Within the next decade, climate change could make tens of thousands of New Zealand homes here uninsurable and unbankable – and therefore far less valuable. In this week’s episode of When the Facts Change, Bernard Hickey looks at who is exposed, and how they might get taxpayers to bail them out.

Follow When the Facts Change on Apple Podcasts, Spotify or your favourite podcast provider.

This week’s climate change summit in Glasgow has focused the world’s attention on how fast the planet is warming and whether the rise in global temperatures can be prevented from spiralling out of control. Here in property-mad Aotearoa, perhaps the easiest way to cut to the chase is to ask the question: how will it affect house prices and interest rates?

That’s the subject of this week’s When The Facts Change podcast. I dig into the Reserve Bank’s launch of a climate change strategy report to drive its operation of monetary and prudential policy, including my questions to governor Adrian Orr about:

- Whether the bank will “look through” climate change policy-related energy price inflation and avoid rate hikes that make it harder for the economy to invest in the necessary renewable energy

- If banks will be forced to charge higher interest rates to people buying McMansions with three-car garages

- Whether the Reserve Bank could print money to buy green bonds here and overseas to accelerate the investment in emissions-reduction infrastructure.

I then talk to Belinda Storey, an independent economist and climate change modeller who has looked in depth at how a warming climate will force homeowners to retreat from coastal inundation and flood plains. Storey, who co-founded climate risk consultancy Kanute, wrote a report on the withdrawal of insurance published early last year as part of the DeepSouth National Science Challenge.

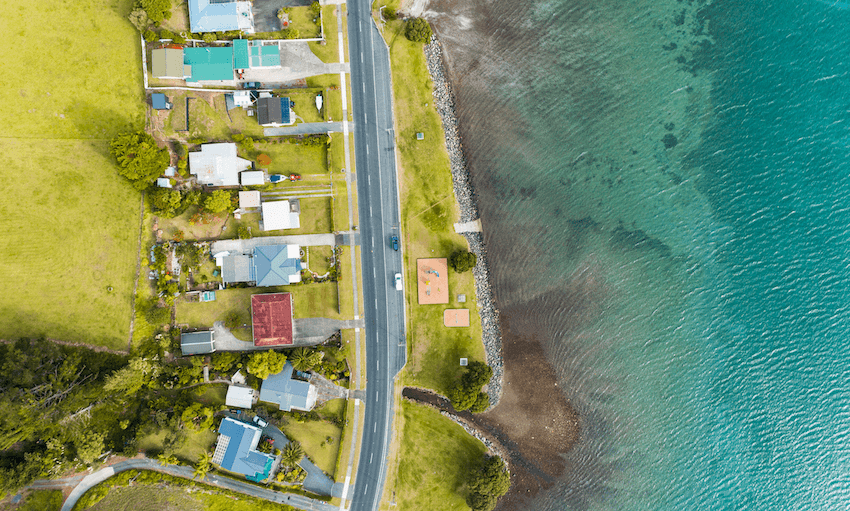

It turns out the currently forecast rise of almost 3°C under the existing global emissions reductions plans will have big impacts on our housing market. Within the next decade at least 10,000 homes in coastal areas will be forced into retreat due to erosion and floods, with the potential for this fate to befall as many as 100,000 homes. As average house prices approach $1m, that suggests $100b worth of property is at risk.

Storey says the moment of truth could come sooner than many expect, in part because our insurers and banks “roll” their loans and insurance contracts with homeowners every year or two, giving homeowners here much less planning leeway than many overseas. The highly leveraged nature of New Zealand’s housing market means that any denial of insurance inevitably makes the house unbankable (the banks won’t lend on it), dramatically reducing its potential value.

In When the Facts Change this week, I talk with Storey about:

- The risks that coastal and floodplain properties could lose their insurance cover completely, or see climate change risk notes put on their Land Information Memorandums.

- The risk that taxpayers and ratepayers at large could be forced to either compensate affected homeowners for their losses or pay to build expensive (and carbon-intensive) sea walls and flood banks to protect vulnerable property assets.

These are all topics that have been too hot for councils to touch, or for the government to contemplate, because of the sensitivities of the property market and the $1.6 trillion of wealth now captured in land and buildings on or near our coastlines and rivers.

These charts below from Storey’s report and from the Reserve Bank’s climate strategy tell the story of how tens of thousands of homes will have to retreat and or be reinsured, revalued and re-banked within the next decade or two.

They also expose the large risks to our insurers and banks, particularly for our six biggest (ASB, ANZ, BNZ, Westpac, IAG and Suncorp) which all face exposure to Australia’s high risk of particularly extreme climate catastrophes and stranded assets.

The first chart from Storey shows the timing of likely forced retreat by affected houses in the four main centres as sea levels rise 10-20cm, and one-in-100-year events become one-in-every-20-year events.

This table, also from Storey’s report, shows how many houses will be affected by a single one-in-100-year event (AEP stands for the annual exceedance probability of such an event, with 1% representing once every 100 years).

Finally, this Reserve Bank chart shows forecast carbon prices under two transition scenarios, suggesting a delayed transition could lump company-killing carbon costs on firms that don’t reduce their emissions, or on banks that finance them. (NGFS stands for Network of Central Banks and Supervisors for Greening the Financial System, the global body that undertook this modelling).