The Reserve Bank (RBNZ) says our house prices are still above "sustainable levels" and a continued decline in prices "remains desirable" for long term financial stability.

The RBNZ makes these comments in its latest six-monthly Financial Stability Report.

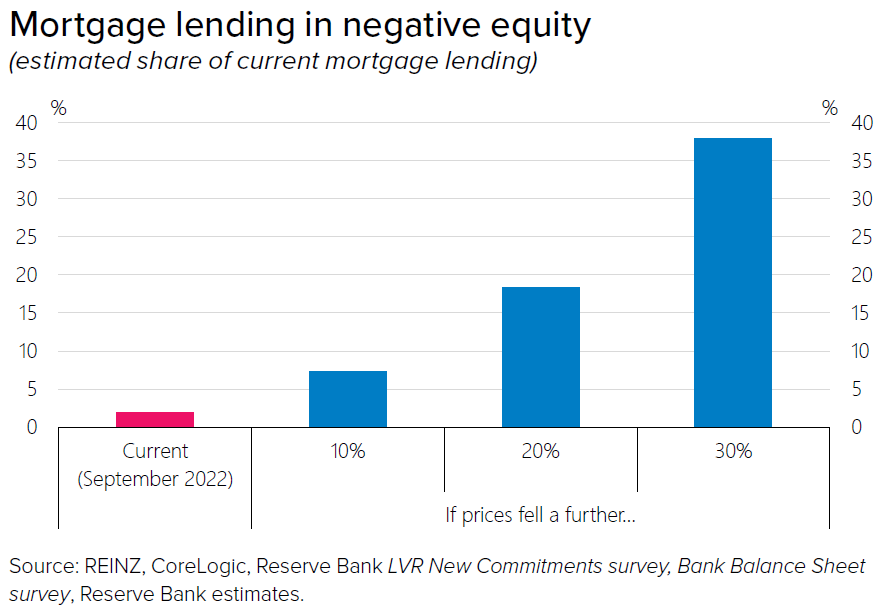

In the report the RBNZ says house prices in New Zealand continue to decline as mortgage rates rise. Nationally, prices are down 11% from their November 2021 peak, with larger falls in Wellington and Auckland. Negative equity and mortgage servicing arrears are not widespread at present, "but will grow if prices continue to fall and as mortgages reprice to higher interest rates".

"Significantly higher unemployment would lead to further stresses among households, and is the biggest risk to financial stability at present."

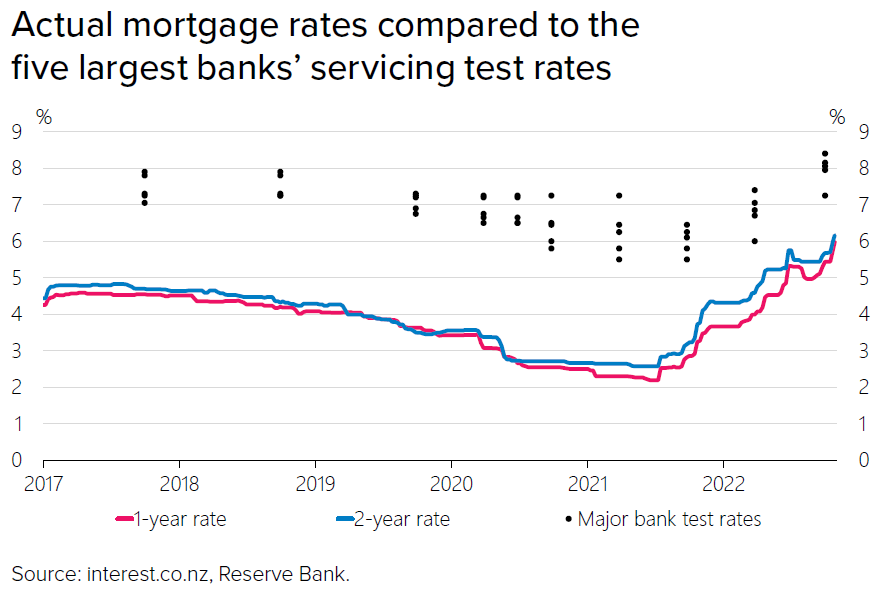

Many borrowers from late 2020 to early 2021 fixed their lending at low 1-2 year rates, and are only now gradually repricing onto the much higher interest rates prevailing in the market, the central bank says.

"The value of new mortgages from 2020 and 2021 is estimated at about 40% of the current mortgage stock, with 10 percentage points of this being first-home buyers. Around half of the stock of mortgages on fixed rates is expected to reprice in 2022, increasing serviceability pressure on these borrowers."

The RBNZ says given the recent fall in house prices, the gap between the current price level and its estimates of its sustainable level has narrowed.

"However, our assessment of the sustainable level of house prices has also declined, owing to market expectations for higher long-term interest rates and historically low levels of rental yields, both of which make residential properties relatively less attractive compared to six months ago.

"In spite of the fall in prices so far, rising interest rates have meant that the debt servicing burden for new buyers remains at an historically high level.

"Furthermore the removal of tax deductibility on interest expenses substantially worsens the cash flows generated by investment properties at high levels of gearing."

The central bank says that in the near term, it expects prices to continue to fall towards more sustainable levels as the effects of higher mortgage rates feed through to declining demand for housing.

"A sharp decline from the current price level remains plausible, as the low mortgage rates that drove the recent run-up in prices reverse."

Distressed sales, which have yet to be a large factor in the current downturn, could also reinforce further price declines alongside general negative sentiment.

The bank estimates that at average mortgage rates of 5%, the debt servicing ratios of the majority of the 2021 borrowers would remain below 40% of their after-tax incomes. Currently offered mortgage rates of around 6% are significantly higher than a year ago, but are not expected to lead to widespread stresses for these borrowers.

"However, if mortgage rates rise significantly higher than 6%, it is likely that an increasing number of borrowers from 2021 will need to reduce discretionary parts of their consumption in order to continue to service their mortgages. First-home buyers are the most vulnerable as interest rates increase, as they tend to have lower incomes and higher LVRs on average than other owner-occupiers and investors."

The RBNZ estimates that at an interest rate of 7% around 46% of 2021’s mortgage borrowers would need to spend at least half of their after-tax income on interest payments.

Looking ahead, rising debt servicing burdens and a slowing economy will create challenges for households, the bank says.

"In situations where households are struggling to make their repayments but are still earning their usual incomes, lenders are likely to be able to provide relief in the form of term extensions or temporary interest-only periods.

"However, there will be some borrowers who find their mortgage debts to be unsustainable, and will be forced to sell their properties. A significant deterioration in labour market conditions remains a possibility, and would lead to further household debt servicing arrears and increase borrower defaults. This could contribute to fire-sale dynamics and accelerate a decline in house prices. A general reduction in consumption by households in financial difficulty would have negative flow-on effects for businesses’ revenue."

The RBNZ says the repricing of households’ mortgages from historically low levels to current interest rates will slow the volume of consumer spending, combined with declining housing wealth as house prices retreat.

"Among households with mortgages, the average percentage of disposable income dedicated to debt servicing is expected to rise from a recent low of 9% to 20%, based on current mortgage rates. Repayment increases will be particularly significant for many households that first borrowed in the past two years.

"The number of households in financial difficulty will grow as more fixed-rate mortgages reprice, and could increase significantly if mortgage rates rise materially above the servicing assessment rates of around 6% that banks applied through the pandemic period.

"The labour market continues to perform strongly, but a significant deterioration in labour market conditions would lead to household debt servicing stress. In these situations, lenders are likely to be able to provide relief in the form of term extensions or temporary interest-only periods for households unable to fully absorb the repayment increases they may be facing."

The central bank notes that the outlook for residential development has deteriorated in recent months, due to declining prices for existing houses, ongoing construction cost inflation, negative net migration, and rising interest rates. The number of new houses being sold off the plans (pre-sales) has declined "considerably".

"Since a high level of pre-sales is a prerequisite for obtaining finance from lenders, developers are potentially facing a substantial slowdown in activity once currently committed development pipelines are completed. A slowing in residential construction would weigh on broader economic activity and employment. However, continued falls in land prices could help to restore the economic viability of future development projects, limiting the extent of the downturn in building activity."

Despite the recent declines in house prices and worsening in the economic outlook, there are still few indications of widespread financial difficulties in the household sector, the RBNZ says.

The share of loans in arrears and impaired lending for owner occupiers has continued to decline in recent months, while the shares for housing investors have been broadly stable at low levels since mid-2021.

"Among the cohort of mortgage borrowers in 2020 and 2021, data from Centrix, a large credit reporting agency, indicate a pick-up in arrears on other consumer lending products from mid-2022, but a relatively low level of stress overall compared to history and other borrower groups. The currently tight labour market conditions are supporting households’ incomes and debt servicing capacity. However, a sharp increase in the unemployment rate amid a material deterioration in economic conditions could lead to widespread defaults and significant losses for the banking system."

The RBNZ says despite the limited signs of stress so far, some households remain vulnerable to falling house prices.

"The borrowers most exposed to negative equity are those who took out loans during the second half of 2021, particularly those at high LVRs [loan to value ratios]. Those who took out loans with high LVRs during this period are particularly exposed, as much of the equity in their properties is likely to have been eroded. At present the share of outstanding lending to borrowers in negative equity remains small, at around 2%, but it could rise considerably if prices were to fall further."

The central bank said it had recently reviewed its LVR settings and assessed the current speed limits in place on high-LVR lending as "remaining appropriate" for the time being.

"An easing in the speed limits would be considered if they were judged to be creating excessively tight lending conditions at a point when we were confident that house prices were around or below sustainable levels."

The bank said it was also continuing to consider how limits on high debt-to-income (DTI) mortgage lending could operate, and are consulting on a regulatory framework with the aim of making final decisions in early 2023.

"We do not see an immediate need to introduce high DTI limits, given the current conditions in the housing market and recent tightening banks have made to their serviceability assessments. However, DTI limits will be an important tool for managing any future build-up of financial stability risks."

Looking at the residential construction sector, the RBNZ says the housing market downturn "creates acute downside risks" for it.

"Buyer enquiries for residential pre-sales have declined heavily as the perceived risks in purchasing off-the-plans properties grows, given declining prices for existing properties and ongoing construction cost inflation. Developers have found it very difficult to meet banks’ pre-sale conditions for finance, leading to a sharp decline in the volume of viable new projects."

Like other businesses, residential developers continue to face a shortage of suitably skilled labour and high inflation in the cost of materials, and with less confidence that any cost escalation can be offset by the final price as would be the case in a rising market. Recently, inflation in the cost of materials has started to ease from high levels, as supply chain bottlenecks have diminished. The number of construction and property development company failures has picked up but remains low relative to the approximately 70,000 registered companies in the sector.

Despite the acute challenges facing the sector, the RBNZ says it has not seen a material deterioration in banks’ asset quality so far, and developers have generally been able to obtain necessary finance to complete existing projects. However...

"A deterioration in loan performance could materialise as loans reprice and firms exhaust the list of viable projects. Residential development loans are inherently high risk, although banks’ exposure to the sector is small. A widespread failure and exit of firms in the construction sector would restrain future growth in housing supply, hindering the rebalancing of house prices with their sustainable levels.

"In turn, this could lead to a future build-up of overvaluation and financial stability risks in the housing market."

This is the statement the RBNZ released with the report:

The rising global interest rates necessary to curb inflation will test New Zealand’s financial resilience, Governor Adrian Orr says in releasing the November 2022 Financial Stability Report

“While our financial system as a whole is resilient, some households and businesses will be challenged by the rising interest rate environment,” Mr Orr says. “It is important that financial institutions take a long-term view when supporting customers and allocating credit to the wider economy,” Mr Orr says.

Global supply chain disruptions, ongoing food and energy supply shocks, scarce labour resources, and the lagged effects of fiscal and monetary policy have all contributed to high inflation.

Central banks have rapidly tightened monetary settings to ensure that inflation expectations remain anchored, but the extent to which economic activity will slow remains uncertain.

There are increasing downside risks to the global economic outlook. Despite New Zealand’s high levels of employment and a sound government fiscal position, we are not immune to these risks, Deputy Governor Christian Hawkesby says.

“Rising household debt servicing costs and declining household wealth will put pressure on domestic spending in the near term, but we are confident that the financial system is well placed to support the economy,” Mr Hawkesby says.

“Banks’ capital and liquidity positions are strong, and our recent stress tests have demonstrated banks’ resilience to severe economic scenarios.”

Financial institutions will need to continue investing in their systems, governance and risk management to build their long-term resilience.

In coordination with our regulatory partners, we are committed to working with the industry to support financial stability while ensuring our priorities are risk-based, evidence-led and outcome-focused.

91 Comments

They've been saying this for years, pre-Covid and post-Covid. It doesn't change what they did during the Covid crisis and the effect that it had.

If anything this hints at a return to trying to talk prices down rather than doing something about it, possibly even the close-out of this tightening cycle. Maybe 0.5% is back on the table after all.

50% real terms.

At this point anything between current drop and 70% is possible. 70% not particularly probable. ~35% nominal drop is gut feel from peak to trough. A couple of years of inflation taking care of the rest.

Disclaimer for the anti-DGM: it’s a guess. Calm down.

Yea this is always the problem when considering real prices, what's the inflation metric. I'm reading the Three Body Problem - and liken the scenario to that. What's the third factor in the equation which provides the clearest indicator of what the dollar is worth against the asset.

Wage inflation does make sense, though in these times it definitely feels like there is a lagging factor behind inflation. Inflation has a lagging factor behind monetary supply.

Using CPI is no exact science, and I know there are flaws, but it's a fairly good indicator as to what the dollar is "worth" against _something_.

An alternative could be to use TWI?

As an aside - it's definitely slightly amusing that we pumped the economy, devalued our wee dollar as much as we could, and used the spare change to buy houses that we already owned. Keeper Orr holding the ball. He turns to the goal and drops the ball to his loosely swinging foot. He slices it haphazardly, it bounces a couple of times across the pitch then we all watch as it slowly rolls across the line in the bottom right corner of our own goal. Some who have never seen an own goal think we've won, To The Pub we go!

Edit: Sorry, I didn't answer your question - I was referring to CPI. 50% real against CPI.

I just came to comment that exact same thing, Private sector wages up and up and up. Either way, massive hit to property. Though also as you say, an unfortunate hit to wage earners due to bracket creep. Gross wages keep up with inflation, but you'll be taking home a little less of the pie.

Depends on where you are in life Brock, my mother just moved into here new place and she will be 80 next year and paid cash so no point waiting "Years" for a massive correction is there ? Most people are still buying and just getting on with it, those in the "Wait and Watch" camp have been there 10 years already.

It's probably not a surprise that wealthy folk with cash, who received much from the policy-driven inflating of house prices after getting in cheap, have it easier. But that's just a wee tad different to a young couple jumping in at the peak then seeing their equity disappear and rates spiral up.

Do we need RBNZ to highlight........many are aware and have been saying and even today posted.

Mr Orr is someone who is wise after the event ......real pity that are called experts and paid for it.

by Carinaz | 2nd Nov 22, 7:26am

The fall so far is nothing compared to fast and steep rise.

Average price in Auckland is 1.37 Million indicating many on average are able to borrow 1.1 million and able to pay mortage of $1600 to $1700 comfortably without any distress. $110000 earning is required to pay out of family earning.

Still a long way to go before any meaningful dent in house price.

7% interest rates and low quality built houses sold for Millon + dollars. Anyone with an IQ lower than 100 would undoubtedly understand that it's not sustainable.

But not sure why people keep on being pumping up this baloon which obviously have limits on how much air it can handle.

We just have to see whether it will leak slowly or burst in one go. Thoughts welcome.

My 20-month-old recently learnt the hard way that if pulling hard on a rubber band gets a bigger onward swing, but the thing hurts harder on its eventual rebound.

Too bad the economic modelers at RBNZ haven't spent much time away from their spreadsheets to understand how the real-world functions.

Michael Reddell thinks it's around that, based on the fact it seems to settle to that level in most places where high house prices don't receive generous policy support (i.e. taxpayer subsidies, tax privileging, and restrictive zoning to constrain supply).

Maybe that's one more reason certain sets of folk in councils are pushing against liberalising of zoning to allow more building on existing land.

For the RBNZ 'sustainable' is to do with bank stability, which reminds me of htis gem from John Clarke

Scarce labour resource is likely to be an ongoing phenomenon.

Even large employers are struggling to recruit higher skilled workers from overseas for offers that would've otherwise attracted hundreds of applications before Covid.

Low to semi-skilled workers are easier to find but this lot arguably adds more to aggregate demand than supply in our infrastructure-crunched economy, adding to existing inflationary pressures. Also, many lower skilled workers engage in lower value sectors that are exposed to households cutting back on discretionary spending.

Interesting that the report points to buyers in late 2021, but ignores the huge surge in buyers (including investors) in late 2020, early 2021 who bought when the LVR restrictions were removed.

In some regions we are already getting back to late 2020 prices. Continued price falls run the risk of exposing a lot of highly leveraged buyers. The surge in investor lending around this time suggests a lot of highly leveraged buyers, who could soon be facing low levels of equity and sharply increase debt servicing costs.

The house price falls will continue until couples on average incomes can afford to buy a house with inflation and rates climbing this crash has only just started. As I have said many times over last 18 months this downturn is going to be a devastating for over leveraged and people who thought rates were going to stay at emergency levels for years which enabled them to take on huge amounts of debt.

Whose fault is all of this mess? The Government? The RBNZ? Yes to both. We, and they, all know that.

But what should they now do? Stand back and say" Oh, well. We got it wrong. Good luck all" and watch as the country is razed to the ground, or try to put what is a raging economic bushfire out?

The RBNZ has the biggest firetruck of them all, and emblazoned across the front of it are three digits and two words, "111 Monetary Policy". It has to use capacity that the truck has. And it now is.

The Government(s) has a future responsibility to ensure that the fuel for future bush-fires never again accumulates. That is called Fiscal Policy. And politics being politics, it is the hardest of the two to manage. Someone always wants the grass to grow in their front yard.

So expect the RBNZ firetruck to be in attendance well after the flame have been doused.

Let the speculative accept their risk/loss, and create a govt supported low interest rate subsidy for first home buyers effected during this period. Note only for those stay working and paying tax in NZ on a full time basis. Any overseas trip or use of first home for investment income then no subsidy. The number here will be quite small.

it is both and they have sucked a lot of innocent families in as well and should be ashamed. I have a staff member who brought late 2020, think house was around 800k which was average price here, two kids, both work...she asked for pay rise we ended up giving about 6% which was good. But suspect they have a combined income of around 135k, they going from 2.5% rate to now looking at 7% when it comes off next year. She is beside herself in the increase which will hit them, there mortgage is still excess 550K. She had no idea rates would ever go up this fast, and was probably told that by the bank, Mr Orr and Grant.

No sympathy from me, had a whole year to break and refix that mortgage. Problem is people cannot bring themselves to refinance at a slightly higher rate so they have waited and waited in the hope it will go down before theirs is due and instead it has doubled. Everyone who had their finger on the pulse and listed to Orr knew we were in for 50bps jumps all of this year. What really worries me is the "Orr speak" now indicates even larger rises next near after all house prices are suddenly "not sustainable".

That RBNZ firetruck I used as a metaphor above has had its siren wailing and lights flashing in the distance for well over 12 months now as it sped towards the current property disaster.

Now it's arrived at the scene and is doing its job, and yes, some are going to lose all they have, because they 'stayed put' - didn't refinance or, better, sell-up - when it was obvious the fire was uncontrollable on its own.

Many individuals are going to be swept up in this (the employee above, perhaps) but Life isn’t fair, it’s never been fair, and it’s not meant to be fair

Yip. The hard lesson how economies always work in cycles is about to be learned by yet another generation.

I just wish the reserve banks and governments hadnt tried to fight nature for so long ... now they have have delayed the inevitable and will have made the trough much deeper.

My money is on a 60-70% fall. Once they drop to a 45% fall and the economy worsens nobody will want to touch houses for a long time.. so the slide will continue until it makes sense to affordably buy property as a home

"Life has never been fair" meanwhile the same generation gets a bonanza for turning a certain age.

Boomer tropes like 'suck it up, life's hard' is how you paper over a huge swing in generational welfare and wealth in your favour.

If you repeat it enough you start to believe it. Or you just go senile and aren't capable of saying anything else.

GV - if you've read 'The 4th Turning', one of their theories was that the boomer generation would be viewed as hypocrites by the generations below them - and it's not their fault. They assume the reason they have had it so good was because of what they did, and how hard they worked, but not what society did for them, nor the benefit of being born during/just after winning WW2 and living in harmony with the new reserve currency (the USD) and the benefits that came with that. It is difficult for them to realise that what happened to them is an anomaly and not a norm.

'What do you mean it wasn't my hard work that mean the house I purhcased at 3x my income is now worth 20 times what I purchased it for?' 'I worked hard for the wealth I have'. Well yes you may have worked hard, but your parents, the GI's won the war and created the conditions that started a new long debt cycle that allowed you to maximise your wealth perfectly for the 75 years (or so) since Bretton Woods at the conclusion of WW2. All of those tailwinds may now be head winds for younger generations who face a period similar to the 1920's and 1930's.

This is correct in every way and is a constant topic of discussion with my parents (boomer) generation, especially those who act more self-entitled. It is extremely difficult for them to look past their life of comfort and wealth (more directed at those i speak to than the generation as a whole)

I guess it's explaining to them there's a big difference between hard work and outcomes. Sure, you need to work hard if you want to achieve a good outcome but hard work doesn't always determine your outcome.

What does make me laugh is when Boomer's post memes from the 50's and 60's, reminiscing on a time that they were only just born into. It's usually the old "we didn't have this nonsense over the top health and safety regulations".....but they introduced it when they became adults.

That maybe true, but also true of this generation as well, a with the invention of the internet a lot of jobs are far less physical. Life is a lot easier in many respects. I think the reason we are having it hard now is that we are not having children at even replacement rate so we don't have the population to support the old anymore, less builders etc. Not having as many children is the right thing to do, the earth is full and as long is we don't just start using poor countries as breading grounds the housing crisis will eventually fix itself, but it will hurt.

We are all hypocrites, I remember hearing about a psychology experiment where they got people to play a rigged game of monopoly (e.g. 1 person go more money and more roles) the people who won attributed it to their "skill". Yes boomers did have advantage, but so do younger generations, it would be naive to believe that other generations don't suffer from this kind of blindness.

Here is a link to an article on the experiment https://www.luhrenloup.com/monopoly-experiment in which it states:

What’s more, when asked afterward, not a single rich player acknowledged that he won because the coin toss was in his favor. It was because of this brilliant move or other that they succeeded. And don’t we all when good fortune comes our way, claim it as our due. It’s called capitalism.

Are we really so sure that we are not suffering from the same delusion, I'm not. I refuse to be angry a people for having the failings of a normal human, because I know that I probably have those same failings.

The same fire truck that threw gasoline on the property market... will drive away as the house burns to the ground and say its your own fault for having a house that isn't fireproof...

But what should they now do? Stand back and say" Oh, well. We got it wrong. Good luck all" and watch as the country is razed to the ground, or try to put what is a raging economic bushfire out?

There is no economic bushfire that is not one they created in the first place and now are fanning those flames in a different direction. First they fanned inflation flames now they fan deflation flames.

What they should do now is remove the ridiculous "sustainable" house price policy that is so vague its not even defined.

What they should do now is stabilise interest rates around current levels for a year or two to let the impact sink in rather than this crusade to deal a death blow to property values and drive up unemployment at any cost.

At the same time this government should do its job of supplying first home buyers with affordable homes like it successfully used to decades ago.

They cannot expect the private sector to do so because no-one will supply housing for a low income/profit or for free. The risks are too high, ask any developer if they would build a house for a 5% margin? or even 10%? No they wont because any cost blowout (like council inspired ones that are all too regular) will quickly evaporate a 10% margin.

The vain attempt to permanently achieve this 'dreamland of easily affordable "sustainably priced" housing' across all housing segments is naive and will prove a doomed experiment.

In the end, the whole conflagration came down to entitlement mentality and a silly belief in the "wealth effect". The false economy policies of relying on inflating house prices to feel rich, in reality just living it up and expecting following generations to pay the bill. What an absolute schmozzle this entitlement has caused.

Like the generation that made some very poor voting decisions around superannuation in the 70's, that today shrug their shoulders and claim it was the politicians that made these decisions and not them, and standoffishly refuse to have a conversation about winding back the old person's benefit based on means testing. "To hell with today's young taxpayers who have to shoulder this burden".

Rates follow nominal growth, which was boosted dramatically & artificially by massive money creation for consumption in 2020, on purpose, by policy makers, causing the present massive inflation. Rates follow, they aren't leading indicator. For latter, need to see credit creation. Link

"..Developers have found it very difficult to meet banks’ pre-sale conditions for finance, leading to a sharp decline in the volume of viable new projects."'

One more condition for finance will gain importance in comming years - Flood prone or prone to soil eroision in next 100 years .

https://www.newshub.co.nz/home/politics/2022/11/financial-stability-dar…

Mr Orr, Need result, go for shock treatment as the only way ...........follow LEAST REGRET.

Shocked 1% rise will do what not 0.5% rise x 4 has done (Also 1% rise is need and is not shock but can say shocked as will be comming from you).

"A sharp decline from the current price level remains plausible, as the low mortgage rates that drove the recent run-up in prices reverse.”

Sounds like RBNZ is admitting that printing money has driven up house prices to unsustainable levels.

Why are they still providing cheap finance to banks. Interest.co.nz reported today

“There was another $400 mln drawn by a bank in the Funding for Lending program (FLP) still on offer from the RBNZ.”

So Banks are able to borrow at 3.5% (OCR) from the Reserve Bank

Banks can then lend to the government by buying Government bonds (last tender 4.4% yield)

https://debtmanagement.treasury.govt.nz/tender/nominal-bond-tender-836

Great way to clip the ticket by 0.9%

No wonder banks are making so much profit.

Reserve Bank warns: 'It's not our job to protect you from the housing market'

https://www.stuff.co.nz/business/99408539/reserve-bank-warns-its-not-ou…

"Instead, the move was a reflection that the bank now believes that if prices do crash, the high street banks will be able to cope" I appreciate this article was published end of 2017 however, it does give insight as to concerns about house pricing and clarity around the role of the RBNZ. In the coming years, things could get pretty ugly on the street. The RBNZ have stress tested the banks for house price falls to -50% and rising unemployment, just to get inflation under control, a worse case scenario might well be the outcome.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.