Independent economic researchers Capital Economics now forecast the global economy will meet the 'old' IMF description of a recession next year - while the NZ economy most definitely will tip into a recession - and our current house price fall will extend as far as 25% from peak to trough.

Capital Economics says global growth next year is set to be - apart from during the Global Financial Crisis and the start of Covid - the slowest in four decades.

The economists have dropped their forecast for global growth next year to just 1.7%. Formerly the IMF had described global growth under 2.5% as a recession.

Earlier this month the IMF itself downgraded its forecast for economic growth next year to 2.7% and said "for many people 2023 will feel like a recession".

Capital Economics concurs, and goes further.

It says persistently high inflation and more aggressive monetary policy tightening "now seem set to do serious damage to the world economy".

"While we had previously anticipated contractions in several economies, the gloom has spread such that we now see global GDP rising by just 1.7% next year."

For this part of the world, Capital Economics expects the Reserve Bank of New Zealand (RBNZ) to hike the Official Cash Rate to 5.0% (currently 3.5%) "as inflationary pressures are pervasive".

"That will push the [NZ] economy into recession next year."

The economists think, however, that Australia will "narrowly avoid" a recession as the Reserve Bank of Australia (RBA) "should get on top of inflation before long".

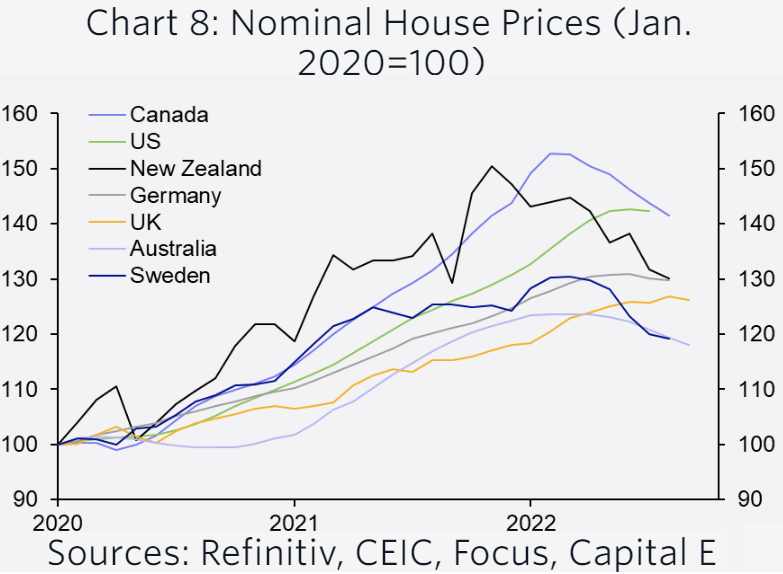

Capital Economics had previously forecast NZ house prices to drop 20% from their peak (which was November 2021), but have now increased that pick to 25%. At the moment house prices here are down around 10% from the peak.

"We ultimately expect house prices to fall by 15% from their peak in Australia and by 25% in New Zealand.

"That underpins our forecast that residential investment will fall by around 20% from peak to trough in both countries, though the resilience of homebuilding in New Zealand means the risks there are tilted to the upside. The upshot is that GDP growth will slow to just 1.2% in Australia and to 0.3% in New Zealand next year, which is about 1%-pt weaker than most anticipate."

Back on the global economy, the Capital Economics economists say they have become more pessimistic about most economies over recent months, "but the downgrades to our forecasts have been largest in advanced economies".

"We now think that rising interest rates and particularly large terms of trade shocks in the euro-zone and UK will send both economies into deep recessions. Meanwhile, even more aggressive policy tightening than we had previously anticipated means that several other advanced economies – including the US – will experience mild recessions. And in China, zero-COVID and weak external demand will also weigh on growth next year. Apart from India, our forecasts now lie below both the consensus and the IMF’s across all regions."

If that all sounds a bit grim, the economists have a further caution:

"But even our new, downgraded forecasts are subject to downside risks. The first is that central banks will have to tighten policy more than we envisage to dampen demand and drive inflation out of the system. The second is that higher interest rates might cause problems in the financial system which then seep into the real economy. Those risks are greatest in economies where asset prices – particularly housing – increased substantially during the low-rate era, where the shadow banking sector is relatively large, and where interest rates are now moving up sharply."

The economists say high inflation and interest rates will affect households’ consumption patterns.

"Survey indicators suggest that global demand for tradeable goods has already weakened markedly. This will be especially damaging to trade-dependent economies in emerging Asia including China.

"We now expect world trade to fall outright next year."

But there is a consolation:

"One consolation is that easing inflation and weakening economic activity should convince central banks to start cutting interest rates before long. Tightening cycles have already peaked in some emerging markets and we suspect that the US Fed will start to cut rates in the second half of 2023. This should mean that the global recession is a relatively short one."

36 Comments

Capital Economics are a rather upbeat optimistic team ... expecting the Fed to begin easing next year ... as if inflation can be tamed over the next 3 quarters ...

... come on , guys ... that outcome is even less likely than our Labour government accepting the blame for their long list of complete stuff ups ... not gonna happen ...

Hunker down , 2023 will be a hard slog ...

It is quite possible that the Fed pivots before inflation is contained as the pain of getting inflation back within its mandated bands could be just too much for society to handle. There would be too much political pressure for somebody to do something to limit the loss of wealth people are experiencing and the high unemployment (stagflation).

Oddly, I can see more fiscal stimulus being pumped into the economy as unemployment starts rising, while the Fed is trying to bring inflation down by raising rates (before the pivot - and then even more after the pivot). In this situation, you have money being added to the economy, while less goods and services are produced = even higher inflation.

1 USD buys 30% more Yen and 14% more Yuan than it did this time last year. The Spot price to ship a 40' container from Shanghai to Los Angeles has dropped from USD 10k to USD 2k in the same time period. IF oil can stabilise below USD 100 then inflation is going to start to drop quickly in the U.S. This will give the FED room to cut in Q3 2023. Hopefully by then New Zealand still has time to yank the stick back and level out or otherwise we will be digging the economic plane out of the dirt and trying to get it flying again with Duck Tape and No 8 wire.

Economies are about more than just house prices - at least outside of New Zealand - but it's always amusing to see how quickly the economists' predictions change. It wasn't that long ago we were talking about a "moderation", or "cooling off", with house prices slated to increase by a mere 5% next year (shock horror!).

Serious damage to the world economy'

All people / agencies responsible for the mess will blame everyone/outside world but themselves. Each one of them be it Mr Orr or Robertson will seek solace that most part of the world is in the same boat.

25% fall...what will it mean.trying to understand..........

Pre Pandemic $1000000 house went up to 1400000 and now with 25% fall will be at $1050000.

So most who bought much before are secure, unless they used ther existing house to finance another..........

Unlike stock market, housing market reacts slowly but if it enters crash territorty than it could lead to mayhem as unlike stock market, housing market is not as liquid and in crash will not go without extracting blood.

2. No-one, clearly

The US has had a CDC team in China for decades specifically looking for emerging novel diseases. Trump defunded this operation after he got into office.

So it's inaccurate to say "no-one" saw it coming - people did predict this and put some (minimal) programmes in place to give early warnings about emerging diseases.

https://www.reuters.com/article/us-health-coronavirus-china-cdc-exclusi…

He didn't use it as an excuse to walk away from literally every campaign promise they made.

But we all know the 2017 Labour manifesto was the kind of Bait & Switch that businesses get in trouble for if they pull it, but some people have a hard time accepting they fell for it and think five years in, the government is going to suddenly become competent.

If it does bottom at around a million people buying from scratch would have to have 100k for deposit and earn 250k combined no other debts. 250k combined wages is over double average wage couples income, so basically only around 10% of population would fit into this category.

Tightening cycles have already peaked in some emerging markets and we suspect that the US Fed will start to cut rates in the second half of 2023. This should mean that the global recession is a relatively short one."

The Swedish central bank prize in economics in honour of Alfred Nobel for this work? Below my assessment of the much-cited Diamond-Dybvig (1983) theory of bank runs (in Werner, 2013. Towards a More Stable and Sustainable Financial Architecture. Credit and Capital Markets), 46 (3) Link

Home prices are now falling, piling on the Fed pivot from near and dear to the FOMC (models).

As if there aren't enough suspects which could end the Fed's rate hikes regime (more importantly represent serious threats to the economy and markets), now we have confirmed falling home prices to add to the already-toxic environment. The empty suits at the FOMC are glued to the CPI which reflects last year's home prices while this year's indicate rapid deterioration. What a world.

Janet Yellen: Ex Fed governor, current Secretary of US Treasury

So there are good reasons to think that fundamental factors have played a role in the unusually high price-to-rent ratio. But the bottom line here is fuzzy. It’s very hard to say how big a role these factors have played, so we don’t know how much remains unexplained. Frankly, even the best available estimates are imprecise, and they don’t definitively answer the question: Is there a bubble, and if there is, how large is it?

Given this uncertainty, my focus as a monetary policymaker is on trying to understand what kind of risks a drop in house prices would pose for the economy. One of the classic ways to do this is to ask “What if…?”—in other words, to pose a purely hypothetical question. In this case, the “what if” question might be, “What’s the likely effect if national house prices did fall by 25 percent, enough to bring the price-to-rent ratio back to its historical average?” Before going any further, I want to emphasize that I’m not making any predictions about house price movements, but instead, simply discussing how a prudent monetary policymaker could assess the risk.

First, there would be an effect on consumers’ wealth. With housing wealth nearing $18 trillion today, such a drop in house prices would extinguish about $4½ trillion of household wealth—equal to about 38 percent of GDP. Standard estimates suggest that for each dollar of wealth lost, households tend to cut back on spending by around 3½ cents. This amounts to a decrease in consumer spending of about 1¼ percent of GDP. To get some perspective on how big the effect would be, it’s worth comparing it with the stock market decline that began in early 2000. In that episode, the extinction of wealth was much greater—stock market wealth fell by $8½ trillion from March 2000 to the end of 2002. This suggests that if house prices were to drop by 25 percent, the impact on the economy might be about half what it was when the stock market turned down a few years ago.

Moreover, the spending pullback wouldn’t happen all of a sudden. Wealth effects—positive or negative—tend to affect spending with fairly long lags. So, a drop in house prices probably would lead to a gradual cutback in spending, giving the Fed time to respond by lowering short-term interest rates and keeping the economy steady. Link

I think we are looking at a 25% average fall from peak. This will likely see vulnerable regions (some Wellington and Auckland suburbs) and housing types (townhouses) seeing 35% drops.

I think we will see some relaxation of the tightening late next year. However, that may be a couple of 25 bps drops only, and then flatline for a few quarters. I don't believe any of the central banks have the appetite to hold longer, but equally they have no appetite to re-ignite inflationary fires either.

In real terms, it is going to be significantly more that then covid era appreciation. Interest rates are going to reach levels not seen in many, many years, and this will have very significant repercussions to the housing market. Pretending that all is fine is no more than an exercise in wishful thinking.

"We ultimately expect house prices to fall by 15% from their peak in Australia and by 25% in New Zealand."

Given Australian inflation numbers today I don't think Australia is likely to fair any better than New Zealand. Reserve Banks need to deal with inflation right now, their hesitancy to take meaningful action is becoming inexcusable and the everything bubble needs to be deflated rapidly.

Capital Economics seems to have forgotten that OPEC+ raised a big Put underneath the oil price of $85 USD. On top of that the world has not been investing in exploiration and processing capabilities of, mainly metal, commodities. I believe their assumption about "One consolation is that easing inflation" is wrong.

Apart from inflation, the world is full of debt, and investors expect higher risk premiums for keeping on funding those debts given the very uncertain political environment in the world.

You are espousing the loanable funds theory of money which has no basis in fact. Banks don't lend out other peoples money and governments with their own currencies don't borrow to spend. Without debt we would in fact have no money as that is how money gets created.

If house price falls extend to 25% from peak to trough in nominal terms (and I think that this is quite optimistic), and if we account for a couple of years of current inflation levels, we are talking about a 40% decrease in real terms.

If we also consider that interest rates are significantly on the rise, with big upside risks to top it up... well, when it comes to sound investing, I would not touch NZ residential housing with a barge pole.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.