It figures.

President Donald J. Trump hired an anti-environment guy to run the Environmental Protection Agency, and an anti-consumer guy to run the Consumer Financial Protection Bureau (followed in that role by an unqualified Peace Corps volunteer), so it figures that he would hire a Fed Chairman who is ignorant about economics.

Here is what Trump’s Fed Chair Jerome Powell told Congress, recently:

“The idea that deficits don’t matter for countries that can borrow in their own currency I think is just wrong … U.S. debt is fairly high to the level of GDP — and much more importantly — it’s growing faster than GDP, really significantly faster.

We are going to have to spend less or raise more revenue.“

Powell called out “unsustainable” federal debt in his opening remarks. But in response to questions from senators, he emphasized that “decisions about spending and controlling spending and paying for it” are up to Congress, not the Fed.

He didn’t use the word, “austerity,” but his use of “unsustainable” federal debt, and his comments about, “decisions about spending and controlling spending and paying for it” are right in line with the worst of the austerity sellers.

He apparently is right on board with the Republican “cut-social benefits and raise taxes on the middle-classes” philosophy.

Compare him with previous Chairmen, who though not always stating truth, at least acknowledged it:

Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency.”

Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

And as has become the rule with debt nuts, Powell never gives any specific reasons why the deficits are “unsustainable,” or why “controlling and paying for deficits” are necessary. Do you think he learned that at Trump University?

And to top it off, get this:

“Defaulting on these debts—as the hetereodox macroeconomic theory Modern Monetary Theory (MMT) proposes simply unthinkable,” Powell said.

Oh really? Exactly when did MMT propose defaulting on debts? Not only is that a Trumpian-style lie, but it demonstrates that Powell has no idea what MMT is all about. The man’s ignorance is as shocking as Trump’s.

MMT (like Monetary Sovereignty) specifically says the federal government never will need to default, because it has the unlimited ability to create dollars.

……………………………………………………………………………………………………………………………………………………

And then we come to yet another debt fear-monger, Randy Schultz, a writer for Boca Magazine:

Remember when Republicans cared about budget deficits?

Last week, the government announced that February’s red ink set a monthly record — $234 billion.

In a growing economy, setting an annual deficit record is like having your house go into foreclosure when the family income is $500,000. Something is wrong.

Huh? How is a federal deficit anything “like having your house go into foreclosure”? It’s a completely senseless analogy?

As recently as 2015, the deficit was $438 billion. Yet Republican policies have the deficit on track to be $1.1 trillion for this year. In a growing economy.

For perspective, the deficit was $1.4 trillion in 2009.

Remember, though, that to hold off a second Depression Congress had to pass the $700 billion financial bailout and the $787 billion fiscal stimulus during that budget cycle.

And revenue tanked with the economy. Republicans can’t use calamity as a defense.

Talk about not seeing what is right in front of his nose, Schultz acknowledges that deficit spending — “the $700 billion financial bailout and the $787 billion fiscal stimulus “– held off a second Depression.

Though he admits that deficit spending saved and grew the economy, he decries deficit spending. Amazing.

In fiscal terms, the GOP sinned most notably by passing the 2017 tax cut on a party-line vote in the Senate and a mostly party-line vote in the House. Thirteen GOP House members honorably defected.

Republicans crafted that legislation to please megadonors and corporations.

The plan offered no structural changes to help the economy over time and thus needlessly increased the deficit.

The sin was not the tax cut itself. That is helping to grow the economy. The sin was to cut taxes on the rich, with widened the Gap between the rich and the rest.

President Trump proclaimed that the tax cut would help the middle class. Of course, he also proclaimed that he would lower the trade deficit, which is at a 10-year high.

The president said companies would use tax savings to boost pay and hire more employees. In fact, many large corporations used the money on stock buybacks, which set a record last year after the tax plan became law.

What a surprise. Trump either lied or spoke out of ignorance. Who could have predicted that?

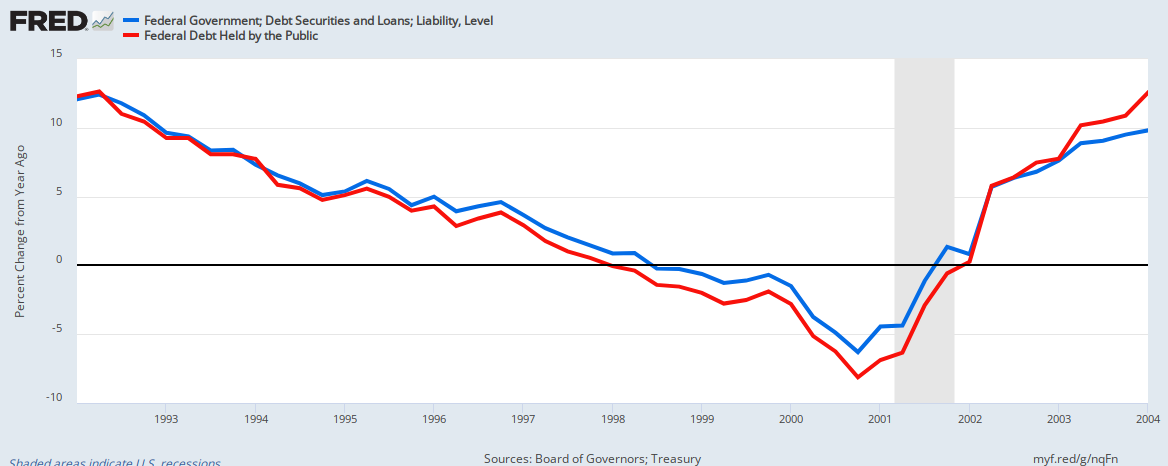

Amid the current fiscal misfeasance, recall that the country ran budget surpluses from 1998 until 2001.

Will someone please mention to Schultz that those budget surpluses led to the recession of 2001?

Why would a federal budget surplus lead to a recession? Because a federal surplus occurs when the federal government takes more money out of the private sector than it puts in.

One would hope that a Chairman of the Fed would understand that starving the private sector of money leads to recessions. Sadly, one would be disappointed.

In April 2000, Clinton addressed the American Society of Newspaper Editors and mused about the country paying off its debt, which was about $5 trillion. It’s now $22 trillion.

Had the federal government cut spending and increased taxes to take $5 trillion from the economy, we would have slipped into a monster Depression that would have made 1929 look like heaven.

Of course, Schultz doesn’t understand this, but paying off the federal debt need not require a reduction in deficit spending. The government could pay off the debt simply by returning the dollars that are in T-security accounts.

This would not have required deficit reduction, and it actually would have increased liquidity. But why worry about facts?

Deficit reversal began under President George W. Bush. Seeing those surpluses, he proposed a tax cut to “give the people their money back.”

Democrats were complicit in passing that plan, which did no more good than the 2017 tax cut.

“No more good” than to increase GDP growth. Otherwise a failure??

For good measure, Republicans in 2003 passed the Medicare prescription drug benefit.

With no payroll taxes or premiums to finance it, Part D adds roughly $100 billion to the deficit.

“Part D adds roughly $100 billion to the deficit,” which means the federal government added $100 billion to the nation’s economy. And this is a bad thing??

Last week, Federal Reserve Chairman Lawrence Powell said, “Deficits matter.” But he sounds like the housemother trying to break up the frat party.

No, he sounds like either a damn fool, who doesn’t understand economics, or like a liar who doesn’t want the public to learn the truth.

A few adults are around. Speaker Nancy Pelosi faced down an attempt by young, ultra-liberal Democrats to reject “PAYGO” – offsetting new spending with tax increases or cuts.

House Democrats have presented a sensible plan to shore up Social Security. Some Senate Republicans have offered ideas to reduce the deficit.

In the above two paragraphs, we are told that the “young, ultra-liberal Democrats” understand economics and want to help the economy grow, while the “House Democrats” would rather promulgate the Big Lie, that federal spending is funded by federal taxes.

Though Republicans once chided Democrats as “tax and spend liberals,” they abdicated on fiscal policy years ago.

Now the chaperones outdrink everyone.

More like the debt scare-mongers want everyone to drink the austerity Koolaid.

Pitiful.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell

Search #monetarysovereigntyFacebook: Rodger Malcolm Mitchell

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

The most important problems in economics involve the excessive income/wealth/power Gaps between the richer and the poorer.

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of The Ten Steps To Prosperity can narrow the Gaps:

Ten Steps To Prosperity:

2. Federally funded medicare — parts a, b & d, plus long-term care — for everyone

3. Provide a monthly economic bonus to every man, woman and child in America (similar to social security for all)

4. Free education (including post-grad) for everyone

5. Salary for attending school

6. Eliminate federal taxes on business

7. Increase the standard income tax deduction, annually.

8. Tax the very rich (the “.1%) more, with higher progressive tax rates on all forms of income.

9. Federal ownership of all banks

10. Increase federal spending on the myriad initiatives that benefit America’s 99.9%

The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

MONETARY SOVEREIGNTY