Business confidence has been "clobbered" by the Omicron outbreak, while inflation and pricing expectations have soared again, according to the latest ANZ Business Outlook survey.

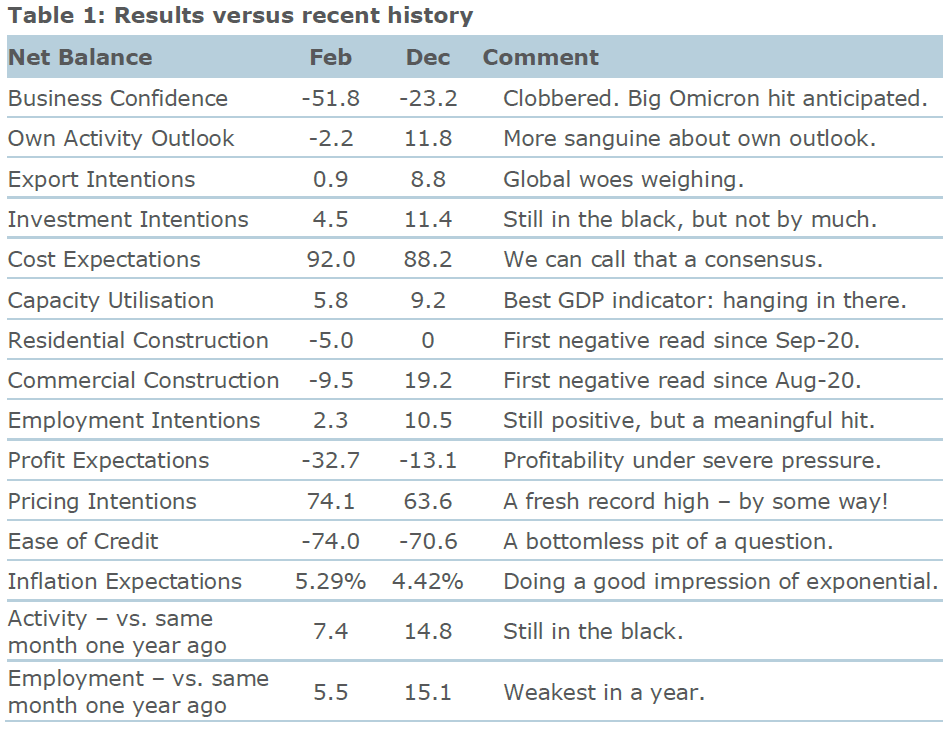

"Inflation expectations, cost expectations, and pricing intentions all hit fresh record highs. Indeed, the latter suggest CPI inflation could hit 8%, rather than the mid-6s the RBNZ and we are currently forecasting," ANZ chief economist Sharon Zollner said.

She said 2022 was shaping up to be a challenging year economically. Getting on top of "super-charged inflation" without an outright recession was looking increasingly difficult.

The February ANZ Business Outlook results showed "widespread anxiety about the impact of Omicron", Zollner said.

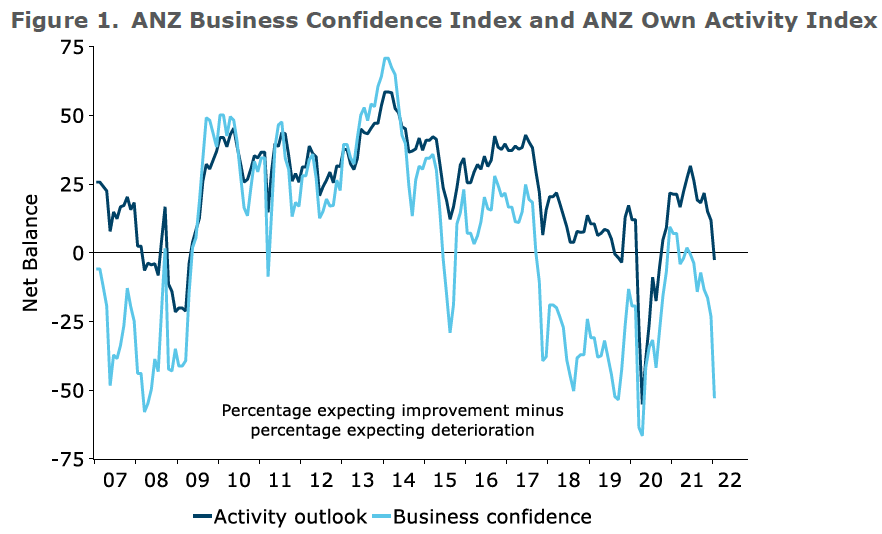

Headline business confidence "tanked" 28 points, while own activity fell a more modest 14 points, compared to December, she said.

Notable features in the survey included sentiment in the construction sector - both commercial and residential - turning negative for the first time since mid-2020. Across all industries, profit expectations have plunged. Companies' employment intentions are still in positive territory - but have taken a big hit since the last survey in December. Investment intentions are likewise still in positive territory - but not by much.

“Activity indicators fell across the board. But that has done nothing to ease inflation pressures, which remain extreme," Zollner said.

“Record-high pricing intentions came despite expectations of weaker activity. Recent weakness in the NZD probably hasn’t helped, though every type of cost is going up. It supports our contention that while Omicron will be enormously disruptive, it won’t do anything to ease inflation pressures.

“The survey makes grim reading, certainly. But this isn’t March 2020 and we do have an idea of the storm that we are heading into. Other countries have been through the Omicron wave already, and have seen a sharp bounce-back in spending on the other side.

“The disruption will be intense, but relatively short-lived. But the question of when cost pressure will ease is anyone’s guess, with wages yet to really get going.

“Cash flow pressures on households won’t subside with the Omicron wave. Retailers seem to be aware of that, with the weakest own activity expectations. Retail is the most pessimistic by a country mile, and services are also negative.

“The Omicron wave represents more stress, more cash-flow pressure and more interrupted revenue, and the cumulative damage to some firms’ balance sheets, particularly in hospitality, will likely prove too much.

“The intense stage of Omicron will pass quite quickly. But both before and after this outbreak, firms face skyrocketing costs, extreme labour shortages, and shipping disruptions that continue to worsen.

“On the demand side, households are facing into higher interest rates, falling house prices, and a vicious increase in the cost of living.

“All up, 2022 is shaping up to be a challenging year economically, and getting on top of super-charged inflation without an outright recession is looking increasingly difficult.

“But with CPI inflation heading well over 6% the RBNZ has no choice but keep right on hiking. And now global geopolitical developments threaten yet more imported inflation via energy markets.

“Buckle up.”

59 Comments

HM

You are seemingly changing your tune .

A couple of weeks ago you were claiming ANZ economists are “fools”.

Your outlook for inflation was over by this year, OCR would be 1.75% tops and mortgage rates back to 2 to 3% within two years. Not an ugly outlook at all.

P8, my position has been very clear and consistent for at least the past 6 months, and I am certainly not 'changing my tune' at all:

- I have had an ugly outlook for the economy in 2022 for a long time, and continue to do so. A number of factors, including higher interest rates, supply issues, costs, high prices, omicron will really bite (and are already starting to bite, and let's add a European War shall we)

- As a result, the OCR will not be raised higher than 1.75. Anything higher, or certainly higher than 2%, will destroy the economy and unemployment will start rising a lot. Just a reminder for you, as you seem to need it - employment is a key mandate for the RBNZ as well as CPI.

- By the time the OCR is lifted to 1.5-1.75%, the economy will be well and truly in a slump. Inflationary pressures, certainly domestic demand-side ones, will have eased significantly by then

Got it?

See you in 6 months and let's see if I was right or wrong, because it will take that long to know. But I know that won't stop you trolling in the mean time.

HM

You know you are going to get hammered if the OCR goes over 1.75 housemouse, but this is a free forum and you have your right to say your piece. For me I see it very unlikely we will stop at 1.75, especially if inflation is 7 or 8 which is very possible. Will know in 8 months time (or less)

With such low unemployment and high commodity prices for our exporters, there was really no justification to keep emergency monetary stimulus settings for so many months.

Yes, there was. To ensure the bubble kept purring along and galvanize the wealth effect (consumer spending). However, the central bankers were caught short on the extent to which people would gorge themselves on debt.

That's right. Waiting to see how much higher inflation could rise once we open up our borders to thousands of Kiwis first and then to hundreds of migrants over the course of the next 3 months.

The fight for basic accommodation, food, fuel, etc. is about to get uglier as ever in NZ.

That is right. And it was blatantly obvious since before the Christmas before last. And they carried on with their foot to the floor on the accelerator. Even now the OCR Should be far higher given the level of inflation. Basically Covid has created a number of problems, but they have over stimulated the hell out of the economy and housing to the point that we now face a hell of a mess with no good ways out.

"Inflation expectations, cost expectations, and pricing intentions all hit fresh record highs. Indeed, the latter suggest CPI inflation could hit 8%, rather than the mid-6s the RBNZ and we are currently forecasting," ANZ chief economist Sharon Zollner said.

Guess what I was saying couple of days ago, it's happening...

by company of heroes | 23rd Feb 22, 3:30pm

The longer they drag it, the higher OCR is gonna be... I still think at some states this year, they will need to do some 50bps hikes. Otherwise, by the end of this year, their peak OCR forecast could be 5%...

As repayments costs rise, money is simply directed from elsewhere aka discretionary spending.

Which is bad because it creates a doom loop. The NZ economy is built around 'discretionary spending'. If share of wallet is allocated to debt servicing, it means less is spent into the economy meaning lower incomes, revenues, and profits. That is also bad the for the bubble.

They could try the Aussie plan (Liberals? Can't remember which party it was...) of rather than printing money and throwing it at house prices - the current approach - giving every adult a direct handout, to be used in the case of FHB and investors to reduce the size of their debt, in the case of non-owners for spending on what they need. Per adult, not per house; doesn't unduly reward speculators as their current approaches have. Reduces the amount of debt and money.

I agree but you can only cut back so far and the RBNZ is just letting inflation rip thinking its going to correct itself. The longer they are not in control the worse this is going to get. If they continue to dither about the rises will need to be 1% a shot. A few on here said 2022 was going to be the perfect storm and there are some pretty big grey clouds building on the horizon.

I'm one of those who see a perfect storm. There's inflation globally which we are in a particularly poor position to resist, with our very open and undiversified economy. We have a very large pre-existing load of private debt, mostly mortgages, and that debt produces nothing of value going forward. We are extremely dependent on imported fuel. We have an overpriced economy that has only been kept afloat by the wealth effect. Rising rates and inflation and a property correction. This time next year the $NZ will be tanked, unemployment will be rising stubbornly, and Gov't debt blowing out as they try to bail out the economy.

And mainstream economic commentators will be completely surprised by all this, because they think the money used for housing is not actually money, or something -- at least, they insist on treating it as if it isn't when they measure things like CPI.

Well if having a $1 Million mortgage last year was "nothing" then this year it is truly wonderful. That mortgage is rapidly being reduced by inflation which is much higher than interest rates paid. The awful position to be in is to have $1 Million deposited in the bank, this money is also reducing at the speed of inflation which is much higher than the interest earned.

It is only getting 'reduced by inflation' if you are getting net payrises that are above the rate of inflation. Otherwise, you're just trying to make those mortgage repayments and cover the basics with less.

Most Kiwis are lucky to get one pay review every 12 months. At the moment, it's easy for businesses facing increasing costs to say there's nothing in the kitty left over. So the debt doesn't get 'inflated away' at all. And if you do get a payrise, it's retrospectively covering inflation you're already incurring first, not the inflation coming between now and your next pay increase, which could be a long time away, assuming you still have a job in 12 months time.

I don’t think the economy is that fragile. There will be some losers in a correction, sure.

For the most part though we have strong export industries. Tourism getting back on its feet will have nothing to worry about with RE prices. And the knowledge economy will be able to attract more talent once the numbers start making sense.

I keep coming back to the $800k-1Mill shoe boxes being built en mass all over Auckland, there must be literally thousands. Who in their right mind is buying them, especially the ones out in the far flung burbs with no public transport. If they start sitting empty, there will be a few developers wondering where they went wrong.

Business confidence has dropped to GFC levels, but we got out of that by reducing interest rates. If interest rates are increased to combat inflation, many businesses will go under, people will loose their jobs and possibly their homes. If they don’t increase rates, we will head the way of Turkey. Loose loose situation.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.