Let’s be very clear about what it was that Labour suddenly ‘u-turned’ on.

Bank profits.

This wasn’t a tax on KiwiSaver, it was a means to force the greedy banks to pay GST on their service fees.

This would have eaten into Bank profits.

Immediately, and I mean fucking immediately, the Banks scream, frame it as a secret tax that will be totally born by their customers, trigger National and ACT and off we are to the races with wild allegations that your KiwiSaver is about to get fucked by greedy incompetent Labour.

In the face of such blistering fear mongering, Labour u-turn.

Now, was it clumsy? Was it ill thought out? Did no one consider that the Banks would scream the moment they saw their obscene profits challenged?

Of course, but the execution is far less interesting than what Labour actually revealed about who really runs NZ.

The moment Bank profits are threatened, it’s the near ending of Western Civilisation that demands an immediate u-turn, when it’s the Children’s Commissioner being removed from Oranga Tamariki oversight to protect the Public service from accountability however, get fucked.

When it comes to u-turning on a Capital Gains Tax so that inequality can be rectified, get lost because that hurts the property speculative middle classes.

So let me get this straight.

Lifting Capital gains tax that will hurt the property speculating middle classes – no u-Turn.

Removing oversight of state abuse so the State isn’t held accountable – no u-Turn.

Adding GST to bank fees that will eat into bank profits – IMMEDIATE U-TURN END OF WESTERN CIVILISATION PENDING!

It’s remarkable that we are such an easily played culture and how the rich can trick us into believing their interests are our interests.

We are a juvenile people with all the intellectual depth of a day old can of coke.

The banks in NZ are so clever and devious that they can turn paying gst which eats into their profit margins as a tax on your KiwiSaver and we are all dumb enough to believe them – that’s real power, when you can masquerade your profit margin as everyone’s interest.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

As an accountant it’s always been a weird anomaly that most financial services are gst exempt. I saw the attempt at the legislation as a logical step. It wouldn’t just have affected kiwis average and other bank fees that consumers see, but also other financial advisor fees, commissions, life insurances etc. These financial service providers have been creaming it since 1985. Oh well, status quo then for accountants as a revenue stream that’s here to stay for my industry at least

Sinic how does it work? If the bank/financial service provider is registered for GST would it not be charging end users and collecting the GST on behalf of the government? I don’t see how it’s a revenue stream for banks if they are currently not charging GST?

It’s a revenue stream for accountants because it complicates tax compliance so accountants are used to figure it out by those that are financial advisers. Most financial services are exempt from gst, so they are never charged to end consumers therefore never collected on behalf of government. Financial service providers still get to charge “market” rates, but there is no gst content so they are not taxed for gst, and no benefit to the gst tax take. This is of course separate from income tax. They still pay tax on their profits.

Right, thanks. Does that also mean the financial service providers cannot claim any GST inputs? In other words they are like an end user and have to wear the GST they pay on things like advertising or whatever?

Wheel, yes they can claim gst on their expenses. Not all financial services revenue) are gst exempt, but most are. Some providers have to pro-rata the amount of expenses they can claim gst on as a result. It can get a bit complicated for many, hence the resulting accountants fees to ensure correct tax compliance in case of a random ird review or audit. Put very simply, they don’t return gst (generally) but do claim it, so net gst refunds.

Many moons ago when I first started in the financial services industry we would claim GST on all our expenses even though none of our income attracted GST. A deal was eventually done with the IRD whereby GST was added on to some of our services, I think around 20% of total income. The corollary of this was that we could only claim GST on 20% of our expenses. One upside of the deal was that the IRD agreed to not look back retrospectively which could have been expensive.

To think that ACT supported the policy was enough to realise it was wrong. The taxing of gst on providers that would have been passed on to customers is exactly the type of policy ACT loves, user pays.

It was a Labour Government initiative?

Supported by ACT, trying to alter the narrative Bob does not change it.

David Seymour could see that it was an anomaly in the tax system, which needed to be rectified. He was just more honest about it than National.

Seymour can smell a flat tax a mile off. A broad based tax that will hurt those on low incomes most. And labour needed National to protect NZ strugglers. Way to go Parker.

You would think, right.

Impact on the average KiwiSaver account of retirees estimated at around $25,000 less at retirement.

And the anomaly of differential between interest paid on deposits and interest charged on loans still in place.

Do you call the GST exemption on domestic rentals an anomaly also?

The banks would have rolled over that GST to the saver. As it happens with any cost that can be oncharged to customers.

Yes. Banks follow the law. But Martin is right that if less is invested in KiwiSaver that the banks would have been crippled….. yeah, right.

The good thing now is that Jacinda from Announcement can do an announcement where she explains that GST will not be oncharged to the customer in the end. To the giggles of all.

You would think that Labour wants to lose the next election. Another case of consulting with none existing people just like not putting nurses on the easy emigration path and doing away with the children’s commissioner

You could well be right Trevor however Willis saying voters can trust National with Kiwisaver is akin to saying you can trust cannibals to babysit your two children for a week.

Labour got this wrong and correctly pulled the pin. To the naysayers, they did not arrogantly forge ahead after listening to advice. The following was the opposite by Nact…

Halved the yearly government contribution, axed the $1000 startup and froze Kiwisaver contributions to the tune of $23 billion dollars.

So why hasn’t your great Labour party reinstated those Kiwisaver policies back to their original settings Bert?

They have had five years? Stop being a sycophant and open your eyes lol.

Stupid Mickey sycophant Boyle, the same reason your beloved great hard right wing parties never repeal any of Labours policies once in government.

Have no idea why someone with such little intellect as yourself comments here, lol.

Rubbish Bert. They would be publicly crucified if they did that. Every government is different whether it be red or blue. Stop harping on about stuff that happened a decade ago. Even you might have changed in that time. Even more bitter.

What do you mean New View? National did do that. Bert’s not wrong. Just like Luxon would not even agree that he would give nurses a pay rise. It’s a fair enough to call Labour out but don’t try white wash the fact that things can get even worse for the groups that National supposedly care about (yes much like Labour said things in opposition).

This morning Willis said National won’t touch KiwiSaver. They won’t or they’ll get crucified like I said. I’m not defending National on what they’ve done in the past. Some people won’t let go of what the last National government did. If you’re going to do that, go back to the shit stuff labour has done in the past. Lange’s government and Douglas could be a good place to start, or doesn’t that count.

Willis can say what she likes New View, she’s in opposition, good luck to you if you believe her.

It doesn’t matter whether I believe her not Bert. If National got elected and changed KiwiSaver they would be hung out to dry by the electorate. Even National can work that out. The thing is it wasn’t National trying to change the KiwiSaver rules this time, it was Labour so that’s what’s happening in the

“Now”world. They reversed their decision not because they realised they were wrong but because most of NZ were telling them they’re wrong. It’s a race to see who can be the most stupid before the election by all parties.

So most were telling them they were wrong and they listened but spare me whether you believe Willis or not because you used her to support your narrative.

As for Kiwisaver , plenty including Seymour see the anomally, the opposition and media attacked Labour, not the anomally.

So my question to you is what to do about the tax free income generated by fees to the provider, nothing?

The anomaly has been there since KiwiSaver’s inception I guess. No one was thinking about it until labour was looking for money. Even if they had planned to change it a while ago why do it now when the population is pretty sensitive about money and their future with less of it. Robertson saying those fees may not be passed on is complete nonsense. I would be happy for gst to be taken off all financial services but the government wouldn’t be happy. The left would be half happy. Happy they don’t pay gst on fees but unhappy the wealthy don’t pay gst on fee’s either. Instead of dicking around with KiwiSaver both parties would be better taking GST off food. But they won’t because they want the money too much.

Good honest and intellectual reply New View.

Very honest person Nicola Willis something we need in Government.

Honesty has been absent for over 5 years now.

Was she your Kindy teacher.

Nonsense new view or should I say old stale pale male view. You offered nothing in your bitter defense of National. What this shows is the contrast between what National have done and what Labour have done. Being bitterly sour because it doesn’t fit your political bias doesn’t make an argument, as all your posts over time have demonstrated. As I clearly pointed out Labour got this wrong.

Can you please Bert concern yourself more with the present instead of showing your blind allegiance to a failed Labour Government.

They’ve had over 5 years to do something.

Bob know one listens to you, you need to stop. Labour have pulled it, you’re a little late, you’ve had 24 hours dumb Bob.

Now come on Bert you know lots of people follow me I have a large fan base on this blog.

They didn’t get it wrong; there was a tax system anomaly that needed to be addressed. It may have been politically inadvisable to push something like that through at this time, but having done so they should probably not have backed down. Backing down just made matters worse; it made it look as though they had been caught out doing something naughty.

Agree Mikesh

And they fixed the anomaly…… It is good to fix problems.

Well said Bert!

It was a dumb idea because the banks etc would have been unaffected by this. As always they would have passed on the cost to the account holders, with interest. Which would have hurt savers and the principal of Kiwisaver.

This had all the thought process of that idiotic cost of living allowance that is not only being paid to the dead and expats but foreign housing speculators as well.

Honest to god, Labour don’t think at times. But at least they acknowledged their mistake this thing around.

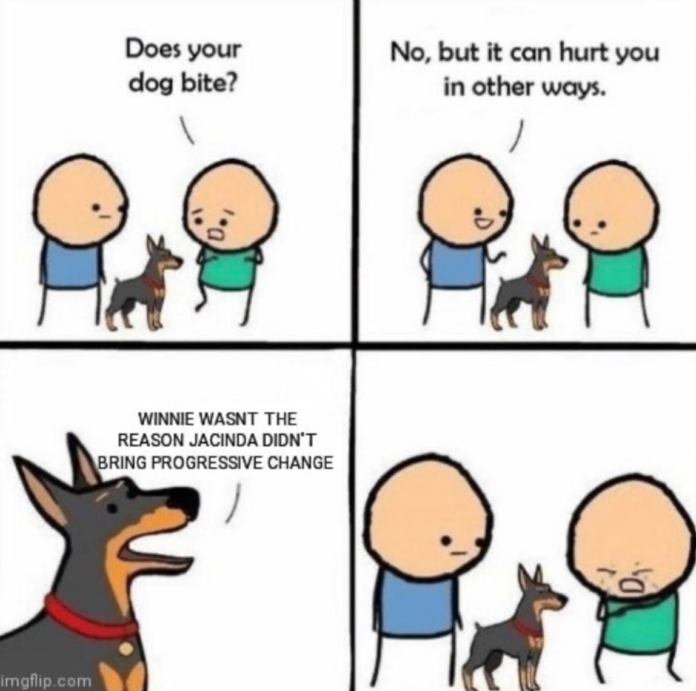

The best thing about this article is frame 3 of the cartoon.

The Banksters win again.

Let’s talk about tax

Left, Right and Centre.

Yesterday morning I penned a essay on the Labour Government’s tax on Kiwi saver banking fees. By lunchtime, before my essay was even published, the tax on Kiwi Saver bank fee transactions was repealed.

https://thedailyblog.co.nz/2022/09/01/guest-blog-pat-odea-hooray-an-ftt/

Greg Presland an author of the Centre Left blogsite, ‘The Standard’ was moved to say “that was quick”.

And he’s right, literally (not figuratively) this tax was gone by lunchtime. To my knowledge never has a piece of tax legislation been on the books for such an incredibly short period time.

So what was so controversial about this tax?

The Centre: The centre say the new tax was, “a rational change”. Greg Presland writes, Under the GST regime the provision of financial services is exempt. Signaling that this new tax on financial services is something new.

The Right; The right have called it a wealth tax, and used the curious fact that this wealth tax only targets superannuation financial services as a cudgel against the government.

The Left: The left have identified the new tax as a Financial Transactions Tax.. And asked why the government targeted superannuation and not other financial transactions which would have raised way more tax revenue for the government and impacted working people less?

The Right and the Centre (figuratively) ran screaming from the room

In a panicky response, the government rushed to revoke the new tax.

.

What a load of nonsense.

Pat is intelligent and articulate, your posts are anything but Bob, honest to God grow a brain.

More nonsense.

More Bob bullshit.

This argument does seem to point to a problem with other “financial” services, e.g. brokerage, bank fees, etc. Why have these been exempted?

Good question Mikesh. But we don’t get to have that conversation now. I honestly don’t know of any logical answer why these were ever exempt gst. It would be good to know though for the “logic” on why food cannot now also be exempt gst also. The old adage was “oh it’s too complicated, just look at Australia”. Is it really though? Nope

Ask Parker. He tried to remove the exemption.

The exemption favours retirement investments. Retirement investments are a public good. Simple as that.

No, it’s really not that simple Johan. But do please explain your opinion…

Ok fair enough you dump down again on the so called thick un-thinking, working class Nuw Zilinders for calling out the government on trying to impose gst on KiwiSaver funds management fees, and you are right that it was targeted at the banks and other financial providers that do make obscene profits. But after all the hoopla in which KiwiSaver was set up in 2006-2007, and was sold to all as the egalitarian superannuation scheme for all New Zealanders, and with the gradual eroding over the years of other services such as health and education, Don’t you think that the dumb Nuw Zilinders have a right to get a bit grumpy when the government mentions it wants to dick around with our savings and contributions.

The MSM at their old tricks of making the news instead of reporting it, as you say the bank and top public service control the media & what ideas are allowed to be popular.

So why didn’t Labour consider removing the need for GST on all fees? And, why don,t they go back to the original Cullen scheme of 4% tax free employer contribution. Why…….because they are clueless, useless, and almost as neo-liberal as the Nats.

We have no choice but to use money, so why should we be charged anything to manage it – let alone with GST on top, and for a service we can’t legally quit?

Just narcissistic aggrandisement. Even if you think that way about wealth that bankers deserve more cake that people deserve it because they have higher energy or more masculine or whatever is just setting everything up for failure.

I would suggest it is also because of a lack of people sending emails and making phone calls to their MP’s office and to the cabinet ministers responsible telling them ‘get rekt c**ts, I’ve always voted Labour but I’ll be voting for the Maori party next election over capital gains/sacrificing children to the glory of the public service’.

Anyone reading this can and should do that re. Capital gains and OT oversight.

It was widely reported from many respected players that this tax would have cost the average kiwi over $20000 in the next 25years.

It was a idiotic decision from a government woefully out of their depth.

From interest,co,nz

Adding GST to Kiwisaver fees feels like a pretty minimal impact on your savings. Say you’re with Simplicity the fee increase would be from 0.31% to 0.36%. With $500k invested, annual fees are $1550/year, GST on that would be $232/year.

$5800 over 25 years. Higher interest rates would be more significant. 5% would be $25,000 for comparison.

Yes, but that $232 lost each year would not be available to earn a return – so you just can’t say it’s $5800 flat over 25 years. It’s actually $5800 plus whatever gains that may have ensued over 25 years……

Stocks suffer from the same problem. How many shares are actually outstanding? If a third party is holding my investment, do they actually own enough shares to cover all their clients positions?

Said another way does tax revenue = need.

Saddled with high with high debt while lowering government revenue will slow the economy. Coupled with inflation and rising asset prices due to energy price shocks will Detroit productivity AKA STAGFLATION!!!

I think a better calculation to think about is…If it was going to cost the average person $20000 over 25 years in gst that means that the providers are going to make approx $120000 per customer over that period. so around $5000 a year per person or about $100 per week….. Seems a lot considering most people wouldn’t contribute anywhere near that amount weekly…. just sayin…. (and yes i know the calculations are not perfect but good enough to illustrate my point that the figures being sold are bulshit)

If GST at 15% = $20,000, then the fees charged by the funds managers must have been $133,333..

Correct calc Mikesh. $133,333 plus gst

Idiots make idiotic decisions.

Finally Bob, you’re talking from experience.

Lol!

Yes correct Bert over 5 years observing the Labour Government.

We know you’ve been an idiot for over 5 years.

If idiot was a synonym with success then yes.

If being an idiot is coloring in with your crayons, then yes.

Someone should ask Roger Douglas about this.

He’d know for sure!?

Yes certainly he would.

@ MB, you write:

” We are a juvenile people with all the intellectual depth of a day old can of coke.”

Well I’m not one of those, thank you very much. And can I also point out that you bank with ASB while I bank with The Co-Op Bank.

And AO/NZ’ers aren’t so much dumb as ill informed. It’s dangerous to confuse ignorance with stupidity. Ignorant people can become enlightened and educated. I’d argue, in fact, that throughout one’s life we continue to learn therefore ‘ignorance’ is usually a brief state of being. Stupidity, however, is something entirely different. Stupid-stupid poor people are to be understood as being enduringly stupid thus poor therefore should be regarded as such but ‘treated’ with kindness and caution. Where do you think war mongers and revolutionaries get their cannon fodder from?

Stupid-stupid rich people, however’ should be chipped. We should always know where they are, and what they’re up to. It’s the stupid-stupid rich who’ve set our only planet on fire for a dollar and you can’t get more stupidier than that. I can only dream of a can of day old coke called Joe Biden. That wee can-do can O’ coke would be a proper advance in the intellectual prowess of U$A’s political leaders. ( I write ‘leader’ because someone has to be the first Lemming over the cliff. ) The other thing stupid-stupid rich people do is exploit, then profit from the stupid-stupid poor who are soon to be seen running about in small circles wailing and screaming while on fire, if, that is, they haven’t already died of thirst, hunger, war, crime and/or disease (but certainly not of laughing) first.

Any thing you care to name is only as strong as its weakest part. Humanities weakest part is the stupidest of the stupid-stupid rich. That’s why banks have to be taxed into oblivion. The commercial trading banks and their human intestinal parasites are singularly responsible for the imminent death of our Earth and all life on Her.

Seen this yet?

Netflix.

Our Planet.

David Attenborough.

https://www.netflix.com/search?q=life%20on%20earth&jbv=80049832

The stupid-stupid rich fucked it and conned ignorant us into enabling that fucking.

But hey! Bezos has a cock shaped rocket! Sweet!

David Attenborough for over 40 years flew a large crew all over the world.

His carbon footprint would be up there with highest.

He now preaches conservation.

What a hypocrite.

Bobblehead Bob

We now see how fast this government can move on policy when they want to, no excuses in future. So for a start Jacinda, drop this ridiculous covid emergency status, like today. Not even you believe in this rubbish anymore.

It was never about the “covid emergency status” it was always about New Zealanders inability to work together.

Homes nz is such a croc. The estimate for this house is $750k but it sold a week ago for $465k. Why is the estimate not $465k? https://homes.co.nz/address/masterton/masterton/91-upper-plain-road/8aG4j

My issue was this:

Labour knows that the middle to upper classes nearly all stay out of Kiwisaver. If I had a dime for every small business owner, family truster etc who has said “I can make more money myself’ then I’d be a lot richer than I am.

Labour knew that it was the working poor of NZ who would bear the brunt but the wealthier middle would gain. See Bernard Hickey’s analysis from yesterday. What it said to me was that they see their core voters as middle class elites who have the money to bypass the system. They also knew that the banks certainly would pass all the extras on to consumers, the average of whom only have $37K in Kiwisaver. (And to them thats a lot)

Just another thing they thought they would impose by relative stealth and no one would be any the wiser.

Most Authoritarian NZ Govt of the last 50 years?

Remember getting bent out of shape about Key’s outrageous privatisation of the power industry and how none of us could believe he could do it? Compare this with everything Jacinda is up to and the media control, Comms led Govt, hiding info, not consulting, propaganda proliferation and seriously, Key begins to look like a good deal.

Rubbish Fantail. The privatisation of the power companies was disastrous for New Zealand. Don’t forget Key raised GST after promising the opposite. That’s dictatorship.

An absolute dictator, seems crayon Bob loves dictatorship.

Key was a Saint compared to the current sly secret agenda Ardern Government.

Idiot Bob at it again. Pull the other ponytail will ya.

Have a look at the NZ Herald by Mathew Hooten, main headline and give yourself a serious effing uppercut fantail, if that’s Jacinda controlling the media, well, fuck Bob’s a genius.

You are brainwashed Fantail.

I think Hooten is without question the best political journalist in New Zealand.

And without doubt Bob the most brainless on this site. Hooten was so good he was the backer behind Todd Muller. Yep Hooten’s a fucking genius. Bwahahahahahahaha!

Bobblehead Bob’s been bobbing for nob

” Stop harping on about stuff that happened a decade ago ”

But it happened and has an ongoing effect on encouraging kiwi’s to save for retirement because after all National want the retirement age pushed out and now you can no longer rely on your paid off house as an asset which assisted so many retirees to have some quality of life on the pension with a paid off home to secure them in financially in retirement.

Well they mostly ignored the very expensive Working Tax Group’s recommendations that could of created a lot more fair tax collection but I don’t believe they were ever going to implement any of it and it was a ruse to help them around uncomfortable tax questions in the media to say we will let the TWG come back first so no further comment on tax and possible increases please.

Julie Anne Genter hit the nail on the head with her comments.

Green Party finance spokesperson Julie Anne Genter called for the government to now turn its attention to reversing the cuts to KiwiSaver brought in by the previous National government.

“Christopher Luxon has shown staggering hypocrisy over the last 24 hours. It was his party that systematically made it harder for people to save for their retirement,” she said in a statement.

“It was National that introduced a new tax on employer contributions to KiwiSaver in 2011 … it was National that halved the annual maximum Government contribution to KiwiSaver accounts from $1042 to $521 … it was National that removed the $1000 kick-start people were provided when they opened a KiwiSaver account.”

Julie Anne Genter said this and she is 100 % correct !

Green Party finance spokesperson Julie Anne Genter called for the government to now turn its attention to reversing the cuts to KiwiSaver brought in by the previous National government.

“Christopher Luxon has shown staggering hypocrisy over the last 24 hours. It was his party that systematically made it harder for people to save for their retirement,” she said in a statement.

“It was National that introduced a new tax on employer contributions to KiwiSaver in 2011 … it was National that halved the annual maximum Government contribution to KiwiSaver accounts from $1042 to $521 … it was National that removed the $1000 kick-start people were provided when they opened a KiwiSaver account.”

She said the government should incentivise New Zealanders to save through KiwiSaver by reversing those cuts.

National has never been about hard working New Zealanders like their pamphlet’s claim otherwise they would never amputate the financial support of Kiwis retirement rights.

They are called the Nasty Natz for a reason !!!!!!

National are morally corrupt to the core, completely control the media( Campbell live axed as an )example. Joyce influenced Mediaworks and the NZ Herald a right wing rag for all to see.

You are 100% correct Mosa as is Genter.

The long term goal of KiwiSaver is to undermine NZ Super. The guts of it was copied and pasted from Winston’s cumpolsory super scheme that was proposed in 1997.

Bollocks MB.

This had sweet FA to do with banks.

They tried to sneak another new tax through, buried in another policy dump. Again their arrogance, and complete lack of transparency is staggering.

It was dumped quite simply because Jacinda didn’t have the stomach for another week of being beaten up.

Apparently it was 5 years in the making??? Yet dumped in 24 hours (if you believe them?)

So what had they been doing for five years then?

This is further evidence that this govt is purely a poll driven populist govt that are literally making it up as they go along.

There is no vision, apart from, ‘how do we stay popular for the next week?’

Yes agree it was dumped because of bad polling nothing else.

Nevertheless they tried to dress it up differently.

I dont see why people have such an issue with tax in this country. Do they not realise that without tax, we wouldnt have schools, hospitals and so on. THe more tax there is, the better our social services are. Plaim and simple.

Yes millsy and to enhance that we need a healthy buoyant economy something the current Government are incapable of.

Why not do what John Key did and slap another 2.5% on GST.

You are not allowed to talk about the past corrupt National government, the plebs will get offended.

Labour trying to deflect the blame shameless.

At least Parker has admitted they knew when to “ fold up”

Good slogan in the making there.

“Fold em” idiot Bob. It is you who’s is shameless.

Study the song Bert.

Go away and do your own study, you lazy twat, you’ll continue to be wrong.

Martin you’re wrong. GST would be passed onto the government and added on top of the cost of services. The amount of money going to the banks would have stayed the same or gone up slightly because they may have been able to claim more GST inputs to offset tax. The amount of money going to the government would have gone up. The amount of money going to Kiwi savers (i.e. normalish, non wealthy people) would have reduced.

If you want to make banks fairer then stop them stealing people’s wealth by creating money out of nothing and devaluing everyone else’s money. Oh and have a nationalised bank (Kiwi bank?) that uses the government’s incredible borrowing power to get normal people, low interest, lifetime fixed, mortgages on their houses.

This policy was really just a sneaky tax grab. Tax is fine as long as it’s spent on good things like teachers, nurses, doctors, education, infrastructure. Labour and National would just have wasted it on more corporate welfare. It also helps if the tax is penalising unwanted behaviour like polluting cars rather than wanted behaviour like saving for retirement.

So some of the kiwi saver service provider aren’t paying GST for their service, does that meant we can get rid of some GST on food essentials if there is a loop hole. This was either a very brave move or a stupid one given the current economic climate. Too many NZers are plain lazy and have a shall be right attitude when it comes to money management we saw this when Kiwi saver first came out with many not having a service provider and many staying with the same old bank for life. We need to start teaching our younger generation about money management. So Labour got their arse kicked better to happen now aye! As for National they don’t have a very good track record when it comes to retirement.

Heard Parker has been locked in his room and Jacinda has the only key.

And Luxon has the only key for Willis’s chastity belt.

Comments are closed.