The Reserve Bank says it's going to establish a "monitoring framework" to watch and assess developments in new forms of 'private money', including cryptoassets.

And the central bank has launched a round of consultation, which among other things will seek views on whether regulatory changes may be needed for cryptoassets.

This is a continuation of extensive work the RBNZ has been doing as part of its Future of Money programme. Part of this also includes work by the RBNZ on potential development of a central bank digital currency (CBDC). The latter work is still continuing.

In a new issues paper titled: The Future of Money - Private Innovation the RBNZ has outlined a number of issues around the development of cryptoassets.

(The term 'private money' means just that as it includes the money you and I have in banks.)

RBNZ's Head of Money and Cash Ian Woolford says cryptoassets are currently used for high-risk and speculative investments.

"Nevertheless, some cryptoassets may become more widely used as money in the future and it is the Reserve Bank’s responsibility to prepare for this. As part of our response we are developing a monitoring framework to watch and assess developments."

The issues paper says that in terms of opportunities, the RBNZ considers that beneficial innovation in private money using new technology may help broaden access to the money and payment system from outside the banking sector.

"Broadening access supports competition, which is key to delivering efficiency and supporting further innovation," the paper says.

But there are risks.

These include fraud and theft, anti-money laundering and countering financing of terrorism , and technology and cyber risks.

"Some forms of cryptoassets, particularly stablecoins, also pose a range of further risks related to the stability of the asset's value, the ability and costs of redeeming the stablecoin for fiat currency, and the solvency of the issuer of the stablecoin. It is important that these risks are adequately managed, including through regulatory measures where needed."

The RBNZ paper says that In addition, several risks also need to be managed if new forms of money become significant.

"These risks are often associated with externalities resulting from strong network effects which constrain market efficiency and impact consumers."

It says the first possible risk is the potential for new forms of money to be bundled with other products or services offered by dominant players in other markets, such as technology or commercial platforms. Some of these platforms operate dominant networks, allowing money issued by them to scale quickly, recreating barriers to entry, and extracting excessive rents.

Secondly, new forms of money should not fragment trust in private money or the efficiency benefits to the wider economy that are currently achieved through 1:1 convertibility and prudential regulation. Therefore, our regulatory framework needs to remain robust. Any changes to promote competition and further innovation should deliver the same level of trust and efficiency.

Thirdly, significant uptake of new forms of money not denominated in NZD could potentially undermine our monetary sovereignty or, at the very least, complicate the implementation and transmission of monetary policy.

The paper says that in the event of a non-NZ dollar new form of money becoming popular, this potentially could have significant impact when the RBNZ is changing the level of the Official Cash Rate - the main means through which it operates monetary policy and controls inflation.

Overall, the effect of a change in the OCR "could be reduced and unevenly borne", because those using NZ dollars would be effected directly but those using the new currency might not.

"We might have to increase the OCR more aggressively to achieve the same effect, with greater costs, more complex economic flows, and more unintended consequences. Such complication would not occur, should the stablecoin be backed by the NZD," the paper says.

Woolford says the central bank's objective is for New Zealand to have a reliable and efficient money and payments system that supports innovation and inclusion.

"We certainly think that competition in private money is healthy. But, we need a level playing field where regulation matches risk across all technologies, consumers have real choice in how they pay and save, and trust in private money is preserved," Woolford says.

New forms of private money can also pose risks to users and to the economy more generally, he says.

"We may need to address private forms of money that don't appropriately safeguard the interests of users, or which misuse market dominance. We need to ensure neither the stability of the financial system nor our ability to influence the economy through the likes of interest rates are lost."

Woolford says there is wide range of regulatory approaches being taken around the world. The RBNZ's focus will be on striking the right balance between enabling innovation, treating all private money forms fairly, and managing the risks for users and the broader economy.

"Our consultation is asking for feedback on where that balance lies and the role of regulation in achieving this."

The issues paper The Future of Money – Private Innovation in Money and background information is available online. The RBNZ will be offering stakeholder webinars and other opportunities to discuss the paper in February and March, with feedback closing on April 3, 2023.

The issues paper indicates that the RBNZ will work with other regulators to develop the monitoring framework. Along with the Financial Markets Authority, Commerce Commission, Ministry of Business, Innovation and Employment and The Treasury, the RBNZ has formed the Council of Financial Regulators (CoFR), which in September issued a definitive statement on cryptoassets.

While the paper's non-specific about what's exactly involved with this framework and when it will be up and running, it says the framework will be "in line with our new monitoring mandate and the CoFR statement".

"This framework will also help us determine the size and urgency of further work.

"This framework could include key measures, similar to those used to assess systemically important financial market institutions (e.g. interconnectedness, substitutability, concentration, complexity and size).

"We also propose to monitor a wider range of metrics relevant to assessing whether or not a new form of money may become widely used."

The paper said this would include the extent to which they are used:

• by New Zealanders for day-to-day transactions and savings;

• for key economic functions, e.g. paying wages/setting prices/interbank settlement; or

• as part of a bundle of services, e.g. media platforms.

"Additionally, we may need to consider non-economic factors. For example, suppose new forms of money become more widely used within some communities for cross-border remittance and have a material or even disproportionate impact on these communities."

The paper says some "start-ups" in New Zealand have been exploring such use cases, "given the existing inefficiencies in this area".

"In that case, these new forms of money would be a matter of concern."

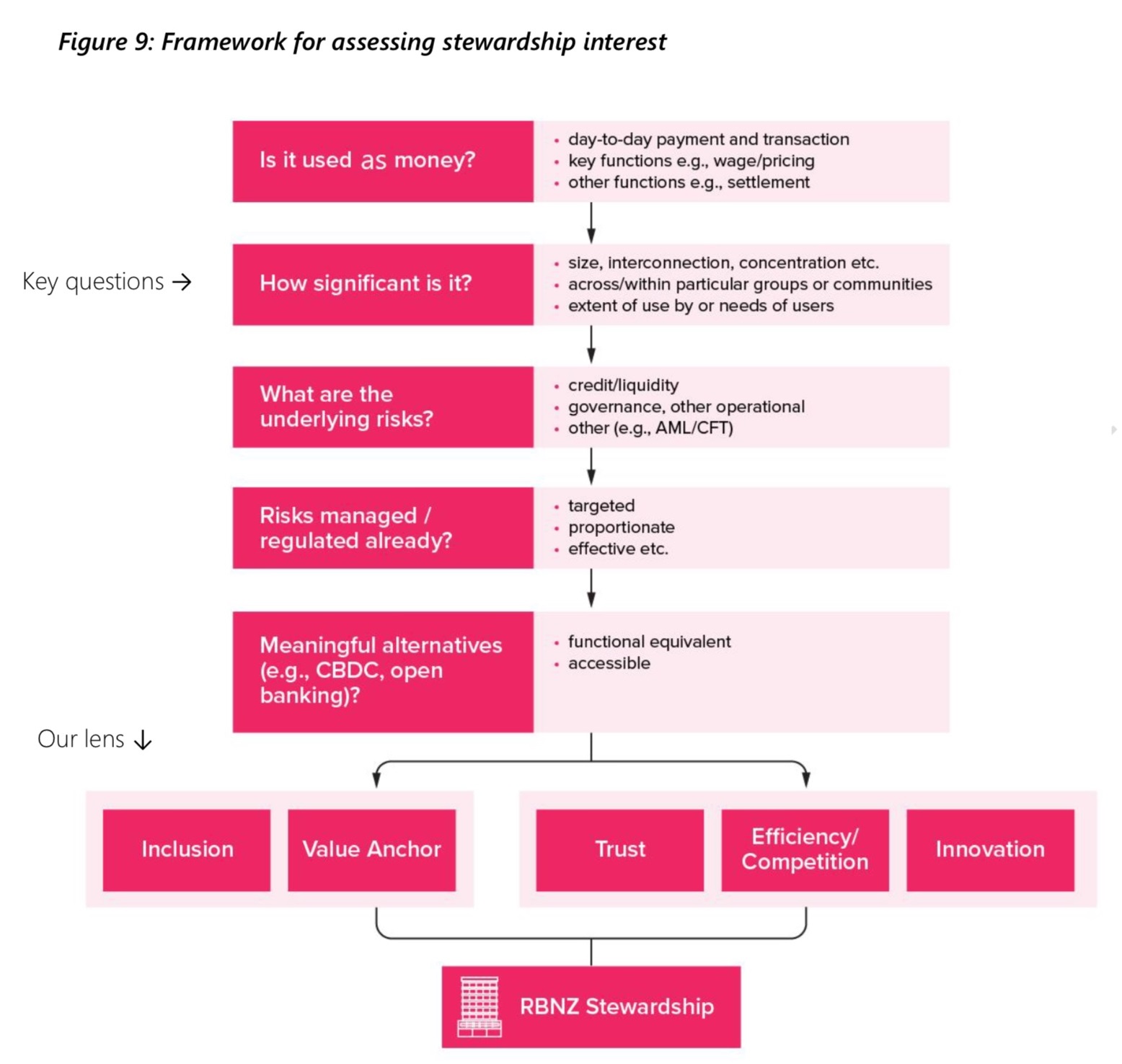

In terms of specific "innovations" the RBNZ outlines the questions that can be asked to assess whether further responses are necessary as per this graphic, below.

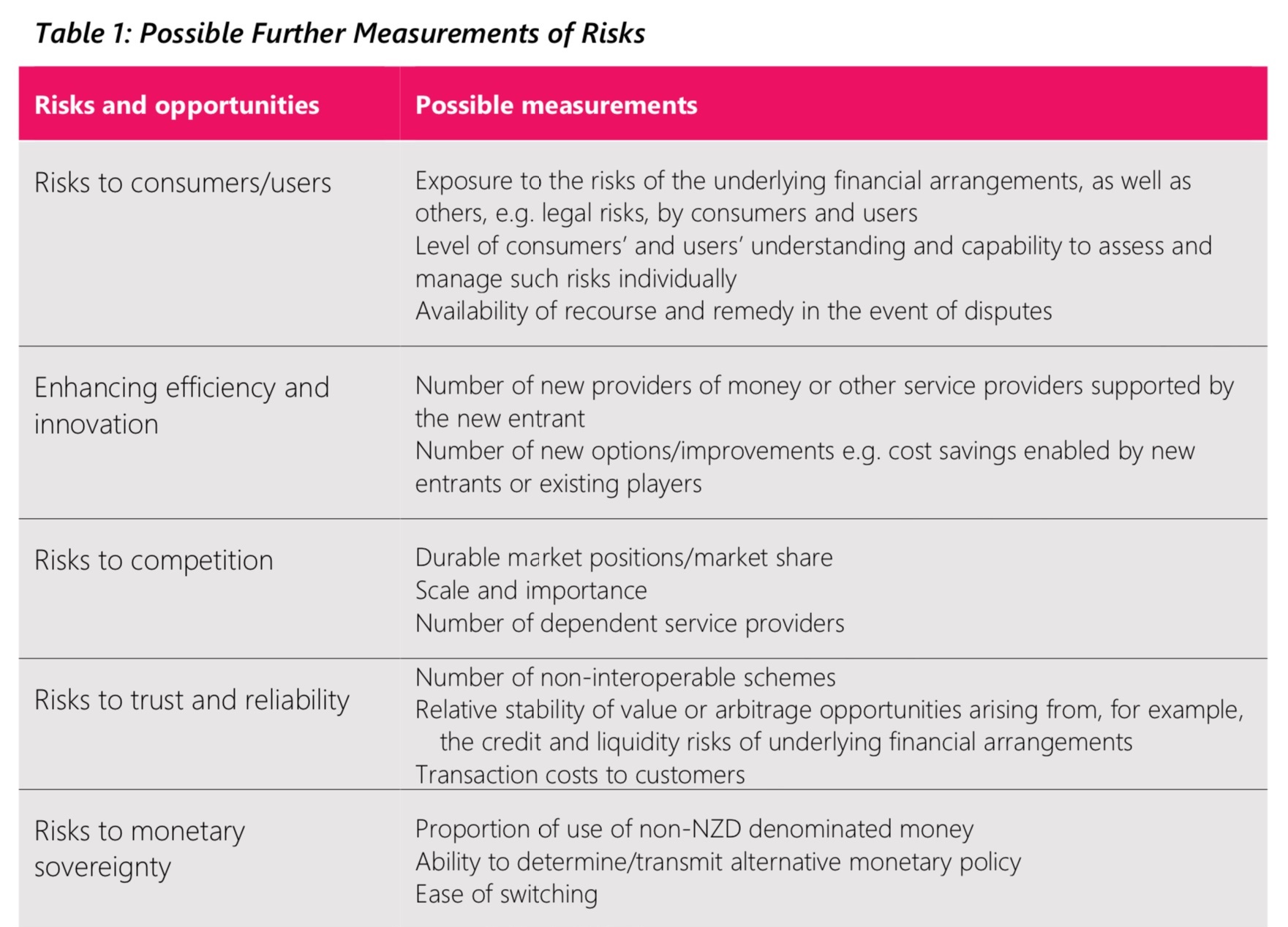

The paper goes on to say that if certain innovations "are of significant interest" the RBNZ will assess further the relevance, nature and magnitude of the opportunities and risks to develop formal assessment criteria. These criteria might include the likes of the following:

The issues paper stresses that the RBNZ is not proposing to ban the use of certain coins or to limit how people choose to pay and be paid.

"There is currently no restriction, for example, on opting to have one’s wages paid in bitcoins, foreign currencies, community ‘currencies’ or other tokens, provided such choices do not affect others.

"In fact, we generally welcome well-grounded innovation that increases diversity in the forms of trusted money and payment options, as this supports choice and competition."

The RBNZ says while the uptake of new forms of money in New Zealand is currently small, the absence of a regulatory framework effectively addressing some of those risks "could undermine trust" in these new forms of money and the opportunities they could present.

"An alternative argument could be that as uptake is currently low and limited largely to speculative investment, we should not consider regulation at this point and instead rely on ‘buyer beware’."

20 Comments

The gloss....

"In terms of opportunities, the RBNZ considers that beneficial innovation in private money using new technology may help broaden access to the money and payment system from outside the banking sector.

"Broadening access supports competition, which is key to delivering efficiency and supporting further innovation," the paper says.

The reality...

So here are reasons they will use to impede or stifle new private money creation (or use of cryptos) outside of the purview of the RBNZ's own digital currency. They state....

"But there are risks.

These include fraud and theft, anti-money laundering and countering financing of terrorism , and technology and cyber risks."

Why can't the RBNZ stop "seeking views", and "launching rounds of consultation", about things they've already decided are happening? CBDCs are happening.

(The term 'private money' means just that as it includes the money you and I have in banks.)

This might be the most important sentence in the whole article.

The numbers in your bank account aren't the same type of money as cash, or CBDCs, or anything else. They're private bank money.

CBDCs will be hard money. They will be central bank obligations, and not the sort of thing they'll want people using frivolously, which is why there will be all sorts of restrictions over how they can be spent.

There is an interesting video on you tube of CBDCs in the UK, fiction or a possible reality? https://m.youtube.com/watch?v=AuLLJsWttlk

The ‘value’ that Bitcoin aims to offer: Transactions confirmed within 10 minutes, anywhere in the world with an internet connection, without the need for any human interference or approval. Controlled by a limited supply feature which cannot be altered. After 14 years Bitcoin is averaging 9.55 mins transaction time.

The network is 'based' on the fact that there will only ever be 21 million units of bitcoin, and each of those units will only ever contain 100 million satoshis within them (e.g. cents). Currently approx. 19 million of these coins are in circulation and the generation of remaining coins is scheduled to occur between now and the year 2140, hence giving it scarcity similar to any other commodity.

The value WAS to be a peer-to-peer medium of exchange outside of traditional financial institutions. One in which the transactions were verifiable and incorruptible. There is a white paper which contains an informative abstract written by Satoshi which can be found here...https://www.bitcoin.com/satoshi-archive/whitepaper/

It was never meant to be a means of investment and that is where the true value of cryptocurrency has been corrupted.

Not necessarily corrupted. It's not great for general payments as we all know because of 10m blocks and tx fees but can be seen as a store of value for many.

With inflation globally in the double digits (real inflation) and cost of living rising ever higher, entry to housing being so steep, there's a huge use case for younger gens to pick BTC over fiat for saving/investing value.

Trust in traditional govt and systems are eroding, faster and faster.

I'm confident Satoshi knew capping the supply to a hard 21m would cause a scarce or gold like mindset.

Those in corrupt countries with failed dollars or economies, its literally a safe haven.

I'm confident Satoshi knew capping the supply to a hard 21m would cause a scarce or gold like mindset.

Yes. For the 'store of value' property of money, Satoshi's monetary policy is far better than any central bank. The manipulation of gold as a SoV has been corrupted by the likes of JP Morgan with the permission of the ruling elite. That being said, central bank purchases of gold are rocketing. Not in Nu' Zillun.

https://www.economist.com/finance-and-economics/2022/12/01/why-central-…

The TRUTH about inflation & the battle for CONTROL – what the globalists WON’T tell you

Is the CRYPTO world ENDING? Are the central planners taking over, installing their digital CONTROL GRID? Professor Werner speaks about the road ahead. Find out how Professor Werner was able to predict significant inflation to happen about now as early as May 2020, well before war, sanctions and energy 'shocks'?

Cant see why the RB wants to waste time with a novelty asset class... The RB can create its own crypto and it would have more integrity. I could understand IRD , Police/Customs checking it out and being concerned...but the RB seriously? Too much time wasted on it already is my guess. If folk cant see the risk in current crypto no amount of legislation will save them. Let the taxman sort the cowboys out....sorry buddy we dont accept crypto as payment......lol

RBNZ could create CBDC on XRP ledger capable of completing currency conversions & settlements within 30sec.

On Demand Liquidity frees up funds with no need to prefund nostro vostro accounts in each country

Each solution is built on a private ledger that is based upon XRP Ledger technology—a proven blockchain that has transacted over 70 million times over the course of 10 years and is trusted by financial institutions around the world.

Step 1

Onboard

Standard APIs enable integration of the CBDC platform into existing systems.

Step 2

Mint

Banks can use the CBDC platform's cryptographic multi-sign controls to mint CBDCs.

Step 3

Distribute

Issuers can directly send CBDCs to authorized accounts, ensuring only valid participants can receive and hold the CBDCs.

Step 4

Transact

Transactions settle in 2-3 seconds across many use cases. Interoperability enables cross-asset and cross-border transactions when connected to another CBDC.

Step 5

Redeem

Participants can return funds on the CBDC platform to the issuer in exchange for fiat.

Step 6

Destroy

The CBDC platform supports the secure destruction of currency, giving the bank full control over supply.

Interoperability and overlay services

Connect to domestic payment systems, core ledgers, and other CBDCs to reach new levels of innovation through programmability support and smart contracts.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.