TLDR & TLDL: The Reserve Bank may have held the OCR last week on the first day of lockdown, but it seems increasingly determined to hike rates quite quickly through the rest of the year, regardless of whether we’re still in lockdown. The first one could be as early as the next non-MPS decision on October 6. It is also preparing for New Zealand to be ‘living with’ Covid-19.

Assistant Governor Christian Hawkesby was quoted in a Bloomberg interview published last night as saying the bank actively considered a 50 basis point hike in the Official Cash Rate to 0.75% last week and that the main reason the bank didn’t pull the trigger was it would not have been appropriate on day one of the lockdown.

He said a 50 bps hike was still on the table for the October 6 decision, which is an ‘in-between’ decision without a fresh set of quarterly economic projections and therefore often seen as less likely to be used to start a rate hiking or cutting cycle.

“We put out a document that would have easily supported putting up the official cash rate last week. It was less about Covid stopping us doing it and it was more about the timing of communicating our policy move -- was the 18th of August the right day as the country went into lockdown.”

“Our decisions around monetary policy aren’t going to be tightly linked to Covid and whether we’re in lockdown or not, or what level of mobility restrictions are in place, in part because one of the big lessons over the last 18 months is how Covid’s impacted both the demand and the supply side of the economy. It’s likely, going into the future, that we’re going to be in an environment where we need to live with Covid in its various forms.”

“A 50 basis point move was definitely on the table in terms of the options that we actively considered.” RBNZ Assistant Governor Christian Hawkesby.

Hawkesby said inflation expectations would be a key ingredient in the decision, given supply side effects on inflation had been more prolonged and persistent than expected. “That’s the environment where you get inflation pressures coming through,” he said.

That’s some hawkish talk right there. So the NZ$ rose almost a cent to 69.4 USc.

Meanwhile, home buyer heat will build for another six weeks

The rate hikes can’t come soon enough for those wanting to use monetary policy to slow down a much more robust than expected housing market.

Independent economist Tony Alexander reiterated just how much demand there is for housing, even during lockdown, while interest rates are low.

“It is quite possible the current lockdown will actually add extra heat to the housing market for a while because low interest rates are around for perhaps six weeks longer than we were all expecting.” Tony Alexander in his OneRoof column this week.

Reinforcing the rate heat, ANZ announced yesterday it was reversing its mortgage rate hikes carried out last Tuesday in anticipation the Reserve Bank would hike on Wednesday. The announcement was made shortly before the news came out about the discovery of the Devonport delta case.

$5.9b of tax-free capital gain in three months

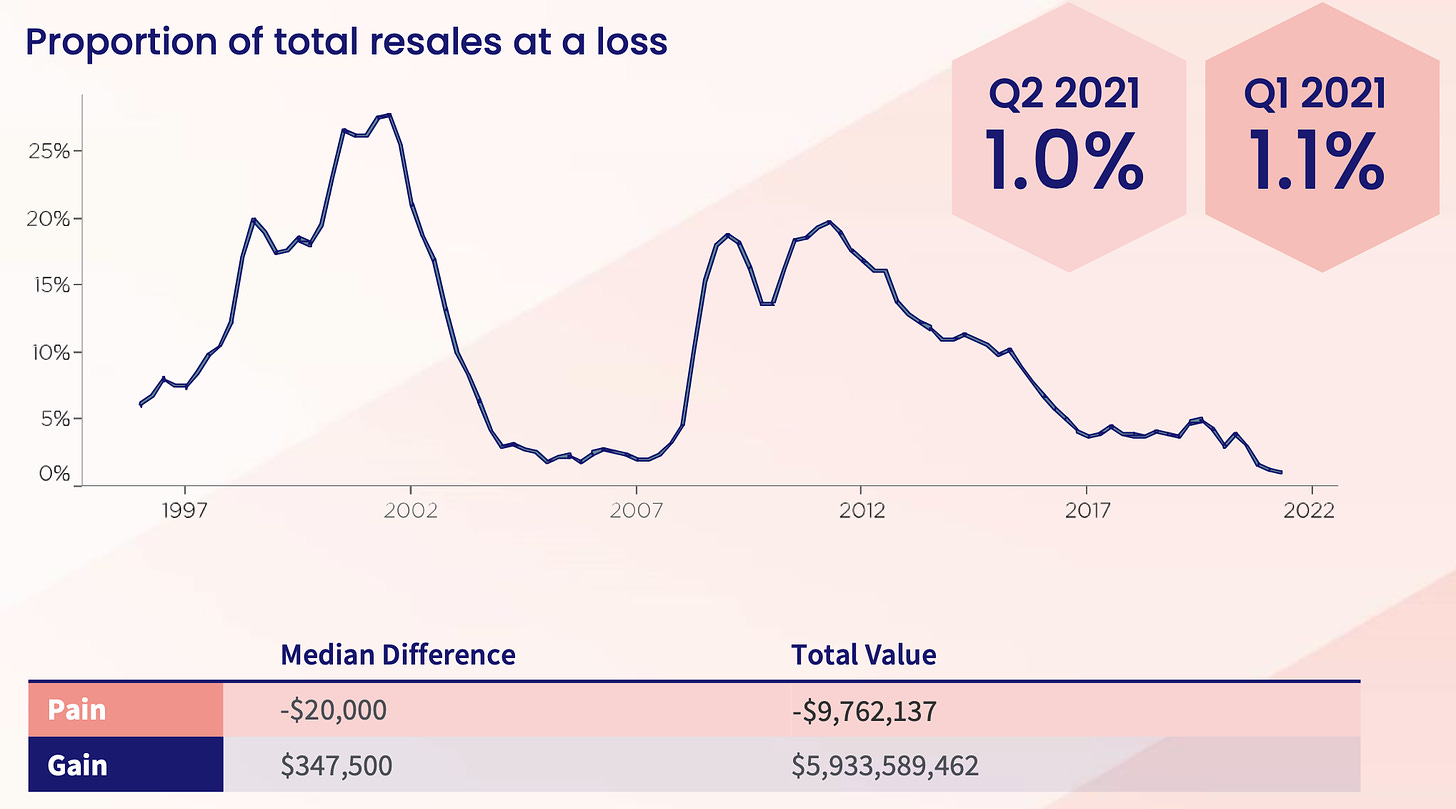

CoreLogic released its ‘Pain and Gain’ report this morning showing that the median profit on property sales was $347,500 in the June quarter, while the total market gain was $5.92b. Just 1.0% of sellers reported a loss, with the median loss being $20,000 per property or a total of $9.8m for the quarter.

Scoops and news breaking this morning

Signs o’ the times news

Useful longer reads

A fun thing

Ka kite ano

Bernard

Dawn Chorus: RBNZ set on rate hikes