It took a while, but now the penny has finally dropped with a very loud clang.

Central banks that spent much of last year explaining why the inflation we were seeing emerging in the world was just a spectre that would disappear like a puff of smoke, are now just about admitting they got it horribly wrong.

The speech in the early hours of Wednesday by Federal Reserve Governor Lael Brainard quite simply put the 'Hawk' in 'hawkish' as she threw around words like "it is of paramount importance to get inflation down" and "inflation is much too high and is subject to upside risks" and also "the Committee is prepared to take stronger action if indicators of inflation and inflation expectations indicate that such action is warranted".

The message and sense of urgency could not have been more explicit if Brainard had given the speech while also brandishing a fire extinguisher.

But while that speech has rightly got a lot of attention, I think even more ominous was the one also given in the early hours of Wednesday by Agustín Carstens general manager of 'the bankers' bank', the Bank for International Settlements (BIS).

His speech is ominous because he's conceding that we could be "on the cusp of a new inflationary era". No. He's not talking short term.

And he also suggests it's the end of the era of counting on central banks to produce sustainable growth, saying that “the productive capacity" of the economy has to be strengthened.

Doubtless our central bank, the Reserve Bank, will have had keen ears on these two speeches ahead of making its own decision next week (Wednesday, April 13) on whether to raise the Official Cash Rate here from the current 1.0%. I think it's fair to say with comments such as those in these two speeches, the lights are flashing bright green for the RBNZ to act.

But to get back to the BIS/Carstens speech, which I think is hugely significant, the following is my summary of some of the main points.

And the big one is: "The forces behind high inflation could persist for some time," he said.

"New pressures are emerging, not least from labour markets, as workers look to make up for inflation-induced reductions in real income.

"And the structural factors that have kept inflation low in recent decades may wane as globalisation retreats."

He said that if his "thesis" is correct, central banks will need to adjust, "as some are already doing".

"For many years now, having conquered inflation, they [central banks] have had unprecedented leeway to focus on growth and employment.

"Indeed, with inflation stubbornly below target, stimulating activity hit two birds with one stone.

"But this is now no longer possible, since low and stable inflation must remain the priority.

"If circumstances have fundamentally changed, a change in paradigm may be called for. That change requires a broader recognition in policymaking that boosting resilient long-term growth cannot rely on repeated macroeconomic stimulus, be it monetary or fiscal.

"It can only be achieved through structural policies that strengthen the productive capacity of the economy."

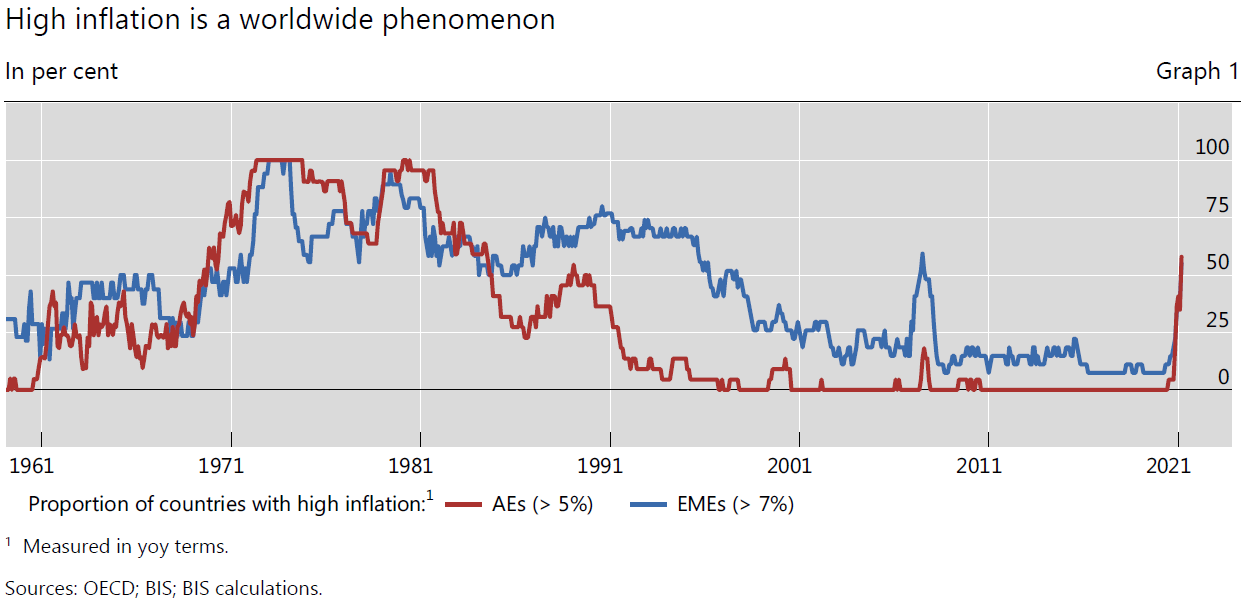

His speech featured the below graph that paints a colourful picture of how rampant inflation is becoming now in both advanced economies (AEs) and emerging economies (EMEs). Indeed, Carstens said almost 60% of AEs currently have year-on-year inflation above 5% – more than 3 percentage points above typical inflation targets. This is the largest share since the late 1980s.

"We should not expect inflationary pressures to ease soon," Carstens said.

He said there are three developments that lead him to think that the inflationary environment may have shifted in a more persistent way.

► The first is that there are signs of inflation expectations becoming unmoored.

► The second comes from signs that the muted link between relative price changes and inflation which characterised the low-inflation era may be shifting. One way of seeing this is by considering the behaviour of price spillovers across sectors. These may now be increasing.

► The third concern relates to the labour market. When inflation starts affecting the “cost of living” in a broad sense, it is more likely to take centre stage in price- and wage-setting decisions. This could trigger a dangerous wage-price spiral. There are early signs that wage growth has "become more sensitive" to inflation.

"So, we need to be open to the possibility that the inflationary environment is changing fundamentally. Mindsets may already be shifting," Carstens said.

"...Looking even further ahead, some of the structural disinflationary winds that have blown so intensely in recent decades may also be waning. In particular, there are signs that globalisation may be retreating."

An immediate implication is that policymakers may need to shift their mindsets.

Central banks may also need to reassess how they respond to inflation resulting from supply side developments.

"The good news is that central banks are awake to the risks. No one wants to repeat the 1970s. It seems clear that policy rates need to rise to levels that are more appropriate for the higherinflation environment. Most likely, this will require real interest rates to rise above neutral levels for a time in order to moderate demand."

Carstens admitted that the adjustment to higher interest rates "will not be easy".

He said central banks "cannot single-handedly ensure global growth by keeping an accommodative stance in all conditions".

"Amid low inflation, this perception became commonplace. It is one central banks must continue to fight against, even more so in an inflationary environment.

"The key to higher sustainable growth cannot be expansionary monetary or fiscal policy. We must strengthen the productive capacity of the economy. Indeed, this is well overdue. Many of the economic challenges we face today stem from the neglect of supply side policies over the past decade or more.

"Over the medium term, higher potential growth would make it easier for indebted economies to withstand the higher nominal and real interest rates that are likely to prevail in the years ahead.

"Central banks have done more than their part over the past decade. Now is the time for other policies to take the baton."

116 Comments

still not sure why you are so fixed on 7% by december - feels a ultra safe prediction -- mortgages rates pushing double figures this time next year is by no means out of the question -- after all it was only the start of 2008 that we were paying more than 10% --

Since then - the can has been kicked down the road for 14 years -- getting fizzier and fizzier with each kick -- and got to say there is nothing happening globally to suggest that this particular explosion wont be even more spectacular and the interest rate number even bigger

Did you mean to say 7% this year ? I agree it does feel an ultra safe prediction. But if you have been following the comments lately you will be amazed at how many people have been saying it will never happen. And yes 10-11% is what some people were paying in the last GFC. People who have vested interests cannot or will not accept 7% talk. So I had better not tell them what is really coming.

It is very important those vested interest people do not listen to this Song from Prince.

https://www.youtube.com/watch?v=9V-vcXOpG9g

or Watch this movie with Brad Pitt

noted 7% this year crash by december! -- and yes i follow just dont comment too much as more often i am out of my depth and knowledge base! but i paid that 11% in 2008 - on a 500K bridging loan and was mighty relieved as the rates came down -- If china stays locked down for three months -- double digits will be all the rage ! mind you -- i fixed last march at 2.99 for five years as writing and wall came strongly to mind - so pretty smug for another three years at least :)

i also moved what investments and Kwisaver etc out of growth /markets etc into safer havens during the olympics when it became obvious Russia would invade - I am not sure if that will be the right move ( only time i have moved kiwisaver since Day 1) but i kind of feel that there are very little upsides to be had as the printing presses will have to stop because of inflation -- and so the market fundamentals must come back into play -- that that surely must mean an end to asset price growth - Time will tell if thats a good call -- but from a Mental Health perspective - i feel pretty good about it!

Nice move with the 2.99% for 5 years. My friend got his 5 year at a very low rate only a matter of months back, I told him a fews days ago that he would be paying 6% for the same loan with ANZ. He almost spat that chicken bone across the BBQ table. Its starting to become BBQ talk, but only really for those who need to refinance soon. I think its going to be the new table talk this year.

Come on Pa1nter, be honest. How many times have you felt like more of a man, a better person, a winner, because you own property and some other poor fool is stuck renting?

We've had years of property owners and landlords getting off on the idea that they are "getting ahead" and getting richer than the peasant class. It's been the national sport, and you have been a keen participant.

It's a bit late to go throwing accusations of schadenfreude around.

Come on Pa1nter, be honest. How many times have you felt like more of a man, a better person, a winner, because you own property and some other poor fool is stuck renting?

I've rented on and off through life, and owning property and having a mortgage clearly isn't for everyone. Who would want a commitment for 30 whole years? Then there's rates, insurances, maintenance.

You have me confused with some sort of Mike Hosking loving National voter or something.

Usually though, people that are eagerly and obsessively anticipating catastrophe for others have some wiring problems.

Fair enough, and I apologize.

Most renters have experienced being looked down upon by lords of the land. I think that's why there were so many "likes" to my comment... it's probably not that people are wishing catastrophe on you or others ... it's just that many renters are keen for a levelling of a playing field that has been very tilted for a long time now.

I don't think I ever have been looked down on by a landlord, but I'm not oblivious to people with plenty that look down those with less. We bred competition into our culture and a downside is people's need to measure themselves against others.

The issue with this highly anticipated housing crash is that it's likely going to make life worse for renters. Sure, the wealth disparity might halt or reverse slightly vs landlords, but fundamental issues won't change, and renters will have less in their pockets at the end of the week.

The status quo is making life worse and worse for renters anyway. With a crash may come significant emigration, reducing demand for rentals. And under 30s would probably welcome the shorter term pain compared to the ever greater wealth transfers to the older generations that has been the norm.

I find their music a bit boring

Glad you mentioned that GBH, I was going to post something similar. I can’t believe how in recent months I am hearing those adverts so often. They have really ramped it up. Incredible how they can blatantly make claims that are clearly false and misleading, shows what some people are prepared to do to keep the ponzi going I suppose.

"...houses double in price every 10 years, apparently..."

To be fair, they pretty much do over the long term. Similar to sharemarkets, but a lot less volatile.

But yes in both types of market there will always be investors and speculators who over-extend themselves and can't survive the inevitable corrections and crashes over the short- or medium-term.

And in the upcoming property crash unfortunately a lot of FHBs and other innocents will be caught up, due to the relaxing of LVRs, and other loose lending policies in 2020. Deliberately intended by our clever leaders to stoke the NZ housing market, now in its biggest bubble in history. Apparently this was to create a "wealth effect", ironically.

"...houses double in price every 10 years, apparently..."

Anyone who has ever said this is referring to the base price paid as the index rather than it doubling outiright at a compounded rate. It's more like 7 over the long run.

The same clown central bankers talking about negative rates only 12 to 18 months ago are now trying to talk tough in the realisation they have messed up at a biblical scale. Give it 6 months when consumer and business cofidence is through the floor and we'll be talking rate cuts again.

... I do recall the 1990s , when as governor of the Reverse Bank Don Brash crushed the economy under high interest rates in order to squish inflation into the tight 0-2 % band ... his job depended on it ...

Now ... we've thrown it all away ...it's blasted to 6 or 7 % inflation ... and for what ? ... to keep the economy ticking over during a worldwide nasty flu epidemic ... Wow !!!!

Eh...we threw it away well before that, using imported price deflation - e.g. cheaper consumer electronics - to justify lower rates that only pump asset prices. We set our tax policy to penalise productive work and reward sitting on assets. Working folk fund society while investors shriek at any hint of reasonable tax.

Greed has crushed the productive economy, ultimately.

Don’t we currently use taxation to drive any IP worth anything overseas along with the owners of that IP so as to reduce inequality. Could you imagine how unequal we would be if we allowed IP worth tens of billions annually to stay in NZ? Think, rocket labs, Zuru toy co, Etc.

The aggregation of capital sufficient to support technology development is the antithesis of our aspirations for equality. Nasty buggers who create things that might drive up inequality need to be chased off ASAP!

Structural policies could be effective in context of nations that have the built infrastructure to support productive capacity expansion but lack skilled workforce or business capital/knowhow. Public policy helps gather the remaining resources from overseas through skilled migration or targeted foreign investment.

Arguably, NZ is miles away from all of that.

It's a real criticism of government and Treasury/Reserve Bank thinking over the past decades. Unbelievable in retrospect, that we used policy to live it up by loading debt onto younger generations, and pretended that was good economic policy. Rewarding sitting on assets, while penalising productive work by making it pay most of the taxes that fund society (including investor subsidies).

What the hell were they thinking...anything beyond their own noses and wealth?

Alternate headline: Fed finally says what Interest.co.nz commenters have been saying for... *checks notes* ....about 2 years. Things are getting ugly out there.

Raising the OCR will do what exactly? My feeling is a good chunk of home-owning households do not have much wiggle room with their weekly budgets. At least those who have bought first homes in the last 5 years, anyway.

It is remarkable how many people including central bankers are surprised by the situation we now find ourselves in.

I first wrote about the inflation that was coming here at Interest.co.nz close to two years ago.

And then another article here

And then another one here.

And yet another one here

And here

And here

All of those six articles were published here at interest.co.nz in 2020 and 2021,

I wrote those articles in some frustration because mainstream economists, largely working as a 'herd' spanning the western world, were using models quantified by historical behaviours and were not recognising the world that we had entered.

I also wrote those articles knowing that when you push more money into a world that for various reasons is constrained in terms of output, then the outcome is predetermined. The only major uncertainty relates to the lag between monetary action and outcomes.

Sometimes, it is important when the world enters a new era to step back from the econometric models rooted in historical situations and behaviours and take a fresh look at things.

Yes, it is going to be painful to bring this inflation back under control. As many a dog has learned, if you keep digging deep down into a rabbit hole, then reversing out is not easy.

Keith

Agree. I wonder if some parties involved did in fact understand that their models were based on outdated and irrelevant historical data, but persisted anyway simply because the short term outcomes suited their agenda. We are not great at looking at the long game any more, politically or otherwise.

Smudge02

My own experience is that the training of most economists is particularly narrow.

They have no other tools except their econometric models.

And the models are peer reviewed by people with the same background.

Unfortunately, most non-economists do not have the mathematics to be able to decipher the fundamental assumptions that go into these models. These mathematical economists are supposedly the experts.

Some years back, I asked one of my own mates from university days, who has had a particularly successful international industry career in a resource-based field, as to what got him on the successful path. He told me that when he arrived on the scene in North America it was the mid 1970s and that was another time when the world had changed in a big way. It was a time when once again the models based on historical behaviours were not working. His own approach based on situational analysis using fundamental economic principles, and coming from a background that was considerably broader than just mainstream economics, including natural and social sciences plus some systems thinking, allowed him to chart a path which stood out from the herd.

KeithW

Chebbo,

When I get some time, I might write something on that.

Actually I am not too worried about the national debt.

But some individuals will be hurt badly and most of these will be people in their early thirties wanting to start families, but unable to afford the associated loss of income.

Right now, I would like to see some significant quantitative tightening to reverse some of the QE. We should not be relying totally on the OCR.

But I am also concerned that there are already some very big forces out there right now, and I am trying to get a feel for the extent of the recessionary forces already at play, which are locked in to have their effect in coming months.

I expect the recessionary forces to first show up in the building industry, and I expect that to be nasty, but I am still starting to make up my mind about the timing. My expectation is that the banks will very soon stop financing any land development projects. And when they do that, they will do that as a 'herd'.

KeithW

.

What do you think of the Aussie idea for quantitative tightening while helping the worst affected? I.e. a nominal amount given to each adult: for renters, to help them cope with the rising costs of living; for those who have mortgage debt, to reduce the amount of debt and essentially un-create that money? Per adult, not per property...so isn't just yet another bailout for speculators.

Rick,

I will have to have a look at it. Do you have a link?

But on the surface it looks like more quantitative easing. Where is the money going to come from? At best it looks like quantitative neutral but only if it is funded by some form of taxation. As Milton Friedman (and others) used to say: there is no free lunch.

KeithW

I'm trying to find it again...someone posted it here a couple of weeks ago and I had a read at the time. It looked interesting. Seemed like they were wanting to reduce the amount of money that had been created by unsustainable housing price lending.

I'd assume some of the money would come from the same place as bailouts to date, yes - QE...I don't recall what they were looking to in taxation to make it quantitative tightening overall.

Fluffy bunny,

In my opinion, the GFC-related repressed inflation was somewhat modest.

However, some of the pre-conditions for the current inflation were in place prior to COVID, given the developing belief within central banks in pre-COVID years that monetary policy including record-low interest rates could be used to stimulate long-term growth, rather than as a tool to be used to mediate short-term economic cycles.

Then COVID set it off!

The effects of the war in the Ukraine are still largely to be felt.

KeithW

And the supply chain stuff will have a long effect. All the just in time principles will be reassessed. More stock will be held at all levels until its all well forgotten. That's more holding costs and a surge in demand to create those stocks. Probably more wastage.

... what I can't understand , is that so many people here , regular smart folk , and me as well , spotted that Adrian Orr had got it badly wrong with his OCR cuts .... inflaming already high house prices , juicing the property market beyond rationality ...

Why couldn't Orr & his inner circle see that which was blatantly obvious to us ... a ginormous error on his part ...

It goes back to the reality that most of these people are very narrowly trained. They don't really understand the real world that most of us live within. And when that world changes, and their models no longer work, then they don't have the breadth of insight to understand that new world.

KeithW

Central bankers won't admit this, but there is (in my view) and element of wanting to make the popular decision that plays on their minds.

They don't want to be the cause of asset bubbles bursting because they know the hardship this will cause and how unpopular they will be if they start raising rates and keep going with them as asset prices fall....but at the same time, I think it has had too much influence on their thinking to the point where they aren't data driven enough....a sniff of deflation and it was emergency 0.75 OCR cut....months or year + of inflation far outside the mandate...and a wait and watch approach...while making the asset bubble situation worse! More moderated use of the tools they have, would have given then so much more flexibility now....instead they were waaay too aggressive on the way down and far too slow on the way up....now they are backed right into a corner as a result.

It is COVID19, Mr Orr would have to been positively insane to keep interest rates high in response to a lethal COVID19 pandemic.

There was/is the pandemic that shut down our tourism sector and most of the entertainment sector - making lots of people unemployed virtually overnight. The disease was evaluated as being extremely lethal therefore we needed to enforce vax mandates and rolling lockdowns. Local/global demand reductions amongst a massive death toll - deflation was predicted.

We have to have low interest rates as part of our COVID 19response. The same reason we mask school children and airline passengers and supermarket shoppers. The same reason unvaxxed people cannot work in most places. The same reason the border is closed to most people. The same reason Auckland spent months in lockdown.

Exactly. Just reduce the debt servicing costs of existing borrowers. No need to encourage more buyers into the market with reduced LVR's. Even the temporary conversion to interest only may have been enough for most people to keep ticking over. Especially once the government widened the wage subsidy support to the entire private sector and kept all public sector workers on full pay regardless. Many peoples cash flow positions were massively improved almost over night. Once they realised they were not likely to die from Covid and they had job/income security. They began trading in houses.

unaha-closp

I don't think you are correct.

The COVID19 responses could have been funded fiscally and with bonds left in the market rather than with an over enthusiastic monetary response.

Some people have made huge windfall profits as a function of the specific monetary approach. Other have been and will be greatly disadvantaged.

You are conflating the need for COVID19 responses with inappropriate monetary policy.

KeithW

Well put, Keith.

One of the unsaid assumptions of the last 4 decades has been that there are little to no resource input constraints. If something is needed, somewhere, someone will supply it for an agreed price.

That is now history. Those somethings may be locked up behind ESG wokery, may belong to Unfriendly Actors, may be available but for impossible to pay for prices, may be available at source but unshippable, or might have transmogrified into Unobtainium.

Those airy assumptions are now dust on the wind.

This is exactly the same thing that happens with transport modelling. It's why we continue to throw good away on ridiculous car centric projects like motorways and road widening. The modellers cannot alter their baseline assumptions to take in the new situation. Models are only as good as their assumptions. Garbage in = garbage out.

As I have been saying for years now, the whole Reserve bank OCR/ CPI model is very deeply flawed. It urgently needs to be reformed, if not thrown out. I would suggest that the starting point should be a blank sheet of paper and asking what are we trying to achieve rather than trying to shuffle the deck chairs on the Titanic.

I still don't understand why the central bankers, economists, etc initially claimed that we wouldn't have an inflation problem, then for months they were saying "okay we do have some inflation, but don't worry, it's just transitory", and now finally they're saying "oh crap".

Wasn't it bleeding obvious from the global lockdowns and unprecedented money-printing by governments all over the world that this was going to lead to a huge inflation issue, with all its knock-on effects including the risk of global recession? Were the experts all incompetent, in which case why do they still have their jobs? Were they suffering from groupthink? Were they lying?

It's because they can't afford for this inflation to exist - they know that fighting it will cause widespread debt defaults as cash rates rise...and they will look foolish for flooding economies with money in 2020 like they did. A response which they massively overcooked.

So they've been hoping, praying like never before that it was transitory so that they wouldn't have to do anything about it.....essentially it was wishful thinking....a bluff that they hoped would fool the markets.

Now they are in a corner knowing that if they do nothing, inflation might start growing out of control....(bad).....and if they act to reign it in by raising rates and starting QT, that markets will likely tank and there's a good chance of serious debt issues around the globe. This in turn could be highly deflationary and then they will have to revert the QT and start QE again! Making them look like fools who don't know what the hell they are doing.

Essentially when countries (and households) become this leveraged as a result of debt monetization/QE/ZIRP, the risks of runaway and inflation/deflation sit on a knife edge.....and central bankers know it. If they didn't carry out the massive market interventions they did in 2020, we could have had a repeat of the 1930's depression.....and that is now still a possibility if central banks start ramping up rates to fight inflation....because we don't have the productivity to increase goods and services enough to create enough income to pay the interest on the debt that has been created to prevent deflation back in 2020.

There are no free lunches in the world of finance and economics....just actions and consequences....central bankers got away with murder in 2020 and now we might be forced to take responsibility for those actions.

I wrote to our Central Banker in chief about 3 times over the last 5 years or so, saying that they were painting themselves into a corner and when inflation hit, they were going to be responsible for a breakdown in the financial system and/or economy they are supposed to be protecting. The replies I got were full of magical thinking, belief built on a house of cards.

What's funny is that everyone can see it happening except the people who we employ to see it before it happens. They live in this delusional world where they seemingly are forced to believe some clearly false doctrine, else they are ostricised.

I don't think it's so hard to explain.

-Recency bias: a middle-aged economist has only experienced a deflationary world. The threat of inflation, having been overstated for 40 years, had lost all ability to frighten. Which, of course, creates the circumstances for its return.

-Political convenience: believing in inflation is inconvenient for both sides of politics. The right want to keep markets pumped with artificially low rates, because they love inflation when it's property (only inflation for poor people, wealth for the rich); the left don't want to threaten the observation that had been hardening into a conviction, the conviction that governments really can print and spend indefinitely without causing inflation, which really presents a giant policy get-out-of-jail-free card.

So no matter who is in government, it's in the interest of central banks to deny inflation is a problem for as long as possible.

Looking at the graph I see a spike in around 2008 where you could have written exactly the same sort of article. However it was a temporary spike in an overall downward trend.

If there is to be a broad long term inflationary trend I would expect it to be more like the upwards curve that evolved from the 1950's to the 1980's, slow at first then building and building, not a sudden large spike that continues going.

High oil prices if they continue will crush demand in the world economy and that will subdue prices.

What I'm seeing in the world today are energy and food price spikes caused by firstly Covid (freight costs and distribution difficulties), then Russian elites trying to steal the newly discovered gas reserves of Ukraine with follow on effects for oil prices, fertiliser, retail fuel and food prices.

This is then exacerbated by the serial incompetence of various country's elites and their management deficiencies.

Just look at Sri Lanka. The Rajapaksa's are in control of the country and have made two decisions - a large tax cut and then a refusal to allow fertiliser imports (because they didn't have the foreign currency for the imports) that have simultaneously sunk govt revenues and sunk farm production. Perhaps in normal times they would have got away with it but right now dumb decisions have consequences. The crowds have been in front of various Rajapaksa mansions chucking stones at the windows and trying to break down the doors.

Likewise in Russia a stupid decision to go to war to steal another country's stuff is not being reversed because Putin has always been able to push on through to victory in the past. I wouldn't be surprised to see him swinging from a lamp post in the next month.

What I am reading in this article and from the comments is the desire to go back to the past when crushing demand by increasing interest rates and cutting wages was brutal for poor people but didn't matter for the general economy because a whole enormous cohort of baby boomer spending was coming through.

That cohort isn't coming through again. If you crush demand by cutting off affordable credit due to a spike in energy prices then you will ensure a deflationary environment and a lot of pissed off middle class people to add to the crowds of angry poor people.

Then you won't get just people throwing rocks through mansion windows and crowds of anti-vaxers setting up camp outside parliaments. You'll get tax increases on the rich and govt seizure of land and assets on various pretexts. After that you'll get tax increases on the middle class and more asset seizures.

If you can't crush wages because the pool of Chinese migrant workers is gone and the only surplus labour is in Africa and the Middle East then lower unit wage costs aren't going to make up for decreased sales like they did in the 1980's and 1990's.

The siren song of bankers who want high interest rates for captive borrowers should be resisted. Alternative solutions should be found for the energy price spike.

There difference is the quantity of debt/leverage in the developed economies now compared to 1970's/1980's. We don't have the option of lifting cash rates over 10% to reign in inflation if that is what is required because that will cause bond/debt markets to die and subsequently every other market to follow.

So if inflation doesn't stop of its own accord, we are either faced with the death of currencies like the USD, or serious pain in raising rates and causing widespread debt defaults as we don't have the productivity to pay the increased interest on the debt that was created in 2008/2020 that allow our economies to avoid deflation/depression at those times.

Essentially we've kicked the can down the road a few times now and each time we do it, the consequences get worse. The only long term solution, is a reduction in the level of debt across economies, but that would require pain which nobody appears to be willing to face - hence why we've avoided it for the last 14 years (2008 to now).

"Central banks have done more than their part over the past decade. Now is the time for other policies to take the baton."

Are you frikkn kidding me.

Or is he inadvertently admitting to CBs having screwed up and now throwing the baton down and hightailing it over the horizon?

I see Stuff is preparing people for losses:

I lost money on a house, here's what you can learn from that

Bought in 2008, sold in 2009, well, duh, yeah.

Same for anyone who bought in 2021 and selling in 2022 I imagine. For most of my life it has been like that. You would always expect to lose if buying and selling within a year or two even.

It's only in recent times that the expectation has been to make mega dollars buying and selling in the same year. Things were terribly wrong when you could buy a house and sell it a year later with enough profit to buy ten or twenty new cars. During a global pandemic to boot!

It makes me angry, my dreams of the Global cities with nice 5% appreciation all ruined...

"New pressures are emerging, not least from labour markets, as workers look to make up for inflation-induced reductions in real income."

It is perfectly OK obviously for corporations and businesses with market power to hike prices and profits, just so long as that doesn't 'induce' any increase in the wages of their workers. Can't have any of that nonsense.

To be fair, the key point of the BIS speech is that we need to get back to focusing on the real economy - real resources, productive capacity, food and energy security, technology etc. The idea that the economy, or the prices within it, can be sped up or slowed down by adjusting the cost of credit by 50bps or whatever is dead in the water.

I wouldn't necessarily pin this so squarely on central bankers. For example, finance sector lobbying of Clinton to repeal the Glass Steagal Act was a big factor, as was politicians' convenient passing of the buck on economic management issues to central banks. But, I agree with your main point absolutely - the financial economy is bloated and simply ridiculous.

Good points - agree.

Its all very unsustainable in my view....but who knows how long the two can remain detached from one another. This inflation might just be the catalyst that reveals the severity of the detachment and that QE doesn't improve the real economy....it just pumps up debt/asset bubbles.

The key delusion appears to be that central bankers/govt thought that we could have perpetual asset price inflation of 10% while maintaining consumer inflation at 3%. Reality has caught up with us. The question is what will they do now.

1) Try and sell the belief that a little bit of inflation is a good thing.

2) Raise interest rates, let the housing market crash 20-30% and eat a recession.

2) Is going to happen. It's already started happening. If throwing free money around was the secret to ever-lasting success, we would have been doing it forever. We haven't and there is a good reason for that, and people with too much debt are about to find out the reason why.

Just like Real Estate agents that only earn a commission if the property sells, they don't care which way the market is heading, as long as it does not standstill or stabilizes. No news is good news and good news doesn't sell.

And if they can help achieve that movement either way by throwing an accelerant into the mix, good for their business.

As long as we can destroy the NZD in the same proportion as the Fed destroys the USD....whats the problem?

(the games that Russia and China could start playing in attempt to undermine the USD reserve currency status will be worth watching....with Russia already starting).

This is worth a look... https://iapp.org/news/a/us-lawmakers-introduce-ecash-act-to-develop-ele…

So it is not Transitory......can say that the entire breed of Reserve Bank Governors be it Powell or Orr, all were lying....should they not be publicly held accountable and shamed so is never repeated and like of this power think twice in future before experimenting.

Key theme in Dr.Carstens speech is: "If circumstances have fundamentally changed, a change in paradigm may be called for. That change requires a broader recognition in policymaking that boosting resilient long-term growth cannot rely on repeated macroeconomic stimulus, be it monetary or fiscal".

I foresee Grant Robertson wrongly arguing with him that he can stimulate the economy. He will point out to the low unemployment in New Zealand. But he does not acknowledge that this was achieved by blowing up government (More Whanau Ora -, MPI-, DOC-, Social development -, and mental health departments and employees) and that is a big non productive part of our economy.

We shall see that countries who have invested their cheap loans in infrastructure and other productive means like education and research&development will weather this storm far better than New Zealand. We have neglected supply side policies for too long!

I foresee a slow decline in New Zealand with 2025 as the bottom and on our way to that point we will experience some rather odd measures like the re-instatement of the deductability of mortgage interest rates but this time not only for investors but for every mortgage holder.

Peter M

Here in NZ we may or may not have inflation beaten by 2025 - that will depend on Government and RBNZ policies.

However, fundamental problems with the NZ economy will remain. The big one is that exports are currently relying on record prices with stagnant volumes. But import demand is roaring ahead. That is not sustainable.

KeithW

Long term there is definitely a real squeeze on labour because you have a situation in many countries where fewer people are entering the workforce than leaving it while the overall population still rises.

Regarding food production, we have over-exploited many aquifer systems and they will simply progressively run dry over the next half century.

Finally, regarding energy, there will be some greenflation as the costs associated with energy transition get passed to consumers.

Too true squishy.

In addition, many professionals are leaving the work force prematurely, particularly in NZ. Tough Covid compliance by Government have accelerated this shift.

In years gone by the MO was to import talent from abroad. However, globally talent is now being highly sought.

I like to have a bit of a contrarian view. I certainly concur that inflation is on its way (in the December Interest.co.nz forecasts for 2022, I said the 3 main issues in 2022 will be inflation, inflation & inflation) and inflation is most likely to get worse over the course of the current year. But I'm quite convinced that the significant rises in interest rates will lead to a serious recession, this, I believe will stop people from spending sufficiently to reduce inflation back to much lower levels (read within the 1-3% band). I've locked my mortgages in August 2021, 35% for 2 years and 65% for 3 years in expectation that interest rates will be back down in late 2023 - 2024

Of course, apart from this discussion about central bank action/tunnel vision etc., are the realities of global resources and fantasies about "growing "our way out of our current, hopefully temporary, problems,...as Powerdownkiwi constantly reminds this column; plus the rarely mentioned factor that every nation is to some degree constrained by it's own ultimate economic capacity.

I believe that NZ has for a very long time, imagined that it ranks in overall economic capacity with other western democracies, eg UK, Australia, Canada & so on. But a moments reflection plus any observant Kiwi travelling overseas, would tell us that our population/educational achievement/arable soil/ distance from markets/ etc., etc., ultimately means that as a nation we will always struggle vis a vis our western cousins.

Failure to acknowledge these constraints means we will, as we have done for many decades, spend more than we earn in a pathetic attempt to obtain the living standard we "deserve", whether it is the form of good hospitals, universities,...whatever.

Yes it is possible to..."punch above our weight" as politicians so often tell us, but that presumes a national ethic of eager learning, hard work, and willing entrepreneurs, rather than more public holidays, more parks, more sporting activity, etc., which we seem to rank above mere production. Even then if we want a satisfying national life, we still need to make the best of our wider capacity constraints, a grade lower than other western nations we like to compare ourselves with.

We are looking at a possible stagflation situation here. How high can you take interest rates before you tank GDP. With the level of government debt post Covid, I expect they will allow some inflation to lessen their debt burden. As always, I predict in 10 years the dollar price of a home in Auckland will be a lot more than it is today.

Here is what Quora says:

During inflation, governments sometimes raise interest rates so that the liquidity of money reduces. But when it is a case of stagflation, there is a stagnation (or reduction) in people's income as well, reducing their purchasing power even more. Increasing interest rates in this case will have an adverse effect on the GDP, which might dissuade governments from doing so. Not doing so will mean that the country will have to endure inflation.

Thus, it will depend on the decision of the particular government and how they decide to fix the situation.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.