Unemployment has remained at an extremely low 3.3%, according to Statistics New Zealand - but the attention grabber in the latest labour market figures is the scorching rates of pay increase.

The Reserve Bank says the employment situation is "not sustainable".

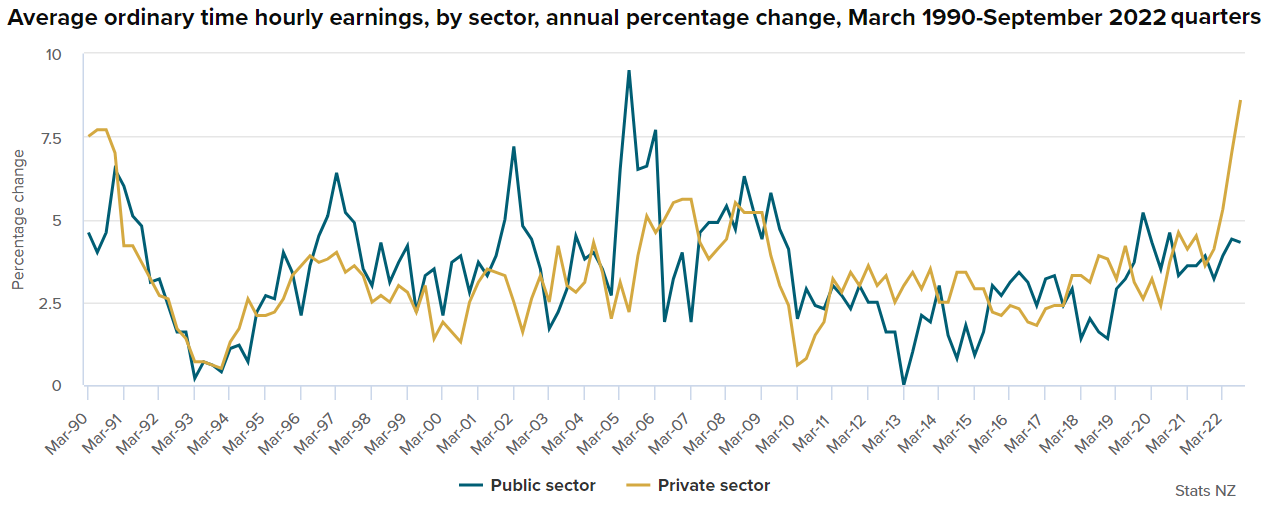

The big figure among the suite of labour market figures for the September quarter released on Wednesday is the astonishing annual 8.6% rise in private sector hourly wages.

Most economists had expected a figure with a '7' in front of it, while it was the RBNZ itself that had the highest forecast. It forecast an 8.3% rise. Other economists had commented ahead of time that it would, given the RBNZ's pick, take a lot to surprise it.

But 8.6% has completely blown everything out of the water and potentially has huge ramifications for interest rates as wage rises of this magnitude are almost certain to push prices higher. It's the classic wage-price spiral.

The RBNZ next reviews the Official Cash Rate (currently on 3.5%) on November 23. The general expectation was that it would raise the OCR by 75 basis points as it strives to bring inflation down from a too-high 7.2%.

However, the fact that wage rises have come in so stratospheric must (I think) open up at least some chance of a 100 point rise - though economists are not tipping or expecting this.

The RBNZ held a media conference on Wednesday for the release of its latest Financial Stability Report. This took place just quarter of an hour after the labour market figures had been released.

Bernard Hickey reports from the media conference that RBNZ Deputy Governor Christian Hawkesby was reluctant to comment too extensively on the jobs figures or monetary policy given that the data had only emerged 15 minutes earlier. The bank would update the market properly on its monetary policy outlook on November 23.

But Hawkesby did say the numbers appeared in line the bank’s view at first blush. He and Governor Adrian Orr reiterated though that employment was above maximum sustainable employment.

"We've been very clear with our monetary policy statements that not only is inflation, consumer price inflation, high at the moment, but employment is through its maximum sustainable level," Hawkesby said.

"So we have a very strong, very hot, labour market, and to achieve our monetary policy objectives, we need to ensure that demand cools such that it can keep pace with the supply that's available. And that's going to involve a period of a cooler demand, cooler consumption, all resulting in weaker employment growth going forward. Now, we have the risks around that which involve how quickly that occurs, what else occurs in the global environment, which may change interest rates further,” he said.

"We get into this and a lot more detail and a couple of weeks time with our monetary policy statement, but it is a combination of the demand side of the economy cooling, through higher interest rates, and the supply side of the economy relaxing, through immigration, increasing the size of the labour market."

Orr also said the labour market was above capacity.

"Employment is beyond maximum sustainable employment at the moment. So it's above. So we're not starting from maximum sustainable employment. And we know that it’s above by a vast array of indicators. An enormous amount of information is being sent to us about the global lack of labour. So this is not a sustainable position, where we are at the moment. Hence, employment growth may slow relative to the labour force. And over time, unemployment rises. And over time, the ability to attract, retain and get the labour you need, improves. And so that's one of the natural ways of going,” he said.

ANZ economists are still picking a 75 basis point rise in the OCR on November 23. Economist Finn Robinson and senior economist Miles Workman said despite the "dramatic monetary policy tightening" already delivered, "we are getting further into wage-price spiral territory".

"And with labour demand still miles ahead of supply, that’s unlikely to change without further action from the RBNZ."

They see the September quarter's underutilisation, employment, wage, and CPI inflation data as "tilting the odds further towards the second 75bp OCR hike that we’ve pencilled in for February (taking the OCR to a peak of 5.0%)".

They say there’s a lot of water to flow under the bridge before we get to the February review, including September quarter GDP figures and December quarter CPI and labour market releases, "but so far there’s been scant evidence that the RBNZ is having a significant impact on domestic inflation pressures".

"And apart from the sharp increases in interest rates that the RBNZ is delivering, there’s not much else to suggest why domestic inflation will actually fall markedly over 2023 (unless we saw a sudden improvement in the supply-side of the economy, or something nasty (and deflationary) hitting us from offshore – unforecastable things).

"We see the RBNZ needing to lift the OCR to a peak of 5.0% to bring the current inflation surge under control, but despite clear downside risks to growth, the upside risks around that forecast dominate, just as has been the case with every one of our OCR forecasts since COVID faded as an economic driver. The earlier the RBNZ gets the OCR to 5%, the smaller the chance that it will need to keep on hiking past this level," Robinson and Workman said.

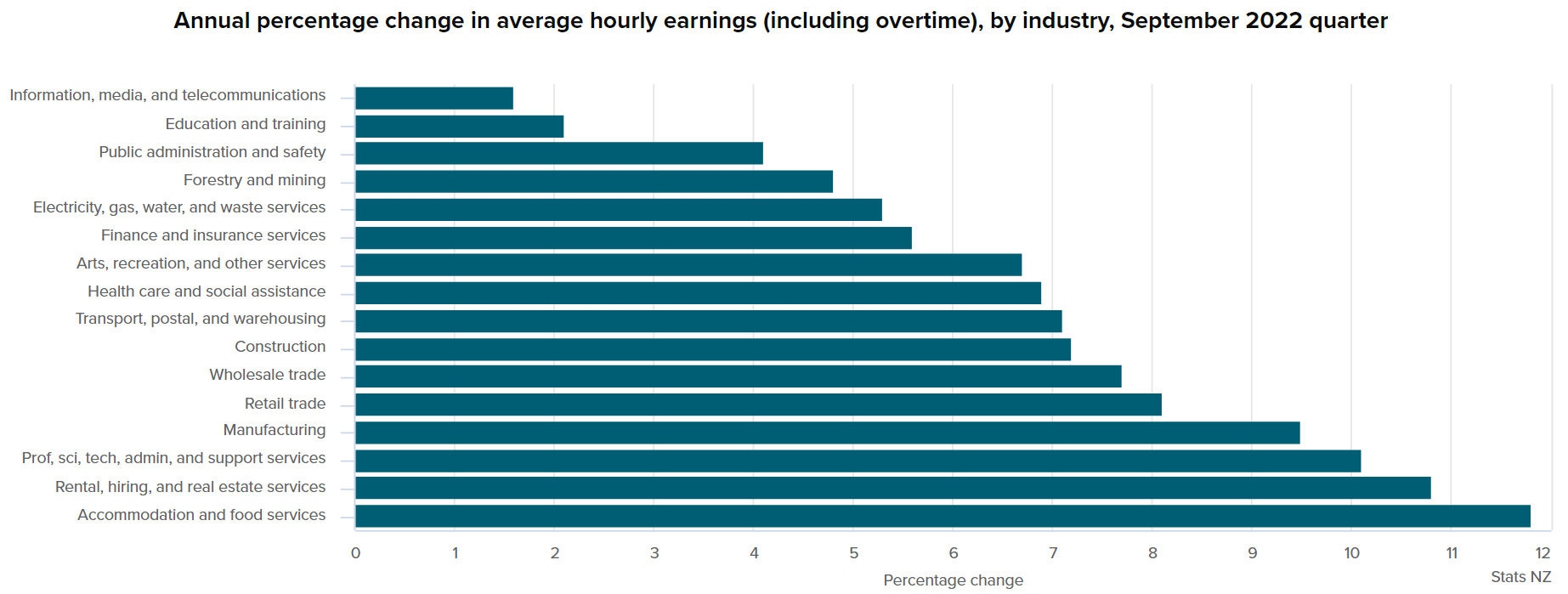

Stats NZ said the professional, scientific, technical, administrative, and support services industry was the largest contributor to wage growth.

Manufacturing, and healthcare and social assistance were the next highest contributing industries, with manufacturing also experiencing all time high hourly earnings growth.

These industries are all relatively large, as well as having strong wage increases, causing them to contribute more to average wage growth than smaller industries.

In percentage terms, the largest annual increase in average total hourly earnings was in the accommodation and food services industry, which rose by 12%. The next largest movement was in the rental, hiring and real estate services industry, with earnings up 11% annually.

In terms of the unemployment figure, at 3.3% it was what the RBNZ forecast, while most economists had tipped it to fall slightly.

Stats NZ said, however, while the unemployment rate remained level, the underutilisation rate – a broader measure of spare labour capacity – dipped slightly to 9.0%, from 9.2% last quarter.

The seasonally adjusted labour force participation rate rose to 71.7%, up from 70.9% last quarter. This is a new all-time high.

This big rise in the participation rate was a key reason why the unemployment figure 'only' stayed at 3.3% rather than reducing.

But during the quarter there 35,000 more people were employed, bringing the total to 2,853,000.

The seasonally adjusted employment rate rose to 69.3%, up from 68.6% last quarter. This is also an all-time high in a data series that goes back to 1986.

The unemployment rate has remained remarkably steady at between 3.2% and 3.3% for a full year now.

ASB economist Nat Keall said the wage inflation readings were the chief area of focus for most analysts "as we look for evidence a worrying wage-price spiral might be unfolding".

"Today’s print didn’t offer a massive amount of comfort on that front."

Keall said ASB economists saw little prospect for any swift relief in either labour market tightness or wage inflation in the near future.

"Much of this tightness is set to be driven by muted growth in the labour force rather than rocketing jobs growth, but the net result is the same: demand and supply for labour are out of whack, with worker shortages remaining an issue stretching well into 2023."

Unemployment

Select chart tabs

178 Comments

How to Fulfill Prophecy from the Scroll.

When the RBNZ Increases the OCR it is Extremely Important it is done with this Agenda.

Go Soft Go Late.

This will fulfill The Prophecy from the Scroll : " Interest Rates will continue to go Up from here and Stay Up for a Long Time."

Go Soft Go Late will also fulfill this Prophecy from the Scroll : "The OCR Forecast Peak Goalposts will continually be Moved Higher and Higher ! "

Go Soft Go Late will eventually result in this Prophecy from the Scroll : "- 80% Crash in Home Prices will be common. "

Go Soft Go Late is Critical to Understanding this Prophecy from the Scroll : "It is NOT about High Interest Rates to Fight Inflation. It IS about High Inflation to Justify High Interest Rates. Ponder on this before the Seal is Broken on the Second Scroll. "

Go Soft Go Late will eventually get us to this Prophecy from the Scroll : " Banks will sell Mortgages at 10% +. ( Double Digits ). " " 10% Interest Rates Next Year, Guaranteed ! "

This sounds great for those who wish for cheaper Home Prices. But beware, there is a much, much, much more sinister Agenda at Play.

Learn about the Taylor Rule and do the Exact Opposite to Fulfill the Prophecies from the Scroll.

Go Soft Go Late.

You are 100% correct. The clown in charge at the RBNZ responsible for this "go soft go late" approach does not seem to understand that the current OCR is way too low, that it has been kept too low for way too long, and that it should have been raised to 5% by now.

He can still show some weak signs of a beginning of understanding if he raised by 100 bps in November and another 100 bps next Feb, but he will not do it: he will only raise by 75 bps at each of the next two OCR reviews, which will simply not work and will force him to go even higher later on.

6% OCR peak is very likely now, but this it could well go significantly higher than that, given Orr's incompetence. As you correctly said, the goalpost is going to go higher and higher, and who knows where it is going to stop.

Squirrel Mortgages : Written by John Bolton, Oct 17 2022

For a long while now we’ve been saying peak mortgage rates will be between 5.50% and 6.00%, and I’ve yet to see anything to change my mind on that.

As inflation gets under control, expect to see interest rates fall, with mortgage rates coming back to around 4.50%.

Who will be correct, John Bolton or The Prophet ?

10% Interest Rates Next Year, Guaranteed !

Never trust a Squirrel, they are only interested in "deez nuts"

This only works if your assumption is that workers can keep taking reductions in purchasing power for the sake of the 'greater good'.

People tend to have this unhealthy obsession with eating and clothing themselves which makes that a pretty crappy assumption that generally just results in them getting gradually poorer. It's not a functional or humane economic model to operate to anymore.

It's not for the 'greater good'. Is just that the result looks the same for them either way.

Whether higher wages and higher prices, or lower wages and lower prices, the purchasing power is approximately the same.

Across an economy, people essentially pay their own wages. The only way to get ahead is to get a pay increase everyone else doesn't get or increase productivity.

I may be wrong, but I think it's the other way round. If wages keep up with inflation, demand may remain high. High demand high prices, high prices high inflation, high inflation high wages, high wages high demand. This is the wage spiral we don't want.

If this continues then I can't see how the RBNZ will have any choice but to raise the OCR above inflation in 2023 and seriously risk over cooking the whole situation come 2024.

Note that RBNZ want unemployment and to squash demand. So will do the opposite of throwing money at the problem until it goes away.

The OCR must be at least 5.5% by next Feb, at the very least, and it is very possible that it will have to go higher than that. An OCR peak of 6%-6.5% is starting to become a real possibility. I can see mortgage rates getting very close to the 8% level by mid next year, and stay very high for a very long time.

We may not want the wage/price inflation spiral.. but it looks increasingly like we have it. Personally I'm fine with it, but there will be many who do not like it.

On the other hand I was hoping for a bit of a recession to get builders and other trades to be a bit short of work so their rates would drop and availability improve, I might be SOL on that one for a while.

RBNZ aren't going to overcook it with large rises, they lack the cajones to do that, they might well over cook it by keeping moderate OCR rises going on far too long. Then it depends how the govt responds, I don't expect the govt actions and the RBNZs to be in sync as the population screams bloody murder as the price of a 1kg block of cheese hits $20+

Consents still flowing through, so potentially stuck for some time. Though I had similar thoughts, a downtick in work for the construction industry and maybe picked up by KO? - though they're out of money supposedly.

My issue with the wage/price spiral is the likely inequality between public and private. Sure a lot of public money spent on Wellington wages, but it's unlikely public wages for essential workers can follow private wages at this rate. Are we seeing a shift to private healthcare for example? I know a few older generation who have given up waiting on the public system and are prepared to pay their way for private care. Just lunch thoughts but a worthy question.

But yea I get your point - earlier in the year I'd predicted we'd be on our second or third 0.25 hike come November, all things under control. Things have been fairly wild since then and we're still marching up 0.5 at a time. Like an F1 trying to take a high speed corner without any downforce, will we just keep on keeping on?

I'm in the medical area. Private hospitals are cancelling elective operations for the first time in my 20 years due to staff shortages. Those facilities are relatively nimble changing t's and c's to retain staff and keep OR's running but they cannot keep up with Australia. Meanwhile Andrew Little is defying all claims of overworked and underpaid DHB nurses with a cost of living crisis adding to their woes. Imaging how screwed DHB's are compared to private hospitals in retaining staff. I work in both and I can confirm your worst fears. The impact on the drain of health alliance staff will take a decade to undo.

Middlemore-Cholecystectomy, scheduled for Wed and postponed 3 days due to case loads with higher priority. A bed was occupied at $800/day as a result. Go figure. Could have been redirected to a private provider but this concept won't be entertained by our egalitarian Gov.

No there is outsourcing. The issue is that the Specialists that work in the DHB are commonly part time and spend some time in private practice. This used to fund a Bach or boat but in the last three years this is just to afford to live in a metropolitan area near the hospital.

In Hawke's Bay I was told Not fact checked) that the DHB aggressively outsourced recently and many of the Specialists involved in surgical care resigned their part time DHB roles to do the same cases for better money up the road in the private hospital.

Arguing salary rises or more people misses the point. Things are so bad we need both in health. There is too much work and not enough people.

No way around the millstone of high housing costs.

The old "people move here for the lifestyle" and "it's a great place to raise kids" that was a replacement for higher wages overseas only worked because other important costs were lower. The obsession with getting rich off housing has cooked things.

Consents lag way behind. And the lag has never been more pronounced. With the frenzy in 2020 and 2021 and the pandemic delays, engineers and architects were snowed under, turning away work, even. Or else long waits. So many consents recently getting the rubber stamp were first instigated a year or even two years ago, it really has been taking that long. Consents become a sunk cost but they can also be mothballed, so many will choose to see them through intending to kick off later (hoping that lending or property conditions will improve).

I personally wouldn’t be looking at consents as a significant indicator currently.

I would just ask builders, developers, architects and engineers how much work they have booked and how far in advance.

Yeah. But we are assuming that they want inflation to drop fast and for asset prices to stabalise, and exchange rates and employment to stay static

In fact plenty of inflation and ocr hikes with drop in the dollar is slowly but surely reducing the asset price bubble ( a good thing for biz owners and rbnz), it will evenually reduce employment (a good thing for biz owners).

The fact that it will make most of us poorer qnd sad... is probably not a key driver for rbnz and their big biz owning mates.

If you understand P = CF / r

Then it is clear that if inflation is steady at 1-2% (including wages) and the value of r goes from 20% in the early 1980's down to 2% in 2020, then the price is going to go up substantially.

If the value of r goes up from 2% to 8%, while inflation and wages are increasing at 8%, then the price will fall dramatically (i.e. our current financial/economic conditions in 2022). Even though wage inflation is high.

For example if you discount a house that generate $30,000 per year in 2021 (approx $500 per week) via rent, and discount that at 2%, you get a price of $1,500,000.

If in the next year (say like what we've seen this year), rents/wages go up 8%, then you generate $32,400 (30,000 x 1.08) and if you discount that with 8% mortgages then you get a price of $405,000. Over a million dollar drop in the price of that asset given the change in discount rates.

So to argue that interest rates don't have much impact on house prices - I'd be very careful about who you listen to.

Caveat - obviously this is a simplified scenario and there are many other variables, but it gives a general view of how interest rate rises impact asset prices. And if you want to see this as a real world example, check out what has happened to the price of the ishares 20+ treasury fund (ticket TLT) - it is down about 50% in the last year as a result of rising interest rates and is based upon the same logic as the above calculation - cash flows (and its growth) vs the change in discount rates.

An excellent simple explanation - a one year NPV of the discounted cash flow associated with an asset subject to a change in the discount rate over a one interval time frame. Hence the capital price investors are willing to pay for those future discounted cash flows today for geared residential property investments will be tempered as the discount rate rises.

Exactly Audaxes - although I would imagine if you attempted to explain this to the RE industry lobby (such as Tony Alexander or Ashley Church), they would have no idea what we are talking about.

Alexander might (if he is a real economist), but it would cause severe cognitive dissonance as the downside potential for asset prices would be far too extreme for him to admit to.

My experience dealing with the real estate industry is that they don't understand their product - what they know is confirmation and recency bias and confuse that with the underlying principles of asset pricing.

If central banks no longer have their back, that is bailing them out every time prices may fall based upon what is happening in the real productive economy, it will be a painful learning experience for them. And if they don't get that lesson, society is going to worse off for it as it makes the financial and social instability we've witnessed the last 20 years or so become even worse.

A good summary of what normally and historically should happen to determine the value of an asset.

The last ten years has not been normal, instead an extended drunken bender fueled by debt and govt fiddling. The market has been disconnected from yield based asset valuation fundamentals, which makes investment more or less speculative gambling. This is the crux of the differences in opinion on this site. Some wish assets to continue to ignore yield fundamentals. Other promote that its coming back into fashion.

Pick your path and role the dice.

What a mess.

Now, ALL Government dependencies will have to go up in tandem - the big one, and getting bigger every day - Old Age Pensions.

Tax cuts? You're dreaming, mate!

Unless we get on top of this now, tomorrow is going to be a disaster for us all, not just the indebted.

The answer isn't higher wages, it's lower prices - so disposable income increases and goes further. How Deflation arrives will be worth watching. But sure as eggs is eggs, it will. The problem is 'when?', and the longer it takes, the worse it's going to get. (NB: And I have a nasty feeling that the Soup Kitchen lines of the 1920s are about to return, but longer)

Yup. We're stuck trying to inflate huge mortgage debt away but it's also driving up the cost of the actual basics we need to survive.

Real, actual deflation is now our only hope. It's that or stagflation, and I'm leaning strongly towards the latter first, followed rapidly by the other.

To the point on our discussion in the other thread, I suspect the increases aren't getting to the people we need for civil society to function effectively. The public sector workers on 4% don't get to pay costs that only inflate by 4%, they pay the full whack whether their wages keep up or not.

Plus there's also the general assumption that wages will be able to keep rising and people seem determined to repeat the wage-price spiral into existence, so there's a high chance that workers would at some point get told no more, regardless of whether costs have stopped rising for them or not.

Stupidity max:

Luxon has been criticising Robbo for spending too much from the public purse making RBNZ's of monetary tightening harder. Tax cuts to the rich have traditionally been sold as having benefits "trickle down" to the masses in more jobs and wages, a premise his team "rejects" (what a great thing to have learnt from team Cindy).

So, Luxon and his team contradict themselves and all their global neoliberal peers. Great way for Nats to kick off the election year.

This would hold more weight if the government wasn't spending like drunken sailors on shore leave anyway. At this point it's just bickering over whether you get to spend your own money or someone in Wellington does. I'd prefer to have that money to offset my extra living costs, given it's going to get spent one way or the other.

the astonishing annual 8.6% rise in private sector hourly wages

When trying to estimate the impact of labour stats on already high inflation, the bigger worry should be weekly earnings, not hourly wages. Higher dollar earnings are put back into the economy by households chasing scarce goods and services.

Couple that with more employed persons and you have more aggregate money circulating in the economy as wages and consumption.

Another worrying stat: total weekly paid hours worked = 2.9%, weekly hours actually worked = 8.9%

So, there is room for weekly earnings to rise if employers are forced to start compensating for additional staff hours worked.

Public sector wage growth is half that of private sector - 4.3%.

https://www.stats.govt.nz/news/hourly-earnings-rise-7-4-percent/

I would argue wages rises still heading to Wellington through different channels. More wages = more PAYE = more activity in Wellington bureaucracy.

Also, public sector contractors, consultants and recruiters are classed as private sector. The bills from these service providers have soared in the last couple of years, thanks to a hiring frenzy from billions being collectively spent on health, media and three-waters "reforms" among other big-ticket items.

For example, recruitment firm Robert Walters made $40m in 2020/21 only through government contracts. It is anyone's guess on how much of that must be just moving the deck chairs around within the Wellington bureaucracy. Cha-ching!

That's assuming National don't manage to screw it up by attaching a rider to the exclusive benefit of landlords or super-earners, which it looks like they're doing. The 'least-worst' is a shitty outcome if it means choosing between parties that are incompetent or ideologically bankrupt.

This is what bugs me most about the concept of a wealth tax. Surely that means the government is incentivised to stoke the flames of inflation as you then have more paper wealth to tax ... or maybe I'm missing something here?

And I agree with your comment 100%. The only risk to the government is if inflation gets sufficiently bad to risk their political position, because the plebs start struggling to put food on the table.

I have similar concerns with a land-tax or similar. Look at what distorting the price of land has done to housing in Auckland (Hobsonville: $250K townhouse on $950K 225sqm of land). Imagine how bad it would get if we made crown revenue contingent on land prices continually inflating like they have shown they've been prepared to game non-indexing of income tax brackets. Agency issues all over the bloody show.

Yes but there are political kudos to be won if you can bring that down, so managing that properly is in their interest - and guess what, they still haven't managed it.

Now you're making a chunk of core crown revenue contingent on land values, and logically that's going to put upwards pressure on them. After all the alternative is ending up with an LVT and huge personal taxes, and the cynic in me suggests that's the most likely outcome.

Smart money always reaches the exit first. Those with wealth will find a way to put their money elsewhere where it won't be touched, it has always been this way. The Government will simply waste more money trying to chase it into deeper nooks and crannies, or have no ability to when it is offshore. There is a reason they are wealthy, and that is not factoring in the outlandish house price increases of late

I can't speak for Wellington, but the ~4% raise roughly matches what we got in my Healthcare profession. My centre is still well staffed but I'm aware of others that have lost many staff during the long painful strike action we took to achieve even half of the average private sector wage increase.

Our last pay increase was in 2020, so this 4% raise covers two years for us. Australian wages are so far ahead of us and we are moving backwards. This time next year I'm sure we'll be back on strike just to try and keep up.

So much for the public sector wage/salaries freeze

https://www.newshub.co.nz/home/politics/2022/04/thousands-of-high-salar…

OT ( CYFS ) is paying front line social workers nearly 90K -- and Kainga Ora - HNZ paying tenancy managers well over 80K --- but even the contracts they offer out to the Private sector -- have a Social Worker at around 120K which has to cover all add costs, trainign, office , vehicle and milage phone, internet and laptop payroll etc --

with Kainga Ora most of the 1700 new jobs created -- have no comparison wage - so you catn see a high % payrise as they were all new roles -- so it may look like those staf are only getting 3% in their first year of payrises -- but in reality they came in at 15K plus above the current private sector rates

Certainly in Health -- the rises for clincial and mangers are much hhigher than 8.8% as we struggle to compete with government agencies that spend $150-160K per FTE -- but fund the private sector 30-40K lower for the same posts --- Even with our much much more efficient operations -- we are simply not able to compete anymore

Not everyone is getting a wage increase or salary increase in line or above inflation, therefore the average persons purchasing power is being slowly eroded away. It's like the minimum wage argument: Some say they need it to live, others would argue if you force buisiness to pay employees more for menial jobs they will simply pass the costs on, therefore the increase in their wage will be moot in a short space of time, same spiral effect of sorts

Low wages because of low productivity. Taking more of the pie from business owners might be justified but has its limits - in the long run, we can only improve our living standards (real wages) by improving our productivity. And more immigration (which is the catch cry we'll be hearing ad nauseam) hasn't done this for the past decade either.

in the long run, we can only improve our living standards (real wages) by improving our productivity

This was true until about 40 years ago. Now it looks like we've created a system whereby the share of any productivity gains captured by the workers is trending towards zero, and the share captured by capital towards 100%.

And this is why we will never become a high-wage economy. Any whiff of workings clawing back decades of stagnating wages has to be immediately clamped down on to ensure the system can keep chugging along maintaining growing inequalities and ensuring the benefits keep getting shared amongst fewer and fewer people.

Never mind the the huge profits many businesses are making right now, sending inflation soaring, yet business profits at times of high inflation are celebrated, but workers individual earnings though are treated as the coming of the plague. Yet they are just responding to the same challenges of supply and demand.

Especially when the much feared 'Wage Price Spiral' has been totally debunked as a concept. Yet here it is rolled out just at the perfect time to run as scare tactics to keep the pressure on.

It's like our economic orthodoxy ended in the 1980s and now all we have is 1980's solutions to 2020's problems. Who knew we mastered how to manage an economy 40 years ago and could just go into set and forget mode.

Neither case is totally watertight. However (I'm not an economist), inflation rates are generally higher than wage inflation, so somebodies being sneaky.

https://www.cato.org/commentary/wage-price-spiral-explanation-inflation….

https://www.forbes.com/sites/forbesbusinesscouncil/2022/07/11/the-myth-…

https://tribunemag.co.uk/2022/06/boris-johnson-wage-restraint-inflation…

https://newrepublic.com/article/165365/wage-price-spiral-inflation-econ…

https://www.wsj.com/articles/inflation-drives-worker-pay-down-not-up-wa…

https://www.johnlocke.org/the-myth-of-wage-push-inflation/

https://conservativehome.com/2022/06/23/why-wage-price-spirals-fuel-inf…

Haven't read them all yet, but the ones I have don't exactly destroy the concept of a wage price spiral. One even says that they are a real thing, but we just aren't in one yet.

There is no evidence based thorough debunking of the concept of a wage price spiral in those links, merely a few opinion pieces with varying opinions.

See the links above.

Maybe share with us the proof that this is actually a thing... not just a right-wing talking point designed to keep wages low and profit margins inflated.

But here's a clue - this bout of inflation has certainly not been caused by workers seeking large pay increases. So why should they be the ones that pay for it?

You're conflating two things, whether we are currently in a wage price spiral..and whether such a thing exists. Come back in a few years and the evidence will be in about the first point. The second will be very hard to argue, the 70's and early eighties looked like a wage/price spiral to many.

Yep, seriously doing it tough atm https://www.stuff.co.nz/business/129338462/nz-company-profits-on-track-…

You miss the point. In terms of inflation impact, company profits are minimal next to wages and salaries.

Tax take from individuals is close to 3 times that from companies, meaning it's a much bigger slice of the economy.

Also, watch what company profits do when times get tougher. Wages are sticky and will never come down again.

With the amount of multinational companies taking their profits off shore. That sounds good to me. At least they can start paying their staff.

NZ is a great place to invest after all. One of the easiest countries in the world to do business and very profitable too.

Don’t feel too bad for the big companies. They are making record profits!!!

This shocking result has absolutely nothing to do with the screaming temporary halt in immigration numbers. As we’ve been constantly reassured by economists employers and politicians alike, flooding the country with low wage workers has nothing to do with suppressing wages for locals. Right? RIGHT!?

How on earth do we get Lower Prices to enable Wages to remain static? Not possible!

Maybe..... if the NZ$1 = US$1.25 that might help.

We are an Import Reliant economy, even to produce our Export and domestic consumer goods and services. So the lower the cost of Imports, the less wages need to rise, and the lower prices can fall - all of them, to increase Disposable Income.

How do we achieve that? The OCR......

Can’t win

House prices looking like they might finally start coming back to semi affordability + biggest pay increases in decades.

Time to start opening the champagne.

We are just a tiny economy that can’t really influence inflation too much. Inflation is inherently imported as we are a heavily import reliant country.

Closing the borders has finally started paying dividends. Hopefully the government doesn’t bend to the business overlords requiring cheap imported labour lol

When inflation calms down the country will be in a great position.We are already doing better than most.

US and Aus have higher inflation and lower wage growth!!!

Common theme around the western world/anglosphere so not just an Orr/Robertson thing.

Appears to be a faulty paradigm among all modern treasuries and central banks.

Then again, central bankers are doing what you would expect when the global reserve currency is getting close to the end of its tenure of dominance. The world will lose patience with the US given the instability it is causing with its money printing.

I see this as a big risk too (NB this isn't the same as me arguing that workers shouldn't be paid more, for clarity's sake).

I've seen a few service businesses I work with scrambling for staff at any cost, so wage bills are through the roof.

This means more jobs need to be won at a higher price, which is fine until it isn't. Many of these businesses operate with wafer thin reserves, almost a "just in time" model of getting cash in the door from new projects. All it will take is a key project or two that was being banked on to not go ahead, and then you suddenly have to cut the mouths you can't feed, so you then don't have enough staff to fulfil more projects ... and so it goes.

This actually destroyed an old employer of mine some years ago - they hired too many staff to keep up with demand and paid good wages, but then a few projects failed and they had to make redundant an even greater number of staff to get back to a stable position. This resulted in insufficient output from the remaining team, meaning more lost projects and eventually failure of the business. Could easily see this happening on a larger scale.

Purely anecdotal, but I've been browsing Reddit's 'Sales' community (for sales professionals, mostly USA-based and lots of tech) and it's amazing how many salespeople there are complaining of deals suddenly being much harder to come by, but also management suddenly expecting much higher levels of sales - because you can't just rely on raising capital so easily any more and you need to actually turn a profit.

I am seeing some signs of similar here in NZ based on feedback from salespeople I've spoken to at client organisations, and am interested in anybody else's experience.

We're heading into risky territory ourselves, as executives push sales to sell more, who are then offering sweeteners such as bespoke customisations, in order to secure clients, but we don't have the staff to handle so many variations at once, not without compromising quality, but said executives care more about making the sale than the quality of the work, usually saying something like "we'll improve it later", willfully forgetting that the reason the quality has dropped is because we don't have the time to do it properly, so I don't know where they expect us to find the time to do the touch-ups, unless they think us salaried staff will do 16 hour days for no extra pay, in which case we'll tell them to get stuffed.

"However, the fact that wage rises have come in so stratospheric must open up at least some chance of a 100 point rise - though economists are not tipping or expecting this."

If the need is of 100 points rise, rest assured that Mr Orr will go for 75 point rise, if not 50.

No more Mr Orr is following the policy of LEAST REGRET but is happy go with WAIT AND WATCH Approach

A wage price spiral has always been a key concern of mine ever since I first wrote here at interest.co.nz in June 2020 about excessive QE. Clearly this spiral is now upon us. And as I wrote multiple times thereafter, there could not be painless solutions. Here is where I wrote in some detail in November 2020 as to what would happen (and is now happening) when no-one else was talking about this. These and other macroeconomic articles since then are archived at my own site https://keithwoodford.wordpress.com/category/macroeconomics/

There is no question that there is going to be lots of pain. The big question now is how the pain is going to be shared in the community.

KeithW

Keith, I agree with you on many things but the wage-price spiral is only an issue if it's approached from the POV that the workers should be the ones to suck up the mismatch between living cost increases and inflation. I'd suggest this ongoing expectation is how NZ workers have managed to fall behind.

We know now there's nothing in it for those living pay-cheque to pay-cheque to take the hit for some sort of greater good, and it won't stop people putting up prices to preserve margins. If the wage-price spiral is real, then there's literally no hope of wages ever regaining the ground that's been lost even in a low-inflationary environment. That's not really a great answer for social stability.

Before we accept wage rises are now the problem, I'd like to hear what the alternatives are, preferably ones that aren't "just take the hit this time around and maybe it will end up working out one day?"

GV27,

A wage-price cycle is an issue for almost everyone. My expectation is that the coming recession is going to affect both salary earners and company profits. My personal opinion is that we do need to adjust tax levels for those on less than say $60,000 in particular and increase the tax rates appreciably for those on say more than $200,000. But that perspective is based on my personal code as to sharing the burden, rather than a belief that either of those steps can be a magic wand that solves the problem.

On the economic front, my perspective remains that most people have not identified the extent of the hard times ahead. Some 2.5 years go I tried to look out over the horizon and I did not like what I feared was out there. At heart I always like to be an optimist but I thought I could see all sorts of long term structural issues which, owing to a failure of recognition, were going to be even worse than they needed to be in terms of their impact. And I remain of that perspective for the coming years. Right now we are living in somewhat of a fool's paradise.

KeithW

Sharing the burden, while I don't disagree, currently 80% of taxpayers pay 35% of the tax take, 20% pay 65%, suppose we could aim for the 80:20 rule. However not sure of the tax rates required.

From Budget 2019: Budget at a glance - tax year 2019/20

Those earning under 60K pay 27% of the tax take and make up 74% of the taxpayers,

Those earning over 60K pay 73% of the tax take and make up 26% of the taxpayers,

At the other extreme those earning over 150k pay 24% of the tax take and make up 3% of the taxpayers.

Yip - one would think it unlikely the elite will want to share the pain.. in fact they will be wanting more from govt, as its election year.

The middle class (or whats left of them after this downturn) are the voters - so they will get some form of relief probably in tax relief and maybe some handouts from both parties... coz its election years. Still they will lose out on house prices and job security but in the main will be ok.

Now that leaves the poor - bottom 50% or so who either dont vote or are already decided on who to vote for (and dont think enough), they dont own houses or investments, live month to month, these are also the renters, the immigrants, low skilled. one suspects those poor buggers are in for an awful couple years - higher unemployment, access to poor healthcare, eating baked beans, turning to crime and crowded garages to inhabit.

What a lovely country we became

A wage price spiral has always been a key concern of mine ever since I first wrote here at interest.co.nz in June 2020 about excessive QE. Clearly this spiral is now upon us.

This data point might suggest that your thinking is possibly correct. I don't agree with you but I am quite possibly wrong. My thinking re wage inflation is as follows:

-- Wage growth has been lower than CPI growth and money supply growth for the past 20-30-odd years. Not sure how you can argue that will change anytime soon.

-- Technology suppresses wage growth, now more so than any other time in history. If it were the 1970s, things might be different.

Furthermore, Japan has more of the QE experiment than NZ has ever had. Where is the wage inflation in Japan?

J.C.

The essence of economics lies in human behaviour and innovation behaviour. The Japanese in Japan respond very differently to Kiwis in Aotearoa NZ and this has been fundamental as to how QE has played out over there. The situation that we face here is a function of multiple monetary tools that have been applied including LSAP, FLP, LVR rules, and of course the OCR. They have all been used to stimulate the economy. All have lags. There are also other structural (non monetary) issues at play, for example NZ's declining exports relative to imports, exacerbated when expressed on a per capita basis.

KeithW

Thanks Keith. I very much appreciate your thinking as it challenges mine and makes me think deeper. And my Socratic approach always makes me defer to those of others.

On the technology factor, I still believe it is deflationary overall and that includes wage growth.

Sir Bob Jones says inflation could reach 15 % next year ... clearly the wage spiral we're entering will keep it higher & for longer ...

... to take a leaf out of former Australian treasurer Paul Keating's playbook , the government could offer to adjust the lowest 2 tax bands for workers , to leave more money in their pockets , as an offset against pay rises ... perhaps also to raise the government contribution on Kiwisaver accounts ...

Depends when and how long you fixed your mortgage for. If you took the 5 year fix at 2.99% and your wages have gone up 15% since then, then yeah, thats exactly how it works. And if you're smart you are smashing that principal down with the max overpayment and building a nice lump sum to pay off when it rolls over.

Actually yes and yes Yvil. The point is if you want them in today's market you have to be prepared to pay, much more. All offset by increase in charges to customers. Hence wage and price spiral. Last time this really got going under Muldoon Govt rates went to 20% to bring it under control. Speculand have fun with that - you will all have to refix at some stage.

Imaging when that 5yr 2.99% comes up for air, and the lowest option starts with a 10...

Its funny isnt it - given rent is probably the biggest cost to most businesses - no talk of a Rent / Price Spiral when landlords laugh all the way to the bank.

But when the workers just ask for a little more than usual - all of a sudden the economy is doomed.

Something not right with this 1980's thinking.

Also - it is not meeting inflation, it is meeting the Market price. When businesses do it why is that ok, but not workers?

It has been loosened. In some cases dramatically so.

Ie The new "simplified" system for skilled migrant visas is uncapped.

The Parent Category Visa, which allows migrants' parents to join them in New Zealand has a lower income threshold and higher cap.

The real question is why would someone with a skill set want to come to NZ if Canada, the UK, Australia, the US etc want them too? Undoubtedly for some it would still be first choice but it would take a particular set of circumstances for that to be the case.

https://www.nzherald.co.nz/bay-of-plenty-times/news/nz-out-of-favour-re…

https://www.rnz.co.nz/news/national/477687/new-millionaire-migrants-vis…

Yep - how dare those peasants seek to keep up with the cost of living increases. Something they did not do anything to increase.

Wages increases are a response to inflation, not the cause of. Otherwise my pack packet would be seriously larger right now.

Why are people so keen to target those that have to live with the effects of high inflation, rather than the causes?

Wages increases are a response to inflation, not the cause of.

Just be careful. People think that inflation as measured by the CPI and / or money supply has a pefect relationship with wage / income growth. That is most definitely not the case. In fact, monetary inflation far outstrips wage growth.

Now, my point re technology means that the value of labour in the 1970s was propotionately greater than what it is today because of the implementation of technology. As a very simple example, Salesforce as a mangement solution.

I think there is something wrong with a system where the working men and women of this country getting paid more is a crisis. I would like to I see a system where people who are working in this country at whatever level earn enough to support themselves and raise a family, buy a house and afford to have some leisure time.

Agreed. We've let a lot of stuff about what made NZ worth living in slip because other cities have more people, at least our commutes aren't like LA's, you can always work on the train (UK) and so on. We've given an excuse for our leaders to do nothing and they've snapped it up with both hands, much to our detriment.

I want a safe place to raise a family, with a house that isn't on a postage stamp and that doesn't require me to pay 40% of my income to own until I the day I drop dead. That it should need to be said is a searing indictment on what NZ has lost as a place to live.

If everyone gets paid more, then everything costs more, and no one is better off. People don't want to invest money in countries with high inflation as the value of their investment is inflated away. The Zimbabweans paid themselves billions each per day, but most could barely afford a loaf of bread.

I think the current rate of inflation is OK, but anything more would be worrying.

The only way we can get paid more without prices going up is through productivity improvements such as technology.

I truly wish I had the answer JJ to achieve what I would like. Current economics dogma does not appear to be working to eliminate the inequality in our society. Seems to be making it worse. I am not clever enough to come up with a solution. I think we have tried the evolution method. Time for a revolution which if I recall correctly our current government promised. What political and economic leadership model is left to try? Seems all have been tried and failed.

The only way we can get paid more without prices going up is through productivity improvements such as technology.

Well we could find a way to keep more profits onshore for one. That would work. Or try to curb the rapacious monopolies that dictate their profit margins without regard to the societies they operate in. That might do it. Actually we could also look at ways to reverse the concentration of wealth upward by taking a closer look at the comings and goings of the top .01%. We could even look at countries in our geographic or ideological neighborhood and ask ourselves why do they get payed more than us yet pay less than us for their essentials. As far as productivity improvements ... having recently returned after 15 years working abroad, I'd say poor productivity is a problem of mindset over technology. NZ is a world leader in "I'll just defer that much needed upgrade, squeeze my drones to work extra hrs to keep the wobbly wheels on, and knock off early to see the bank about that drawdown for the boat".

Second this whakahokia mai. The system is extremely flawed when in order to achieve optimal function, people need to lose their jobs. Bet these recent events will confuse the benefit bashing right. If employers don't want to pay their workers more, they shouldnt be complaining about their tax dollars going to unemployment benefits.

"The money we print and circulate for New Zealand is the sap that flows through Te Putea Matua, ensuring New Zealanders have a means of exchange, a story of value, and a unit of account they can trust." https://www.newstalkzb.co.nz/news/business/reserve-bank-governor-adrian…

Too much sap flowing through Tane Mahuta. Maybe its time to lop a few branches before it gets dieback.

From Stats NZ release

Private sector average ordinary time hourly earnings increased by 8.6 percent to $36.09.

Meanwhile, the public sector hourly earnings increased by 4.3 percent to $44.76.

Private sector wage inflation, as measured by the LCI, was 3.9 percent compared with 3.1 in the public sector.

Does this mean that Private Sector workers are earning more per hour but working less hours? If they were working that same hours as Sep 21 would the LCI inflation not be 8.6% instead or 3.9%

I wonder what the unemployment rate for CxOs is? I'm guessing near 0%. But apparently, that's never a problem economically. I am also guessing the salary increases in the CxO suite was way higher than the Accomodation and Food sector punters. But again, apparently that's not a contributing factor economically.

Sorry lower paid people. Inflation is high, you need to lose your job for the good of the economy. Sorry tax payers, higher unemployment means more taxes to cover a higher number of unemployed. CxOs, not to worry, we've given the tax accountants an extra 5.5% to help you avoid paying anything extra.....

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.