/status/1442949756993490945?s=20

Bitcoin is peaceful and made for enemies.

Bitcoin certainly makes it far easier to manipulate the market, use bots to crash the value, cause vastly more harm to the environment, increase power prices astronomically even with the added coal burning just to make transactions, and scam the general public. There is very little positive about bitcoin, oh wait it does make it infinitely easier to track every personal private transaction so you can see Bob brought stuff from big b*t*hes britches and the time. So if you are keen on a lack of data privacy and different agencies having more control over your private data then you and leaking it constantly then that could be a benefit.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.