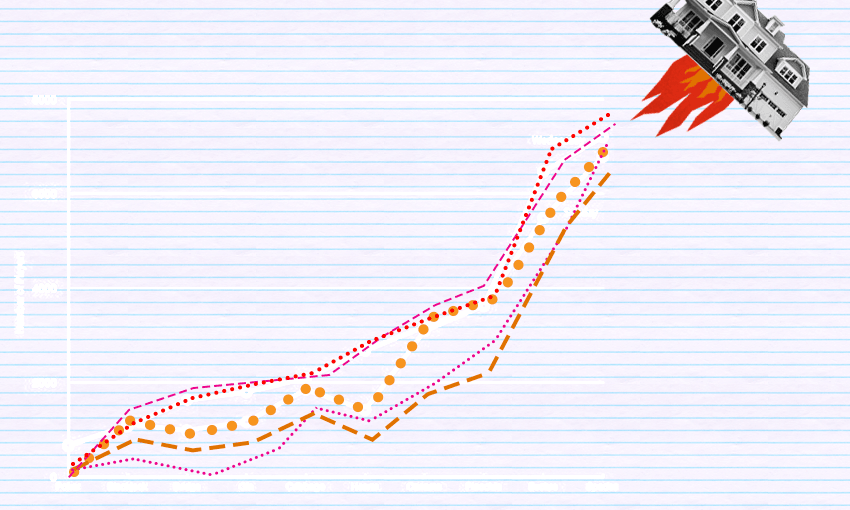

The housing market monster continues to grow, causing panic and rapture, depending on who you are. Michael Andrew highlights some of the most vexing stats.

It was supposed to be a quiet summer – the lazy, festive period that would typically see the masses forgoing open homes for the open road, and property investors taking a well-deserved break and heading away to one of the many holidays homes they already own. But no. It wasn’t to be. It turns out the lure of the “For Sale” sign is so irresistible, not even our beautiful beaches and campgrounds can compete.

And so the housing mania that plagues our national psyche continued unabated throughout the warm months; the real estate agents kept grinning, the investors kept collecting, the auctioneer’s gavel kept banging, and the housing market activity just kept on intensifying.

Perhaps that’s why the government this week focused its attention on what unconventional monetary policy and a chronic housing shortage has transformed into fully-fledged monster. While finance minister Grant Robertson pledged to curb the market, which he said had “moved quickly and rapidly in a way that is not sustainable”, he conceded there was no silver bullet.

“What we do know is that now is the time for bold action. We have to confront some tough decisions, and we will do that,” he declared.

How he will do that is uncertain. LVR restrictions are to come into place in March, the RMA is set to be scrapped, and the “bold” policies will be announced throughout the next few months.

In the meantime, though, the housing market sits there, malevolent and grotesque, like the mind flayer from stranger things, casting its parasitic spell over New Zealand. What it wants is a mystery. All we know for sure is that it continues to grow and spread in strange and terrifying ways. Here are five of them.

13.4%

The average price increase across NZ in 2020

It was the year of Covid-19, a year that saw a recession, and yet house prices marched onwards, upwards. The national average asking price for December leapt by 13.4% compared to the same month in 2019, bringing it to a galloping $767,050. It was also the first time the average asking price in every single region reached a new record.

Auckland’s average asking price was over $1m for the third consecutive month in December, while Gisborne saw the biggest spike – up 32% on the year before. Manawatū/Whanganui was up 22%, Southland up 15%, and Otago up 13%. And to think, less than a decade ago I was eyeing up a lovely villa in South Dunedin for $250,000.

23%

Increase in home transfers

The number of houses changing hands has also reached nauseating levels, with national home transfers in the second half of 2020 up 23% from the same period in 2019. Throughout the year there were 152,532 home transfers in total, up 5.1% on the year before.

In December alone, Auckland led the way in terms of homes bought and sold: 5,919 – a 53% spike compared with the same month in 2019.

Nationally, the December number of home transfers rose 40% to 19,224.

But the frenzy didn’t stop at Christmas; it continued right through January as well.

Peter Thompson, Managing Director of Barfoot & Thompson said his Auckland team sold 1086 houses in the month at an average price of $1,068,134.

“This January was the most active January we have experienced as an agency for 17 years. Even during the height of the last property cycle we never came close to selling this many homes in a January,” he said.

48

The number of years since so many houses were consented

One of the more pleasantly surprising numbers on the list, this shows that throughout the quarter to December, plenty of new homes were still being added to the meagre pool. In fact, the number was the highest quarterly figure since December 1973, when 10,713 new homes were consented.

The greatest increase came from new townhouses, flats, and units consented, which rose from 8,208 in the year ended December 2019 to 11,603 in the year ended December 2020. They now make up nearly a third of all new homes consented, said Stats NZ.

However, as impressive as the numbers are, construction statistics manager Michael Heslop says that compared to 1973, new houses in 2020 per head of population are still much lower.

29%

The drop in the number of homes for sale

This of course leads to the crux of the problem, the abysmal imbalance between housing supply and demand which has seemingly prevailed New Zealand for years. It reached new levels at the end of December, when there were 29.1% less homes available for sale compared to 2019, according to Real Estate NZ. This was despite a year-on-year 19.2% increase in new listings coming onto the market during December.

Real Estate NZ also said the housing stock of 16 of 19 regions fell to all-time lows since records began 13 years ago and the national stock level was also at a record low.

$600

Record highs for average weekly rent

Another grim number to finish on: the rancid cherry on top of the mouldy cake. It highlights the seriousness of the situation. In January, Wellington became the first region with median weekly rent over $600, reaching $615. Auckland wasn’t far behind, with median weekly rent reaching $595. Many of these recent increases occurred in a flurry after the government’s rent freeze term ended late last year, when landlords eagerly capitalised on the soaring value of their properties at the expense of many tenants struggling to make ends meet as it is.

What this shows is that the housing market madness doesn’t just affect home buyers. It affects everyone, whether you’re actively participating in the market or not. The frenzy and ridiculous inflation only exacerbates the growing gap between soaring rents and stagnating wages, creating a poorer quality of life for many New Zealanders and pushing them further to the fringes, and ultimately creating a more divided and unstable society.

So, the sooner we figure out how to slay the monster and cast off its spell, the better our country will be.