The strain is showing for Kiwi businesses. That's the verdict from ANZ chief economist Sharon Zollner in the latest monthly ANZ Business Outlook survey.

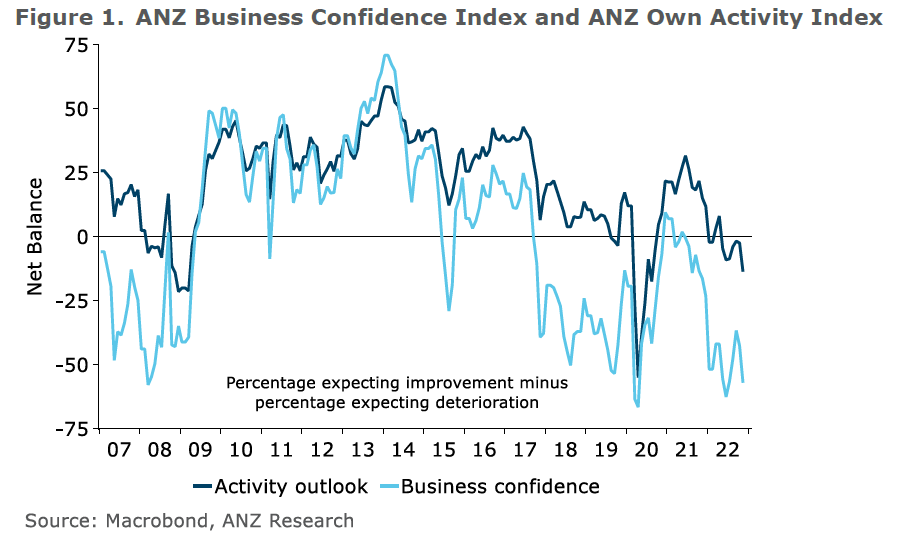

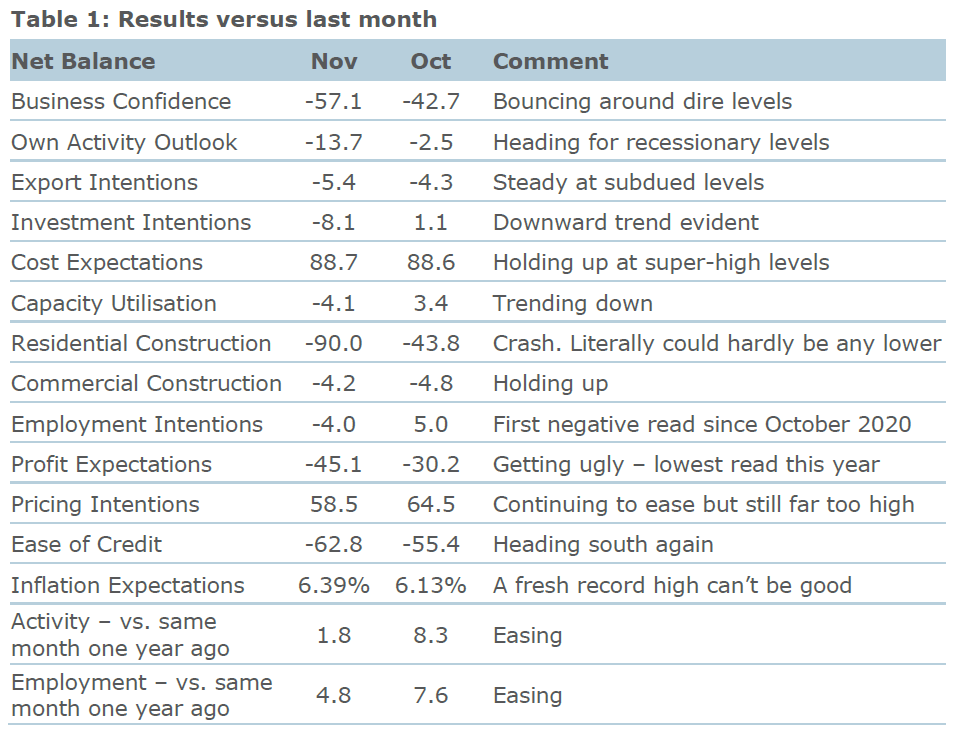

The 'headline' result in the latest survey is that business confidence fell 14 points in November to -57, while expected own activity fell 11 points to -14, only 8 points shy of 2009 lows.

"The survey clearly indicates weaker activity ahead, which is what the RBNZ [Reserve Bank] is trying to bring about in order to lower inflation pressure," Zollner said.

While activity indicators may be weaker, the expectations of inflation have hit a new high.

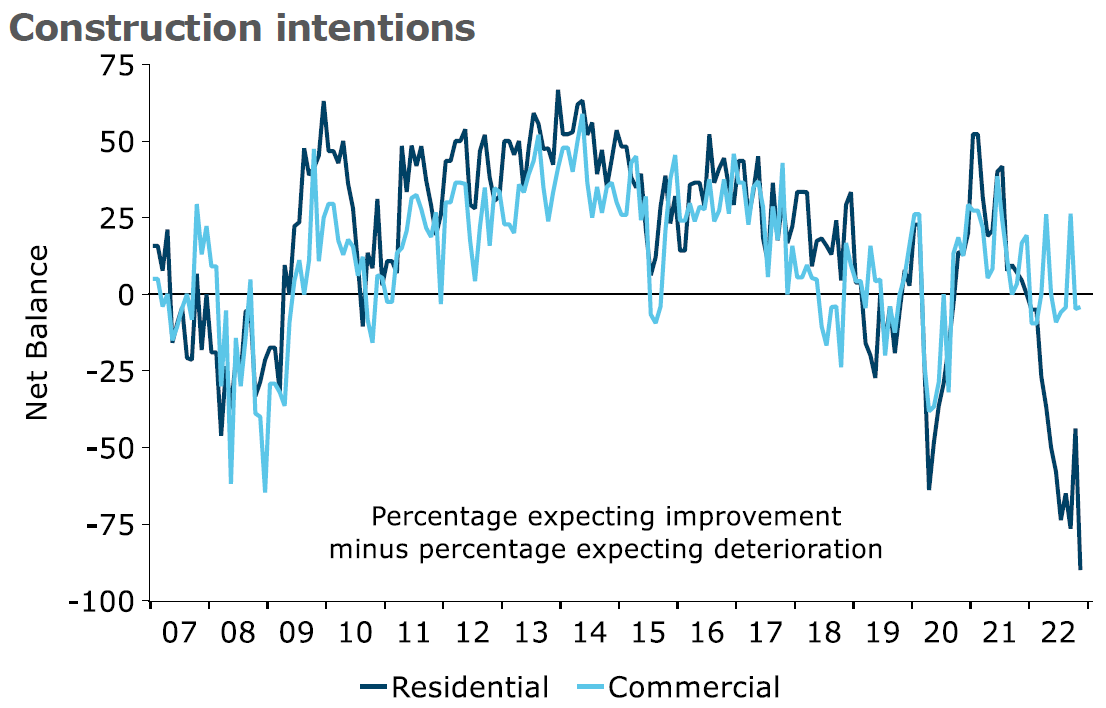

Among specific sector results, the residential construction sector, having seen something of a lift in sentiment from low levels the previous month has this month in Zollner's words "tanked".

"Activity measures were generally lower, and are trending down. Residential construction intentions plummeted to a fresh record low," she said.

"The survey is a mixed bag for the Reserve Bank. The survey clearly indicates weaker activity ahead, which is what the RBNZ is trying to bring about in order to lower inflation pressure.

"The construction sector is on the ropes, and is expecting to actually drop prices, in what would be a very welcome development from an inflation-fighting perspective, given how much construction costs have been contributing to CPI inflation."

Zollner said pricing intentions and cost expectations are falling – but the latter is barely off its highs, and pricing intentions are still far too high for the Reserve Bank to take comfort.

"Inflation expectations hit a fresh record high, which will not provide the RBNZ with any comfort whatsoever."

One thing that was dropping, however, was employment intentions - which went negative for the first time since late 2020.

Zollner said regarding a specific numerical estimate of where firms’ own selling prices will be in three months’ time, it was encouraging to see this fall to its lowest read this year, 3.7%.

"Expected cost increases eased for every sector except manufacturing and services, but outside of construction, it’s a stretch to say there’s a clear downward trend."

She said that on average, firms are still expecting margin compression, with costs expected to go up 6.1% over the next three months, but their prices by only 3.7%.

“Wage growth is a crucial determinant of non-tradable inflation in a tight labour market. Reported past wage settlements rose.

Expectations for wage settlements for the next 12 months are trending down for construction, but are sharply higher for retail, and are holding pretty steady elsewhere. The aggregate was unchanged at 5.6%.

Zollner said: "The strain is showing for kiwi businesses.

"Cost increases remain relentless and margins are squeezed, firms are chronically understaffed, and they’re waiting for the hammer to fall as the impact of relentless monetary policy tightening eventually kicks in.

"There are a lot of dark clouds on the horizon, and this month’s survey reflects that.

"More generally, pricing intentions are continuing to ease, but they are still much too high. And inflation expectations jumped back up to a fresh record high, with retailers expecting inflation of 7%.

"If everyone else is doing it, and customers are expecting it, then the fear of losing customers as a result of passing through cost increases is much reduced.

"The Reserve Bank is trying to bring that fear back by increasing consumers’ price sensitivity."

Business confidence - General

Select chart tabs

26 Comments

Unemployment in construction and related sectors will start surging from mid 2023. This will have a multiplier effect in all areas of the economy, by heavily reducing discretionary spending. And as someone mentioned the other day it won’t be just unemployment having an impact. Some will retain employment but reduced hours and drop income levels. Bonuses will be curtailed. And so forth.

Makes sense. We entered the construction boom somewhere in 2015, so we're almost at the end of the typical 7-year boom-bust cycle.

What a time to reopen migration channels when the job market has peaked and could start declining soon. Employers still hiring will find cheaper migrants to fill vacancies, instead of out-of-work Kiwis who may not have greener pastures to fly to either.

I guess this is the path back to maximum sustainable employment that RBNZ desires.

We have a couple of domestic projects that I managed to persuade my wife to wait on until the middle of next year. I don't think we will have any shortage of builders wishing to quote competitively by then - which should please her (it certainly pleases me, as for the last 18 months they haven't wanted to give us the time of day). Boot. Other. Foot.

20-30% of the sector is a step just above hired labour so will migrate into anything else.

Another 20-30% are so close to retirement they'll just cut back hours.

The rest will tick over with whatever's still going on, including a freakish amount of furloughed central and local government work waiting to break ground.

Don't want to sound like a broken record, but the national economic model of SMEs riding the back of the property Ponzi was always fraught with risk (not necessarily a black swan either). The exceptionalism dial went to 11 among the ruling elite and the general public.

I too wonder that. As I've said earlier, none of my business friends or relatives are using their homes as security - all those that did lost them due to poor business management (and in one case, investment in a non-viable business). It was sharp lessons for them, but they all bounced back and their businesses now stand on their own cashflow.

Be interesting to see how a general downturn affects them though.

I have seen franchises here that have struggled to get any growth over the last 10 years flourish over covid, people buying themselves a job, mostly housing backed.

Im pretty sure franchises country wide have seen some pretty massive growth. They are attractive to the risk averse. I also think there will be a solid winding back of this.

Construction industry has done this to itself with the support of the Unitary Plan, especially residential. Those that are less 'wise' think they are a 'gift' to society and charge horrendous rates, whether it is for their labour, or for materials.....those who are wide have been open and fair. Add in REA, developers, consultants....they/we have cannibalised ourselves. The shock will shake out and those with equity and a good plan will survive. meanwhile we all live with the appalling buildings that have been constructed in some areas.....

What I am seeing here is bad....quite a bit is getting through council inspections too....I have seen complex work done by unskilled people, signed off by an LBP and the workmanship was poor. The same people thinking they are a 'gift' to society: "won't get out of bed for less than $100 per hour. Many paid too because they were caught in the time-trap of finance. This was done to fellow Kiwis by Kiwis....but I might add, that I don't think it is an Otago/Southland issue....work I have done down there is far more 'honourable'.

People have stopped caring about each other.

The industry is full of cowboys and cowgirls, always has been and also will be. Most of the shonky cowboys and cowgirls will be out of business within a year. I am not just talking about builders and tradies, I am also talking about architects, architectural designers, planners, surveyors, project managers, landscape designers, sales people and RE agents.

There’s an awful lot of dross and dodgy-ness that will be cleaned out, thank god.

Well that's the point of what Orr / Jacinda / Robertson are doing right? They are purposely and intentionally raising interest rates to destroy the economy and cause a recession due to inflation/too much spending.

They are manufacturing an economical crisis...... and once that occurs, they will swoop in and save the day again by packing in crazy amounts of stimulus again.

-7

Just reading the above, many seem to have not wanted to see this coming, unfortunately the head in a bucket of sand trick only works for so long.

I dont own property, but with my business, we have no debt and have built cash reserves over the glory days, got it in a position where we could lose 50% of revenue and still be viable and lose no staff. You just have to be a pessimistic when everyone else is eating caviar and drinking champagne.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.