Palm Oil Output at Risk as Virus Lockdown Worsens Labor Shortage

Palm Oil Output at Risk as Virus Lockdown Worsens Labor Shortage

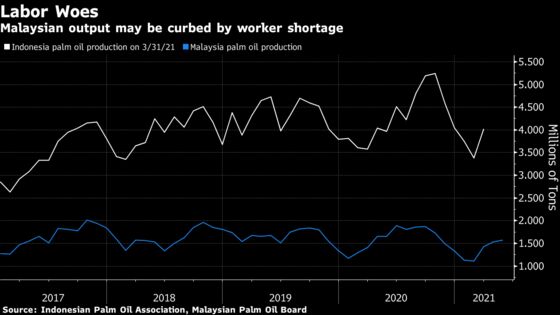

(Bloomberg) -- A resurgence of Covid-19 infections in No. 2 palm oil grower Malaysia is set to exacerbate a labor shortage and curb production of the world’s most-consumed cooking oil.

The Southeast Asian country, which announced it will extend the first phase of its national lockdown to the end of June, has shuttered non-essential industries and is expected to prolong a freeze on the recruitment of foreign workers as it battles with a third wave of the pandemic.

“The crux of the issue is the labor shortage. We have lost of about 20% to 30% of our potential production because of this,” according to Nageeb Wahab, chief executive at the Malaysian Palm Oil Association, a growers’ group that represents 40% of palm plantations by area. “That would have gone up more this year especially among smallholders,” he said in an interview.

That means Malaysian palm oil planters may now miss estimates for yields to rebound in the second half, which were made due to the annual seasonal high cycle that typically begins in July, and the initial assumption that restrictions on workers’ intake would have been eased. The Malaysian Palm Oil Board last week reported January-May production is about 6% smaller than a year ago.

Lower-than-expected supplies from Malaysia are supporting benchmark palm oil futures, which rebounded as much as 2.2% on Tuesday after tumbling to their weakest level in more than four months a day earlier. More than 70% of the plantation workforce are migrant workers and the country produces about 26% of the world’s palm oil.

“There is good chance that production disappoints as the government is not allowing foreign workers to come in,” and is unlikely to do so when Covid cases are high, according to Ivy Ng, head of research at CGS-CIMB. “It should be supportive to prices if supplies are not as strong as projected.”

Crop Losses

Despite nearing the peak cropping months, labor constraints will prevent a big jump in yields and keep Malaysian production below 19 million tons this year, Nageeb said, lower than the 19.14 million tons in 2020. The shortage of oil palm harvesters, which was around 40,000 before the pandemic hit, has probably doubled by now, he said.

“Everybody is short of workers today,” Nageeb said. “We’re seeing numbers from companies, the shortage keeps on increasing month by month.” While the government initially approved the sector to bring in 32,000 workers, “that has taken a backseat in view of the recent spike” in cases, he said.

Losses in revenue will also be “much, much higher”. Planters, who were already losing about 1 billion ringgit ($243 million) a month last year because of the shortage, may now be missing out on at least 1.2-1.5 billion ringgit per month as palm oil prices are higher on year and labor is even tighter.

In contrast, top grower Indonesia is set to churn out a record crop this year as favorable rains boost yields, according to PT Astra Agro Lestari, the country’s biggest-listed planter. Production may climb by 2 million tons to reach 53.6 million tons in 2021, with output of fresh fruit bunches rising gradually to a peak in the months of September through November.

©2021 Bloomberg L.P.