Right-wingers oppose state-provided social programs like education, health, and welfare services on the grounds that they create powerful and wasteful new bureaucracies. But it’s means-tested benefits, not universal programs, that empower bureaucrats to act like petty tyrants.

We have seen that in New Zealand with the delivery of welfare benefits to the unemployed and sole parents and income support through the tax system for low-income families with Working for Families.

Benefits in New Zealand are very low and cannot meet people’s basic needs. That has been confirwed by the government’s own Welfare Expert Advisory Group in their report.

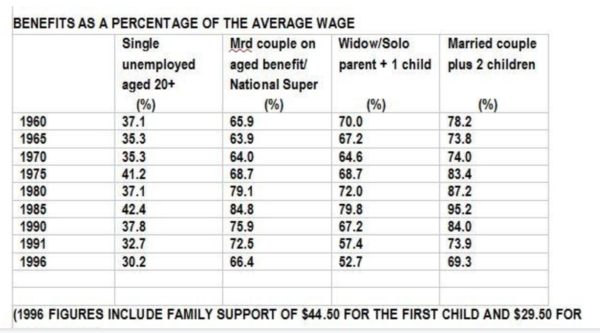

It is simply a lie when people claim that benefit levels being “too high” encourages people to choose benefits over jobs. Levels of unemployment were much lower in the period from the 1960s to the 1980s when benefits were twice as high in relation to average wages than they are today.

The real value of benefits in relation to average wages has been halved since the 1990s and the hugely unpopular “Mother of All Budgets” in 1991.

1991 benefit cuts drove up child poverty and it remains unchanged today

Prior to the cuts in 1991 around 25% of children in beneficiary families were identified as poor in the Household Economic Survey. That rose to 75% post cuts and hasn’t changed much since.

But, only half of the cut in the value of benefits in relation to the average wage was due to Ruth Ricardson’s budget in 1991. The rest came as a consequence of both National and Labour only increasing benefits by the Consumer Price Index rather than average wages for the next three decades. This only changed in 2020 when benefit increases were restored to being in line with the average wage movement again.

The poverty produced by this cut is real and felt and can’t be discounted as simply the result of a “relative” decline.

The value of the benefit for people on National Superannuation was also cut in 1991 but its value in relation to the average wage was maintained at 72% for a couple.

The “deserving” and “undeserving” poor

To justify these cuts (and the refusal of future Labour-led governments to reverse them) a whole ideology around “deserving” and “undeserving” poor has been developed. Anyone who is not working is deemed a “bludger”. Cartoons of overweight brown people queueing up for any handout available became almost normalised.

Assistance is targeted to those deserving people in work through Working for Families.

Universal entitlements like the family benefit were eliminated so assistance could be targeted to the deserving more accurately.

The system became one where seeking assistance became more and more difficult, humiliating, and vindictive.

The economic recession that was partly induced by the 1991 welfare cuts saw unemployment go from less than 4 % to 11% on average. But for those of Māori or Pasifika descent, the recession was a depression with unemployment reaching 25% and whole communities shattered.

Anti-union laws were imposed during the crisis and union protections were removed for most private-sector workers. Real wages were slashed.

Prior to this recession, Māori and Pasifika had higher labour force participation rates than did Pakeha. That was before the infection of these communities by a mass virus of laziness that saw tens of thousands of them quit work over just a few years.

Full-time male employment fell by 120,000 over four years from 1987-91. Of course, this impacted much more on Māori and Pasifika. Working-class communities and families were torn inside out and upside down.

To compensate for the loss of real income families worked more hours. Two-parent families with both working full time doubled from 20% in the 1980s to 42% of all families.

Another 28% of families today had a parent working part time.

A report by Simon Collins in the New Zealand Herald November 25, 2006, found that average family income in 2001 in constant dollars was the same as in 1981 despite the fact that the proportion of women working went from 47% to 61% and the percentage of families working 50+ hours a week went from half to two-thirds.

On top of that household indebtedness exploded from 28% of GDP in 1990 to 100% today.

It was also during the last few years of the 1999-2008 Labour-led government that WINZ radically reduced the percentage of people receiving welfare support from the State.

WINZ imposes a culture of benefit denial

In the mid-2000s WINZ imposed a culture of denial that saw a halving in the percentage of unemployed people accessing benefits. Many had no choice but to to try and survive with no income at all, rather than face ritual humiliation, belittling and bullying from caseworkers.

The Household Labour Force Survey measures the number of people officially unemployed, as well as a broader number of people who are “jobless”.

Between 1990 and 2003 the number on benefits never dropped below 64% of the “jobless” number. Over the next decade, it dropped to only 18% of the “jobless” number.

No explanation has ever been provided as to this was achieved.

A billion dollars taken out of working class communities

People receiving a benefit as a percentage of the working-age population fell from 13% to 8% when unemployment only fell on average from 8% to 6%. I am convinced the big growth in homelessness since 2008 is directly related to that policy of excluding people from even their minimum entitlements. Getting that 3% of the working-age population (about 110,000 people) off benefits essentially has just removed about a billion dollars a year from working-class communities.

It is reflected in overcrowded homes, people living in garages or on the street, kids staying at home longer, poor health, poor nutrition. That billion dollars saved isn’t going to the likes of you and me. It is being used by a big business-friendly Government to hand out favours to their friends. And of course, there is always enough for the police, prisons, military, and spies to protect their system.

These numbers are behind the hunger and homelessness associated with joblessness over the last seven years when unemployment was officially relatively low. But if you were unemployed and couldn’t access any form of entitlement then misery was the inevitable result.

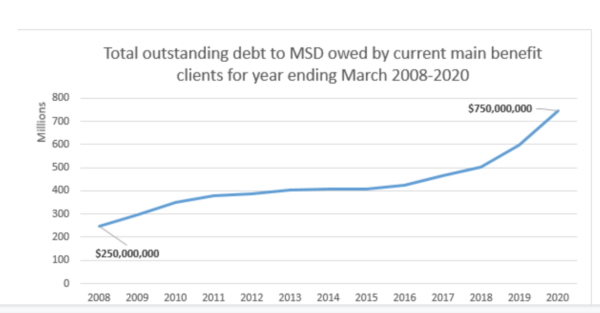

This is also the reason beneficiary recipients have seen their debt to the Ministry Of Social Development (MSD) triple from $250 million to $750 million since 2008. These debts are then used to bully and harass people further including imposing addiitional penalties if not repaid on time.

The system of denial and treating working people accessing income support (working or not) as potential frauds or bludgers continues.

This contrasts with how tax avoiders or wage subsidy recipients are treated.

Tax “evasion” treated differently to benefit “fraud”

The different treatment of tax avoiders was highlighted in a Victoria University research paper titled: “Why is tax evasion treated more gently than benefit fraud?”

We investigate a higher rate of welfare recipients than taxpayers. Around 5 percent of welfare recipients are investigated in an average year, compared to around 0.01 percent of taxpayers.

We have greater numbers of criminal prosecutions of welfare fraudsters than tax evaders. In a typical year, there are 600–900 prosecutions of welfare fraudsters and 60–80 prosecutions of tax evaders.

A higher proportion of prison sentences are given to welfare fraudsters, for a lower level of offending, compared to tax evaders. For an average level of offending of $76,000, 67 percent of welfare fraudsters received a prison sentence. For an average level of offending of $229,000, 18 percent of tax evaders received a prison sentence.

Bernard Hickey in the Spinoff article headed “The real impact of New Zealand’s economic response to Covid-19” looks at the big capitalist recipients of wage subsidies and how they are treated for potential fraud:

So far, only one reported prosecution has been launched by MSD against those who took the money without justification, out of over 1,000 cases referred for investigation. During that time, MSD has launched dozens of prosecutions against beneficiaries.

The biggest losers in the Covid recovery have been those in itinerant work or piecemeal work, who have lost income, along with those renting. Last year those on benefits and the working poor received benefit increases that were not enough to cover rent increases. Last year they received a doubling of the winter energy payment, but not this year.

The government announced earlier this month it would lift the incomes of 346,000 families by an average of $20 a week with various increases in best start payments and higher tax credits, but only from April next year. The PM said it would lift 6,000 children out of poverty. It is costing $68m a year for the next four years. Just imagine what $20b worth of cash paid to increase benefits, let alone to invest in housing and infrastructure, would have done to reduce child poverty.

Last month, MSD minister Carmel Sepuloni announced an extra $9.6m in hardship assistance for low income workers, although some of it can be clawed back at a later date.

Child poverty activists have described the recent one-off grants and tax credits, some of which are clawed back as recipient incomes rise, as disappointing and out of touch.

That has been reflected in massive increases in demand for food parcels and a rise in debt owed by beneficiaries to MSD. As of March 2020, 67% of beneficiaries owed an average of $3,600 in debt to MSD, with debt rising $150m to $750m in the year to March, 2020. The Govt has rejected suggestions of an MSD debt moratorium or writeoff.

Criminalising Working for families overpayments

Finally, we have the New Zealand Herald look at Working for Families in an article headed “Welfare debts pushing thousands into ‘poverty trap’”. Thomas Coughlan writes:

The Government is collecting tens of millions of dollars worth of penalties and interest on debt owed by some of the poorest Kiwis.

As of September 30, Kiwis owed the Government $193.2 million from being overpaid working for families tax credits – usually because they have not notified MSD that their family circumstances have changed.

Payments vary depending on whether someone is in a relationship or is living with children of a certain age. If the Government is not kept abreast of a person’s changing personal status, that person might be overpaid any benefits or tax credits they receive- the Government will then treat the overpayment as debt, and try to claw it back, in some cases with interest.

More than a quarter of debt relating to working for families ($54 million) is actually not the overpayments themselves – it is the penalties and interest charged on that debt.

The debt is made up of $138.2m in overpayments,$29.6m in penalties, and $25.4m in interest debt.

The evidence is that if the jobs are available nearly everyone who wants to will work. Māori and Pasifika don’t have a wefare gene. In fact, they had a higher work participation rate than Pakeha before the 1990s restructuring of capitalism imposed endemic unemployment.

But low benefits do force people into taking the worst jobs on offer more quickly than would otherwise be the case. Higher benefits suit workers better because it gives us a little more bargaining power when negotiating our next job after losing one. That is why it is wrong for the CTU to be negotiating a new social insurance system of benefits for regularly employed people instead of fighting for higher benefits for everyone. That undermines working-class solidarity and power.

Cutting benefits weakens working class power

Cutting benefits went hand in hand with cutting union power and lowering real wages. That is why they destroyed collective bargaining and union representation for most workers at the same time.

But to cut real wages the employer thinks he needs the gap to grow between wages and welfare payments. You have to make living on a benefit as miserable as possible.

One of the worst things that has been done by the this Labour government has been to maintain the unequal position for parents in work or those not in work in terms of child support payments. The In Work Tax Credit is a payment of up to $72.50 per week ($3,770 per year) to working families for the first three children and up to $15 extra a week for each additional child. In work parents get $72.50 a week more. This is taken off them if they work less than 20 hours a week for a sole parent or 30 hours a week for a couple and rely on a benefit for support. Managing the boundary between being entitled and not entitled is a nightmare. The work requirement was suspended for the Covid emergency but could be returned anytime. The Child Poverty Action group has critiqued it as a failed way to deal with child poverty from day one.

We should demand a returning of benefit rates to 40% of the average wage for the adult unemployment benefit, an individual entitlement to benefits. This level of suppport with individual benefits was provided as a Covid welfare payment last year. The adult age should be returned to 18 from 25. Child support payments should be universal for all parents and not mean-tested.

That will fix the system not social insurance for the regularly employed. Then we can retrain the thousands of WINZ staff dedicated to denying entiiitlements and prosecuting welfare recipients into a much more worthwhile and useful job.

I would argue that it is open ended nature of benefit entitlements that have helped create the permanent subculture of failure that now exists in New Zealand.

Entitlements like health and education are mechanisms that can uplift people out of poverty whereas long term reliance on welfare traps communities into reliance on it.

You’re allowing your bum to speak for your brain again andy.

No not his bum, feelings trump facts. That’s why the woke and the right wing are indistinguishable.

That is assuming he (Andrew) actually has a brain countryboy

too true IGGY both rightard SJWs and bourgeoise SJWs are cut from the same shabby threadbare cloth.

I speak from personal experience. Being the child of a solo mum raised on benefits to the age of 18, I made it my business to drag myself out of the mire and succeeded.

Personal experience is a very low form of evidence Andyboy..

Plagiarism! Isn’t that a direct quote from John Keys memoirs Andrew?

It seems too exact and concisely apt to be used as a quick retort?

what other societal response is their other than a return to ‘victorian values’ to address the structural unemployment inherent/neccesary in the neo-lib system and is one of that systems main economic economic levers.

I know people who, as the article says, just got sick of being treated as a criminals, ad jump through so many hoops, before even getting a payment. They gave up and told MSD to just go fuck themselves, and started dealing drugs to make ends meet, but still with pride and integrity intact.

I suspect not an uncommon occurrence but andy should praise their entrepreneurial spirit and pulling themselves up by their own bootstraps..

(which is a physical impossibility so a valid simile)

Show us the jobs please.

not being supported by the system with a disability and being married to someone who works just pushed me into work unsuitable for my disability, in fact it made my disability worse and now I cant work at all.

The constant repetition that benefits are too high, or that solo parents must go out to work otherwise a generation of indolent people will arise, are false and such lies should never be acted on. But they are behind much of our ‘lack of welfare’ system. So lregirgotated lies spread and infect the minds of people who wouled deny others the ability to build a decent life for themselves and if they are parents, for their children. The state does mot care about imost of its lies.

I thought we had a pretty good society in the seventies and now the findings from Lake Alice institution and how obvious cruelties were being excused or ignored, showed that was a false idea and that we can’t rely on authority to hold to fair and kind standards. So we have a *nurse now venting about attacking medical workers and vaccination buses, spouting anti-vaccination beliefs. Will we need to question the standards and mentality of anyone we deal with? The stress on individualism over a group morality of care and concern for the group’s welfare, tribal and local community, along with our own, with individuals able to flourish finding their skills and gifts would result in a happier society. I consider it is merely a cost-saving procedure by government and financiers, basically leaving people ‘to stew in their own juice’ rather than enable and empower them, then when they fail they get fined, outed to society, put in jail, made an example of. This society we have now is descending into madness, suspicion, hate.

* https://www.rnz.co.nz/news/national/457824/dunedin-nurse-referred-to-nursing-council-over-online-threats-to-attack-vaccination-buses

The devil is in the detail of govt policy, take the disability strategy for example, its a little known fact that the mentally disabled in workplaces only earn a percentage of the minimum wage based on their ability.

100% legal for employers to exploit this.

Disgusting govt policy.

Obviously you have never been on a benefit Andrew and you probably don’t know anyone who has. Having been on a benefit when needed and knowing many others on one and who have gone of one I can tell you the benefit system can work if delivered properly. Punitive measures don’t work far better to have incentives and other measures to encourage and assist those who can to get into meaningful, secure sustainable work. But unfortunately there will always be some people who are unemployable.

Speaking of benefits…the ACT party created Charter schools but wanted the taxpayers of NZ to pay for the private enterprise where profits went back to the private investors. Talk about hypocrisy. ACT has always been the biggest beneficiary but at least they’re on their way out.

Just like in the us the southern states are indeed the welfare queen states without the funding from the likes of california via federal payments they’de be west africa…actually

they ain’t that far off…..

tornado you say, epic floods you say…gimme some of those socialist federal handouts we despise.

I think there’s another darker reason why the down trodden must remain so.

It’s a psychological mechanism used by the hyper riche, the most obnoxious of all bludgers, to deflect inquiry and strengthen the logical fallacy that it is the poor who’re riding our economy into the dirt

Before sociopathic, egomaniacal narcissists can sequester vast amounts of money to roll about on with their little dicks out they must first convince we normal people that we’re unworthy of even the shittiest wages or the most meagre of stipends we attempt to scrape and scratch by on.

They do that by influencing our msm with their tiresome drivel about how hard work and boot straps is the only way to go when in reality it’s a criminal mind and a black hole where their conscience used to be that’s all that’s needed.

There’s no real need for fancy words or complex debate narratives. The Kiwi riche are crooks and need slapped down with taxation’s but that’s not going to happen while the crooks have our politic by the balls.

Urban billionaire Kiwi’s on a country of 5.1 million who’s primary industry is agrarian is a pretty big sign post to what, and who, is fucking us without the kissing. To vulgar? Too bad.

Lets ask fay, richwhite, gibb, chandler, hart, watson and now theil, page and God only knows who else etc etc what their opinion is on that subject?

It’s the capitalist’s creed: ‘winning is everything!!!’, ra ra, ‘to the victor the spoils!’, and ‘subdivide! subdivide! subdivide!’ ( I heard all of them at real estate school, the coffee was lousy so I left early) and please excuse my misandry, but the loverboys on your list need some girly counterparts ….

I don’t know their names yet other than shitters, richardson, tolley etc, all those who crush the cars and the dreams of the young by PHOTOGRAPHING them for their database and CONNING them into signing a ‘consent to assume online internet identity’ ffs.

LOL, usual tripe from Mike Green. Agree we need to lift benefit levels to get kids out of poverty and we need a state house program to ensure all these kids can grow up in a safe and dry home. We also need support and training programs for solo caregivers so they can re-enter the workforce when their children reach 18. But lifting the unemployment benefit level, I would suggest a lift to something par with Super entitlements, with a maximum cap one can claim over their lifetime, say 5 years. No time for the unemployment lifers!.

‘Treen’. Not Green. And that’s just one thing you got wrong. “LOL”

‘Unemployment’ To be unemployed, or to be unemployable, is the very definition of lost hope.

Hopelessness is a disease given to us by rich sociopathic swindlers and crooked politicians. As can be seen by the feeding frenzy foreign banksters are having without constraint over our house prices.

‘Unemployment lifers’, as you so eloquently describe the unlucky and unlovely, are harmless and have no real influence on the broader sweep of society whereas the dirty riche can, and have, destroyed generations of AO/NZ’ers merely because they can. Aye boys? All shits and giggles for you isn’t it? Bit of a hoot?

‘I have no time for the’ likes of you, big and fishy. You’re a problem. Not a solution.

@CB. Right with you CB.

Bang on! The Covid payment proved that this ‘Labour’ capitalist Govt thinks that beneficiaries are “undeserving” unless forces ‘outside their control’ like Covid put them out of work.

They are still pushing the neoliberal bullshit that the market is the natural order, and those who cannot compete in the market are written off as ‘losers’.

That’s why they will never challenge business as usual to correct the huge social deficit that goes back to Rogernomics and the ECA.

That’s why they will never undo the damage they did in the 1980s. They a paid up bosses’ lackeys.

This is why they rejected the advice from Maori backed up by the experts like Hendy that Maori would cop the most damage from Covid unless given special care.

That sounds too much like ‘separatism’ and ‘socialism’.

So the sabotaged their public health policy of ‘elimination’ in Auckland in September, immediately after Key’s ‘hermit kingdom’ outburst.

$60 Billion for the bosses to boost their profits, but not one billion to correct the 40 year deficit owed to beneficiaries!

No chance in hell that they will return to benefits pegged to 40% of the average wage.

Social Insurance is their answer because it makes workers pay for their own redundancy and it is time limited. The UK imposed this a couple of years ago under a Tory Govt.

Labour abandoned social democracy under David Lange in the 1980s.

It is now a Liberal Party heading in an authoritarian direction.

We saw this process destroy the UK Labour Govt under Tony Blair.

Therefore begging this Govt to return to the pre-1980s social democracy is futile.

NZ has one good thing going for it.

It is a weak dependent economy increasingly dominated by the US and China in a global terminal crisis of capital which is seeing the class contradictions explode.

The compounding economic, climate and pandemic crises brings the inevitable showdown between those who defend labour and nature on the one side, and those who defend dying capitalism.

The class lines are forming with those who put the lives of workers first, such as the Te tai Tokerau checkpoints, against those that sacrifice workers lives to keep their SMEs afloat.

Inevitably those who side with the bosses ‘freedom’ to exploit and burn the planet, will be the fascist fodder, led by expat Trumpites self appointed bishops and anticommunist farmers.

They are the small misguided mislead minority.

On the side of the vast majority, those who blame the bosses and not the beneficiaries, the solidarity in the unions between Maori, women, migrants and unemployed, is the base line of resistance capable of mobilising and uniting anti racist and antifascist movements.

At a time when the global capitalist system is destroying what is left of nature and with it humanity, our survival is in the hands of international worker solidarity and socialist revolution.

For humanity to live, capitalism must die!

Equally bang on @ DB.

What’s the difference between capitalism, communism and fascism?

Nothing. They’re all fascist.

AO/NZ must adopt a new and refurbished democracy where it’s socialist rather than the fungal infection that is capitalist.

Communism hasn’t been tried yet.

Stalin, Mao etc abused Marx using his name to sell their dictatorships to the masses who were not impressed.

In fact Trotsky called Stalin’s dictatorship imposed upon revolutionary workers to usurp their power, a fascist regime.

Communism is a society of the future when classes cease to exist and the state withers away. People administer their own lives collectively, democratically, and assuming we get their in time, in harmony with nature.

The neoliberal centre-right Ardern-Robertson government, whenever confronted with demands to help the poor to live, to be housed, to eat, to be schooled, to be healed, resorts to the Micawber argument that every dollar spent on the poor is a dollar that must be taxed from others: “We can’t afford it!”

The behaviour of governments around the world during the 2008 GFC, and again since the Covid pandemic struck in 2020, shows that in fact they merrily conjure billions of dollars out of thin air when it suits them. It’s what they do with those dollars that matters. Creating money runs the danger of inflation (same cake, thinner slices). The Ardern-Robertson government had the Reserve Bank throw billions at trading banks over the past two years to lend as mortgages to prop up the New Zealand housing market. This has had the inflationary result of immiserating non-homeowners by putting the price of houses fantastically beyond their reach. The houses are worth no more than they were two years ago, or ten; it is the structure of price relativities that has changed, whereby those holding mere Kiwis discover they will buy only half as much House as they once could.

Had the Government, as it was urged, instead distributed those billions as helicopter payments to everyone on the IRD or MSD books, there probably would still have been an inflationary effect, but it would have been more evenly spread, along with the largesse.

The Government can easily print all the money it needs to restore all the welfare benefits to pre-Ruthanasia levels and entitlement as Mike Treen suggests. To balance that, the Government may need to collect tax, not to pay for the benefits, but to subdue any consequent inflation; it is not revenue, but currency withdrawal. It doesn’t need to come from higher taxes on the incomes of workers: rather, it would make sense to clip the wings of the asset rich with a property tax. Discouraging the rich thereby from spending so freely would balance the extra spending power of the poor, subduing inflation, keeping the Kiwi valuable for all.

Spot on. @ JT.

Spot on as well.

Beardsley Ruml, Taxes for revenue are obsolete, 1945:

https://modernmoneynetwork.org/sites/default/files/biblio/BeardsleyRuml.pdf

The speech (about 8 minutes in):

https://ssgreenberg.name/PoliticsBlog/2019/03/25/beardsley-ruml-taxation-for-revenue-is-obsolete/

yeah the kind of ‘shovel ready projects’ receiving squillions were weird in itself- window-dressing and turd polishing were in when community gardens, public showers etc were not

The system demands the need for poor people.

here is a $25b Welfare Budget including $13b Superannuation to be profited from for providing all the services and business subsidies too, rental property owners subsidised mortgages and contracted provider services.

What beneficiaries actually receive in payments from the Welfare Budget is less than $4.5b which is inclusive of the infrastructure, WINZ, staff and assets etc ….WINZ/MSD is a data collection agency.

now they are eye opening figures Danny

I’m not convinced they actually believe their is deserving poor. It’s just another tool to bash working people.

We are left time after time watching more people with mental health issues and physical health issues become homeless or top themselves. The weakest amongst us, the down trodden, those who are truly poor.

Treated like trash by both main political parties – mainly because they don’t vote, and need help which they can’t ask for.

A underclass exploited by the tories for political gain. Ignored by the liberal left because to lift a finger to actually help, would mean accepting that the current economic system is broken. And then they have to do something about it. The labour party as it currently stands, is not going to do that.

And to make it worse, the tories want to ramp up the vicious economics which destroys lives, destroys communities, and destroys families.

Deserving poor as a concept is a sick joke, one which lets those who should be working for all of us, commit unspeakable cruelty in the name of helping.

One of the best articles, it is both contextually, and historically on point…

The old means tested benefits is just discrimination at govt level.

From my perspective being partially in a wheelchair and unable to work stuck at home on zero income because I happen to be married to someone who earns over that paltry $56k a year set by WINZ. If you were to halve my wifes income, both of us would be earning below the minimum wage, but thats seen as fair?

Then when you compare that to the benefit called superannuation, it seems its ok for your partner to work for you to get a benefit, oops I mean pension, you can have assets, shares and other income too no problem at all.

And then to top it all off we have covid payments to the temporary unemployed which is a gold plated benefit where you can have a partner earning up to $3k a week!

I have been stuck in this trap for nearly 20 years, no matter what politician you write to, they just fob you off with a bunch of meaningless words and zero action.

Even been fobbed off by the human rights commission telling me they dont have a mandate for that!!!

Discrimination at its finest and all bloody legal.

Sorry to hear and simply not right Mark. Maybe just print off 62 weeks worth of letters sending one, once a week until action is taken. But send it to the opposition MP for better traction.

Sorry to hear Mark and agree with Bert. Saying that, I know advising someone who’s been knocking on doors to keep going seems mean but, unfortunately, it’s the only way really. I’d be tempted to also write to someone like Winston Peters and ask what his party would do about it. Whatever his faults, one thing about Winston is that, when he picks up a cause, he’s often like a dog with a bone. He just won’t let go.

there’s always our NZ com[pllaints dept a sob-story on RNZ, NOT SAYING YOUR STORY IS A SOB-STORY FAR FAR FROM IT BUT THAT’S HOW THEY’D REPORT IT….it’s a sad sad state of affairs when that’s the only form of complaint that gets traction, the whim of an RNZ ‘lady bountiful’

anyway not gonna use the usual homilies but take care of yourself, mark and your Mrs

My personal experience is different from most of the points in this article.

In the mid 2000’s the minimum wage was around $11.00 per hour, or around $420 a week after tax; the adult benefit was around $145.00 a week after tax.

Nowadays, the minimum wage is $20.00 per hour, or around $650 a week after tax; the adult benefit is around $300.00 a week after tax.

Plus, the Accommodation Supplement is still in place.

So I believe that beneficiaries are much better off these days than they were fifteen years ago. Hence there is not a need for universal entitlements.

But that’s only my opinion.

wern’t the Treens actually green, yup I have vague memories of dan dare….though luxton as the Mekon does seem kinda fitting

Who was in charge during the mid 2000’s. What a effing disgrace. You can guarantee the unemployment figures were jimmied back then.

Apparently unemployment isn’t too bad but I’m sure that depends on how you jimmy the figures. There will be many on part time work and require a top up. In my opinion the emphasis shouldn’t be on benefits but on wages. The minimum wage. If everyone got to spend a minimum wage based on the cost of living half the problems would go away. The massive administrative juggernaut required to police and pay out the benefits as they are now structured could be halved. The argument that more people would be given more money we can’t afford, would be partly offset by less administration. Less parasites in Wellington. It may cost the country a bit more but you have those who can’t work and those who can’t work full time being topped up to a 40 hour week based on the minimum cost based wage. When we look at what’s happening now it would be an affordable fix as we’re having to pick up the problems in health and crime. I haven’t done the sum’s but don’t think it matters it would be worth it. No doubt someone will correct me but that’s how I see it. Making sure people don’t abuse the benefit but get paid enough money to survive on is too complicated. Just give the people enough to live on and get rid of the dead wood in Wellington.

The reported unemployment rate from “Statistics NZ” is bs. A mangled constructed nominal minimum figure.

The real figures that you have to rely on are the quarterly reports from MSD and the total number of people in receipt of a payment, which is 359,000.

That does not include the recent second tier of wage subsidised employers. Which was about 400,000 people costing another $3.8b which does not feature in any SNZ reckonings.

So that 359,000 number equates to 11.2% unemployed people and also who are of the available workforce of eligible age.

So when the ‘market’ does not produce full-time sustainable good paying secure jobs and prefers a ‘flexible’ labour force pool to ‘dip’ into when needed. There it is. Or, the alternative is to import the labour which creates a whole set of new problems where employers find it cheaper to import staff instead of training NZ’ders rendering the ‘pool’ of standby workers redundant.

The cost of sustaining a flexible workforce for businesses is $25b annually like it or not.

People have barriers and dissatisfactions set between them and work. If they don’t jump out of their box and salute when offered a job any thinking person could understand why. And indeed critics talk about being work-shy which can happen.

Young people may be trying to have the traditional light-hearted time that one looked forward to as a young person, much harder now. My neighbour used to be supervisor of a building company and might have to get apprentices out of bed to work. Though that might be only once or twice ‘Sorry it was my birthday’ sort of thing. But they were part of society going through different ages and stages. Eventually they would settle as a citizen and probably be working on maintaining their own house.

Read the background of many politicians and bureaucrats. Never done any real work at all, just mind stuff, facilitation, manipulation, and management. No wonder that Mao tried to get everyone to do some rural work, he noticed the large separation in thought and style between producers and organisers.

And the idea of a pure statistic like dividing paid work from unpaid, and 1 hour of paid work a week counting in the bag of stats is unsatisfactory for anything besides watching for variations. Real stats should be on 30-40 hour jobs worked, and how many are doing gig work. Also what anti-social hours people have to work, all those little things that affect people’s living day and their duties as a person to family and when they see others, when they sleep and how many hours they get etc.

Denny I can see the welfare figures are daunting. $50 billion and the total crown revenue at $ 118 b and shrinking doesn’t leave much wriggle room and the politicians are always conservative. And there’s Covid, so I see I may have been a little enthusiastic. I still feel by having an increased minimum living wage the savings in other areas would be massive. Firstly government takes back the GST that the lower paid spend and the tax from the extra money business gets. The money go round. Then because the poor are better off less crime fewer mental illnesses less health expenditure. Less administration on policing benefits. We still most likely can’t afford it. But can we afford not to do it. The government would say no but be happy to up the police budget. Cranky thinking.

Wrong. It’s $25b not $50b which is inclusive of $13b for Superannuation.

Most of the remainder of the $25b are business subsidised and wealthy landlord rents because there are not enough houses. This is why there are 25,000 people living in motels.

I just googled it like everyone does.

What does the Government spend its money on NZ?

The three largest areas of total Crown expenditure for the 2019/20 financial year were: Social security and welfare: $49.9 billion. Health: $20.5 billion. Education: $17.6 billion.6/07

Bs. You’re blind or reading the wrong column.

What date is that budget account? 2095! Let me check for you.

Whatever.

is anything actually being done????

Comments are closed.