To the Finance and Expenditure Committee

Thank you for the opportunity to talk to our submission on the Budget Policy Statement (BPS). Child Poverty Action Group (CPAG) is an independent charity working since 1994 to eliminate child poverty in New Zealand through research, education and advocacy.

We acknowledge the good work of government keeping us safe in the pandemic, BUT we are facing a pandemic of poverty that has been intensified by COVID.

When the BPS talks about the need for children to have “safe, dry, warm houses” it seems empty rhetoric and tokenism. We encourage the government to be bolder and put the needs of children who are not thriving at the heart of its fiscal policy. The public are willing and ready for a change in the narrative.

We are deeply concerned that in balancing the budget priorities, the fiscal position and net debt will be more important than taking the necessary steps to address the worst of child poverty. We fear we will see a further mushrooming of the use of private charity and food banks.

The budget policy statement itself highlights that last year well-being has slipped. More than 30% say they don’t have enough or only just enough income. The percentage of people needing charity and food banks has gone up significantly (over 20%) and many will be families with children.

As the BPS outlines, sole parents, Pacifica, Maori, unemployed, the ill and disabled families are particularly badly hurt in this COVID recession. CPAG is really concerned that as the years go by the time young children are spending in real poverty is lengthening with serious long-term consequences for them and for our country.

We question the inherent fiscal conservatism of the BPS. We look at the projections to 2024 and see how taxation as a percentage of GDP is expected to remain the same at around 27%, and Government expenditure around 30%. We do not see how the government is factoring in a step change for children and their parents.

We are baffled to understand, that in the light of intense need, why the government is still putting $2 billion a year, unscrutinised, into the New Zealand Superfund. It is a bit like saving for a rainy day and not fixing the leaking roof today.

The preoccupation with a net debt projections ignores the NZ Super Fund of around $60 billion. Logically these assets should be offset against the gross debt making our net debt situation even less scary and even less of an impediment to providing urgent support for families and children.

We note the governments expressed intention to make sure additional spending is well targeted, yet many current measures have not been. For example, doubling the winter energy payment for all superannuitants is very costly and unfocused while children are going hungry.

The preoccupation with net debt has obscured the state of the worst-off families’ balance sheets. Those living under very low poverty lines have been going further into debt with MSD and the private sector. Core benefits are too low as the projected growth in spending on supplementary assistance, such as the Accommodation Supplement, hardship and emergency housing grants surely demonstrates.

Working for Families is also ignored. It is very hard to see that the worst off 170,000 children who are under the lowest official poverty line (40% After Housing Costs) are even a small part of thinking about well-being. When families lose hours of work in the current precarious job market and need to go on a benefit, the income support for their children is actually cut. This is all in the name of providing a work incentive.

It is an absolute mystery to CPAG as to why we punish these families by denying them $72.50 a week of Working for Families simply because they need a benefit or a part benefit. The impact has been more poverty not more families in full-time work. Work incentives should not be tied to children’s payments- doing so is using poverty itself as an incentive. And a cruel one, when it is not feasible for parents on benefits to make the leap into full-time well-paid work. Fixing this might cost a half a billion dollars but that would be a highly targeted and effective expenditure and start to make a real difference.

A second problem with Working for Families is that family tax credits are poorly indexed. NZ Super for those over 65 benefits are wage-linked as are benefits now for working age adults. Figures in the HEFU show that expenditure on Working for Families is static in nominal terms out to 2025. Children and their needs for income are seen as clearly less important than other New Zealanders. We would urge the government in this budget to remedy these two defects in Working for Families, not as a promise for some time in the future, but with immediate effect. It can be done.

The burning issue that will not go away with ignoring, tinkering, pretending, is housing. It surely must be the number one reason and root cause of poverty in NZ.

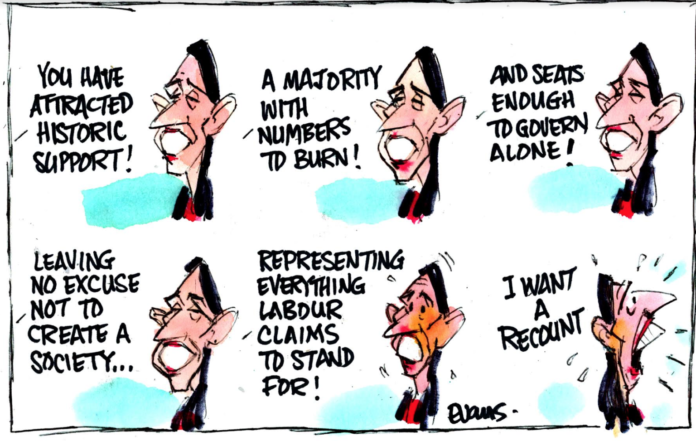

And yet we wait for our popular world renown infuriatingly timid Prime Minister who leads a majority government to do her job and take action. And we wait and wait and aside from ever so slight and largely future dated adjustments, nothing happens.

Thing is, Labour cannot sit in their hands much longer because it’s coming to a head, the red flags are accumulating. Fewer houses are being listed because people are opting out of this insanity. More people are finding their accommodation situation tenuous. If the housing market is still largely left to its own devices the way it is then it will hit a ceiling where affordability and debt risk collide and the market will seize up. That is bad. And more families will end up in the street. That is worse.

Do you really really want that on your political epitaph Labour?

Agree X-RAY. Housing must be adressed. We advocate for income tax broadening to include the untaxed imputed inome from housing equity as the only tool left in the tool box that addresses the accumulated captial gain to date and offer signals to divert real resources away from top end housing.Time for this to be seriously considered

The case for taxing a deemed rate of return on excessive real estate holdings (after a family home exemption), to redirect scarce housing resources to where they are needed most Published at Interest.co.nz. 26th December 2020

https://www.interest.co.nz/opinion/108521/susan-st-john-makes-case-taxing-deemed-rate-return-excessive-real-estate-holdings

By basing the imputed tax on equity you are, in effect, giving the home-owner a deduction for interest. This was always a problem with Gareth Morgan’s formulation, but perhaps it was justifiable given that interest was deductible in the hands of landlords. However, now that deductibility in respect of rental properties has been removed, it is perhaps no longer justifiable.

I think I would also base the tax on the homes original cost rather than its equity value. I assume ‘equity’ includes accumulated capital gain.

Net equity deducts the mortgage from gross value of house. It means that it is impossible to produce losses as is common now. It has some of the features of the removal of interest deductibility but has a far wider reach capturing accumulated capital gains over time in the base

If an imputed income is applied, calculated as percentage of the property’s equity, then interest would be assumed to have been deducted in arriving at that imputed income, and the home-owner’s only liability would be for the tax on that income. However, if interest was declared undeductible (as has now happened with rental income), the home-owner would have to pay tax on the interest as well as any tax attributable to the imputed income.

I’m assuming that a home-owner’s normal property expenses would be taken into account in arriving at a suitable percentage for the imputed income.

‘Thank you for the opportunity to talk to our submission on the Budget Policy Statement (BPS).’

Government committees and local government committees need public submissions so they have something to ignore. They later say “The public were consulted.”

It’s called Manufacturing Consent, and is one of the oldest playbooks in politicians/bureaucrats repertoire.

After they have gone through the phony processes they will do whatever they wanted to do anyway.

And in this thoroughly rotten system, there is no accountability.

With respect @ SSJ.

“… eliminate child poverty in New Zealand through research, education and advocacy.”

Nope. The best way to eliminate child poverty in [AO] NZ is through more money in the pockets of those in poverty and reducing or indeed eliminating costs for access to state owned ( taxes paid for ) infrastructure.

I.e. More money can be provided by taxing the shit out of the cadre of useless swine who fell on us in a frenzy of greed more than 35 years ago. Reducing costs to use what was once our infrastructure could be achieved by freezing the assets of the afore mentioned then redistributing those funds back into our communities. That can be achieved by starting at the most impoverished and working upwards. Trickle-up, if you like.

“…We encourage the government to be bolder and put the needs of children who are not thriving at the heart of its fiscal policy. ”

They’re ‘encouraged’ enough already. We ‘encourage’ them by paying the fuckers six figures plus entitlements and sundry perks like being able to be floated about in BMW’s with heated, arse massaging seats.

I think it’s time to be less ‘encouraging’ and more ” Do it! Or you’re out on your fancy panties and criminal charges may follow! ”

We should remember that every time we give a politician an opportunity to interpret our ‘requests’, they’ll interpret them as being an opportunity to exploit us for their privateer mates like this scumbag.

ron brierley.

One of rnz’s sycophantic ‘reporters’ recently described him as ‘a titan of industry’.

https://www.theguardian.com/world/2021/apr/01/new-zealand-tycoon-ron-brierley-pleads-guilty-to-possessing-child-sexual-abuse-images

Hi Countryboy. We advocate for more money for low income families as a core activity. We agree that money matters- pretending that it doesnt is insulting to the families we speak for.

The culture at these select committees is to be polite to be heard at all. I feared I was too blunt.

After doing the oral for the BPS each year for many years as we allude to in the full submission one does have to question the value of the process. Ten minutes is an impossible time to do justice to the issues.

There are good people on the select committee but this is not a good way to enagage with them

As pointed out many times, the whole hearings process is geared to silencing dissent or even facts-based discussion.

I know from much experience in dealing with such people and discussion afterwards with the very few honest ones, that most members of committees don’t even bother to read written submissions and just turn up on the day to collect their pay and to vote in favour of whatever had already been decided.

Don’t worry with the woke in charge, ‘charities’ are taking over.

“Variety New Zealand

Adam loves the water, but his parents can’t afford to pay for swimming lessons. Food, rent and utility bills take priority. Adam’s dad suffered a work-related injury last year. His mum stays home to care for Adam’s younger sister who has special needs. Adam knows not to ask to go to the pool.

This is the reality for 1 in 5 Kiwi kids who live in poverty in New Zealand. Children like Adam are missing out on essential life skills, falling behind and feeling left out. You can help. For just $50 a month, you can change their story.

Please, will you sponsor a child today?”

The answer seems to be if you can’t beat NZ screwed up system, join the cash and criminal class. It seems to be working well for the drug smugglers and people who are working for cash. Gangs up 13%.

The denial of ” working for families ” income for beneficiaries I’m sure goes against the U.N. charter on human rights being malevolently discriminatory. especially in the light of the immense capital gains being made by speculators in the housing commodity market. I emailed the U.N. that H Clark was not suitable to work in their organisation as ” Administrator of the United Nations Development Programme from 2009 to 2017 because of this cruel policy. ”

It’s a disgrace that we value speculators not levying a hefty CGT more than our poorest children.

All part of Labour not taking it’s traditional red pill but living in a blue pill ( National Lite) dreamworld lost in the neoliberal matrix. I despise them for it! 🙁

Not the NZ I want to see. Private charities do the best they can but we must not permit them to be the main way we care for families in dire need. This is the model our forefathers came to NZ to escape from

For decades I have written to ministers both left and right sides of our political sphere about my disability situation and the lack of help or support and they all seem to just dribble out a bunch of words on paper they are proposing like the disability strategy that doesnt really help people but particularly not myself, just a blanket statement of meaninglessness.

And here we are now with Labour with no support partners to hide behind, its them standing alone with nobody else to blame why they couldnt help anybody.

The truth is Labour now are no different to National. They just dont care.

@ Mark, With your loyalty to China, shouldn’t you be helped by the mighty Xi Jinping in the mighty China that you post about not NZ?

What has my comment got to do with China?

Put down the shrooms dude.

You claim National are no different from Labour now prove it. I’ll make it a bit easier on you. How many bills have National and labour voted together on. You can start your history where ever you like.

90% of your comments are pro PRC so why live in NZ, when you seem to only say negative things about NZ aka “my disability situation and the lack of help or support”.

Susan’s articles come from someone with a long track record of supporting the discarded underclass of this country, and a reputation for accuracy, so the question for me is just how do we put pressure on the Labour Caucus, so that they will in turn pressure the neo liberals in the Govt. Ministries, SOEs, and endless contractors?

My take is community organisation, political organisation and appropriate direct action. The 70 NGO “letter to Jacinda” on raising benefits before Christmas was a good shot across the Caucus bow. Such coordination needs to be continued and given material force, not mere protests but deeper until neighborhoods, regions all organise themselves. There is so much happening already out there, what seems missing is a unified national leadership for the working class and its alienated members.

Maybe the current iteration of NZ Labour is beyond hope, help or ability to change. In which case the generational replacements for the previously/currently dominant socio economic groups will have to step up.

TIger Mountain

Thanks for that comment and I agree that that letter to jacinda was an important illustration of how we can all work together. The problem is that the NGO sector is exhausted. CPAG spent 10 years in the courts fighting the discriminaton in WFF and has been fighting it in the political arena since–25 years of saying the same thing– it started in 1996 with Bill Birch’s child tax credit that was denied to those families deeemd not independent from the state. Now we have a new generation of politicians to educate who know nothing of this history.

Institutional memory…exactly. How many MPs apart from Sue Bradford, and now Marama Davidson, have ever genuinely known what so many New Zealanders have to put up with.

I was involved in the unemployed movement during the Shipley years, and unions, solidarity issues etc. and my partner was a beneficiary advocate at the Auckland Peoples Centre and independently since, and tackled the “Benefit Investigation Unit” one time personally, and helped with appeals etc. so we have some idea of this field.

Really it will take a combined approach to get anywhere imo. So many people are doing good work, in disparate ways which can pay off over decades like Pay Equity, but time is pressing now.

Giving Money to the Poor = Giving Money to Landlords.

Therefore food grants/banks are the only option. Maybe the poor will start voting and not vote for Labour? It’s up to them. Pretty pathetic complaining about your situation then NOT voting or voting Labour.. a party that failed for 3 years then called for increasing house prices before their latest historic win.

Perhaps some people can’t be helped? Shanty towns and tent cities may soon manifest. I’m sure Labour will send in their totalitarian clowns to stomp that out.

The Daily Blog, as always.. very naive!

The good news is that there are less landlords and rentals because the government strategy is to help first home buyers instead who are coming to NZ and the developers that build them (not very well, truth be said). Luckily there is plenty of foreign owned business who are taking over the rental situations in NZ, and although tend to charge 3 x as much for 3 x less, that’s ok because they are working for shareholders not society and thus get a free pass with capitalism and Labour’s NeoKindness Rogernomics.

“such as the Accommodation Supplement, hardship and emergency housing grants surely demonstrates.”

@Susan: Also Temporary Additional Support (TAS), which is used to prop up income to meet basic rent, because even AS is too low. TAS eligibility caps savings at $1113 – which is more like <$1000 when you factor in the threshold WINZ start requesting bank statements and interrogating – figures far too low to survive on.

FWIW, WINZ paperwork has been changing to increase it’s level of detailed scrutiny over beneficiaries. Staff continue to flagrantly scam beneficiaries on the ground, and deny access to grants without punishment – putting people into destitution, desperation, and debt.

“[2021-03-11] Unemployment agency attacks disabled man, aggressively denies emergency dental – NZ”:

https://www.youtube.com/watch?v=vYB2Qj_cMkw

Your work continues to educate, inform, inspire and motivate action – another excellent post. Happy Easter!

Thnaks Lostrelic. The welfare system is a total mess. Sadly if the government does what should do and greatly increase benefits, the off-sets in 2nd and third tier benefits will leave many without a signifcant boost. They will be freer however of the need to beg for top ups. They will have more time and more dignity

Grandee of our old , and better, social democracy, 36 years gone. But the best of us old-timers remember. And we, the best of us toto. As per Sanders and Corbyn. A govt of all the SD talents to replace Jace and Grant who grew under the gray dim of Clark’s real ‘learning’, the rich’s ‘winter of discontent’ in ’99. They don’t remember. Are all about what ‘can’ be done, selon focus groups.

Aren’t they so deeply unserious. Nothing there.

I’m afraid on the Left blogs this is always how it ends, Welfare State grandee. Not even us can get excited about the voiceless poor. The comments end quickly on these posts that describe our heart. Not a good sign. But the last of the Welfare State children are now talking up for demo-cracy, as the first children brought it down.

Comments are closed.