The latest ANZ Business Outlook Survey has recorded a drop in business confidence and activity levels - but another rise in inflation expectations.

"It’s a stressful time for businesses. Costs are still rising rapidly, and passing these costs on has become more difficult as customers become more price sensitive," ANZ senior economist Miles Workman said.

"Many firms have been chronically understaffed for a long period and the strain is telling. And economists are out there warning that interest rates are going to keep going higher (and house prices likely lower) until the New Zealand economy goes into recession or something close to it.

"If the global economy doesn’t side-swipe us first, that is."

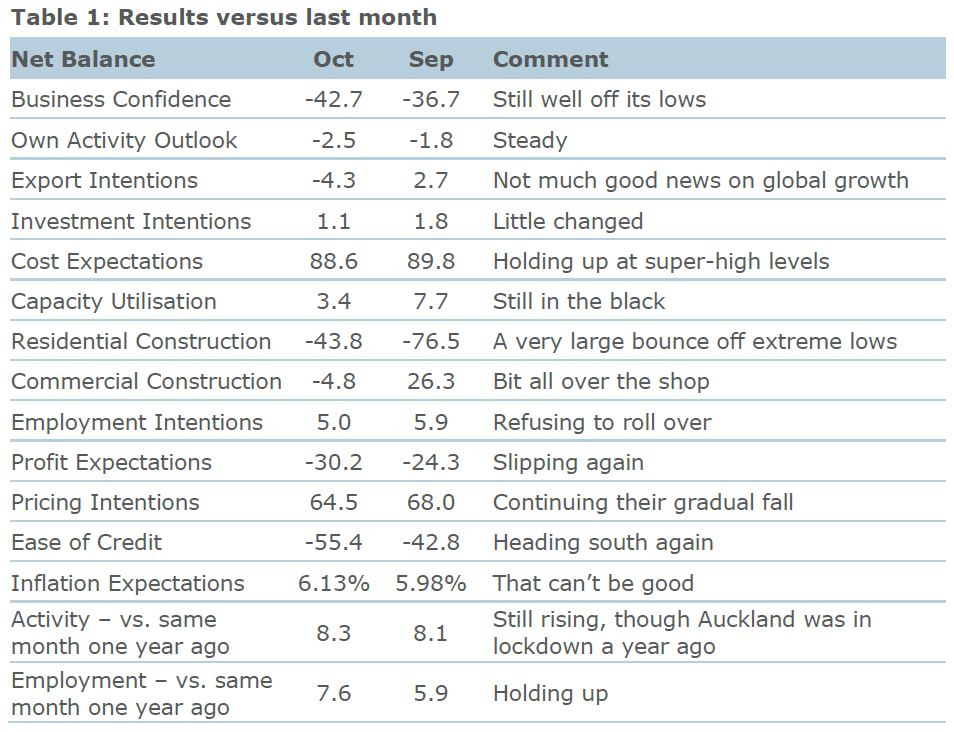

The survey, covering the October month, showed that business confidence fell 6 points in October to -43, while expected own activity dipped 1 point to -3.

Workman said most forward-looking activity indicators slipped a little. Responses received after the unexpectedly strong CPI inflation figures last week were weaker on average.

Expectations of future inflation rose again to over 6% after falling in the September survey.

"Economy-wide inflation pressures are still very strong. Pricing intentions and costs are falling – but they are still far too high," Workman said.

Commenting on the survey results, Westpac senior economist Satish Ranchhod said while the survey doesn’t signal that inflation pressures are getting worse, inflation pressures remain intense, "and we’re not seeing any material signs that they have started to abate despite the large rise in borrowing costs over the past year".

" Overall, today’s report, along with other recent developments, supports our expectations for a jumbo-sized 75 [basis points] hike [to the Official Cash Rate] from the RBNZ at its upcoming November policy meeting."

"As regards a specific numerical estimate of where firms’ own selling prices will be in three months’ time, the highest were in the retail sector. While not the lowest, construction sector pricing intentions have fallen the most since peaking early in the year."

On construction, sentiment in residential construction remained very much in minus territory - but did bounce quite a bit off the record lows seen in the previous month.

Back on the survey more generally, Workman said the survey asks firms their expected costs in three months’ time relative to today.

He said expected cost increases bounced back up this month in every sector except manufacturing, "perhaps reflecting the weaker NZD".

"They are very high across the board, particularly bearing in mind that the question asks where costs will be three months from now, not a year ahead. On average, firms are still expecting margin compression, in that costs are expected to go up around 6.2% over the next three months, but prices by only 4.3%."

Workman said reported past wage settlements showed "mixed movements", but were unchanged in aggregate at 6.5%.

"Expectations for wage settlements for the next 12 months increased 5.6%. The labour market remains exceptionally tight.

"With all that going on, it’s no wonder headline business confidence remains very subdued. But firms are clearly still very busy, and are soldiering on.

"The economic outlook is certainly murky, but the New Zealand economy has a lot going for it. Debt is higher, but nowhere near the worrying levels other economies are struggling under.

"We’re relatively insulated from the energy cost implications of Russia’s invasion of Ukraine. Our primary export base is food, and when it comes down to it, people gotta eat.

"Overall the economy is still surprising economists with its resilience. It’s a rougher path ahead, but the country is still moving forward."

Business confidence - General

Select chart tabs

60 Comments

And economists are out there warning that interest rates are going to keep going higher (and house prices likely lower) until the New Zealand economy goes into recession or something close to it.

"If the global economy doesn’t side-swipe us first, that is."

I feel this nicely sums up the mess we are in

Essentially saying that things will only get better after they have become worse. Fantastic (not).

Then again, this is the result when you live in la la land the print money, drop interest rates, pump the fiscal spending/budget deficits and expect everyone can have free lunches and the worlds most expensive houses with no long term consequences.

I find it curious that we have a system with an explicit 1-3% inflation target. Deflation should be what we expect in an era of rapid technological advancement, since technology is supposed to create economic efficiencies, which should lower prices. I want deflation, not just to get us out of this mess, but in general, because it would be indicative of a more productive economy.

At this stage of the long debt cycle, with high levels of debt, deflation is very scary and must be avoided at all cost - as it would cause widespread and rapid debt defaults.

Inflation on the other hand also creates pain, but it avoids the immediate default by many sectors - which we would have seen in 2020 if central banks and governments hadn't intervened in such an extreme way they did.

I understand the logic of avoiding deflation as we presently stand, but that is precisely my point. We have engineered a situation where we try and avoid deflation, yet when you stop to think about it, deflation per se is actually a positive indicator of economic efficiency. We have it ass-backwards.

Why would she? National can't articulate a coherent tax policy at a time when Robertson is playing silly buggers with the real incomes of Kiwis by hinting at indexing (if there's a need he should just bloody do it and stop trying to use it as an election ploy).

She has nothing to fear as long as National thinks there's a good moral case for aspiring FHBs to be underwriting the financing costs for rental property investors.

National has learnt that Labour have no Integrity and well steal any decent policy from them, you will have a great election fight as its going to go to the 12th round, most of the big steal;able policies from nation will come out in round 11 and 12, ie Sept/Oct 23.

Its going to be a brutal fight for survival. Its probably going to be an ugly fight and will leave NZ feeling very split at a desperate economic time.

Transformational..

It was never going to fly anyway

"The too-clever-for-its-own-good nature of Three Waters finally caught up with it and sank its teeth into its own rear. The Government, in essence, is pushing ahead with plans to create a brand new set of indirectly controlled public assets with their own debt structures and ability to charge the public fees without asking for (or receiving) permission from those who will ultimately pay higher those higher water charges and bear its debts.

It was an understandable strategy. Voting taxpayers and ratepayers almost always reject tax increases and higher debts whenever they’re asked upfront for permission from politicians before it is done."

I love their "repeal and replace" billboards for Three Waters. I suspect despite the Trumpy phrasing they'll also do very little about it. David Seymour's right, I reckon. Minor tweaks but nothing substantial - and I suspect they'll keep co-governance with only minor tweaks, having signed up to it during their last time in govt.

The fact you consider stealing good ideas from the opposition to show a lack of integrity just shows you are stuck viewing politics as team sport / entertainment, which is the sort of indulgence many commenters on this site can afford but many ordinary Kiwis on Struggle Street cannot.

In my view politics is about making people's lives better: if the opposition have a good idea I want the government to steal it every time.

This is precisely why the majority of people I talk to are avoiding both National an Labour like the plague. Unprecedented times mean we will have an unprecedented election, the general public are looking to what is best for the nation not just themselves as there are too many forces at play outside of the governments control.

I doubt it. They remain in denial. They still talk about the recovery and how good a shape NZ is in. Robbo yesterday was endorsing wage growth in the economy, whereas disinflation actually requires wage restraint if the wage-price cycle is to be broken. So zero recognition of what mess things are in.

There is no wage-price spiral. There's the expectation that workers will continue to fall further and further behind growing living costs, but that has its limits.

The wage-price spiral is a convenient excuse to not lift wages in a country with a long tradition of taking the piss with low wages based on the idea of Kiwi Exceptionalism - that not only should we not have to compete for our own talent if we want people to stay here, but that it's unreasonable for people to expect to make ends meet and businesses shouldn't have to pay wages that lets people do that. Because they're special.

There is no wage-price spiral. There's the expectation that workers will continue to fall further and further behind growing living costs, but that has its limits

Yes. Because it's not the 1970s anymore. Modern economies are more driven by tech, which is deflationary for wages and incomes.

Nice headline in Stuff: https://www.stuff.co.nz/business/money/300721499/anz-house-prices-likel…

Also an interesting was: "The bank’s economists said it was hard to pinpoint the eventual floor for the housing market."

Those deep in debt/leverage situations will no doubt be wondering if/when interest rates will ever come down. That's a load of dead money going out the back door on a asset that's declining in value. Many speculators will be starting to feel buyers remorse.

This affected group is growing in size by the day. They are educating their kids and extended family on what not to do.

ASB posts record annual profit

10/08/2022 — ASB June year profit pushes towards $1.5 billion, CEO Vittoria Shortt says affordable lending principles working in rising interest rate ... (interest.co.nz)

ANZ NZ interim profit tops $1 billion for first time

4/05/2022 — ANZ Group's interim cash profit from continuing operations fell 3% to A$3.113 billion. Its return on equity dropped to 10% from 10.2%, with its ...(interest.co.nz)

Yep hard times ahead....according to the banks..."Its a stressful time for businesses" says Miles.....lol

Unemployment must rise before inflation comes under control: Economists New Zealand’s unemployment rate needs to increase to around 4.5% to stop adding pressure to inflation, ANZ’s economists say. a sharp rise in unemployment would show how much “clear air” there was under what were still extremely overvalued house prices. (stuff 27.10.22)

Wonder if those promoting firing folk would be happy if their job went first...lol , Wait a minnit wouldnt a sharp rise in unemployment result in mortgage defaults? Or are they suggesting those in rentals get fired first? Wouldnt it be wiser to explore where the inflation is coming from...Is it a result of increased markups ,Could it be folk exploiting what was a crisis perpetuating that crisis..? Regardless if we keep overcooking our present circumstance we will undoubtedly find our way into a full blown recession. Lets accept the recent inflation spike but realise it doesnt mean 7% to 9% pa is the new norm...because its not....better to adapt to the present circumstance than try and undo what cannot be undone. Hard too not consider whether some financial institutions are hell bent on crashing our economy . Lay off our RB they are somewhat more sane in their outlook. A conservative approach is required .

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.