As New Zealand house prices continue to soar, it is worth examining the origins of this amazing boom.

Why has New Zealand’s average house value rocketed from just $25,500 in Dec 1980 to an estimated $715,500 at the end of last year?

The average New Zealand house is now worth 28 times more than it was 40 years ago while the NZX 50 Capital Index has appreciated a more modest tenfold over the same period.

Meanwhile, United States equity markets have completely outperformed the country’s housing market over the same 40-year period. The median US house price has appreciated just five times since Dec 1980 while the Dow Jones Industrial Average has risen by 33 times, the S&P 500 Index 28 times and the Nasdaq by a massive 64 times.

Forty years ago, New Zealand house prices were much lower than US house prices, but our prices are now more than 50% higher.

What has caused this dramatic turnaround?

Banking regulation

The banking sector has played a huge role in the residential property market in recent years but before 1984, it was heavily regulated and had little exposure to residential property.

Trading banks were hamstrung by myriad government regulations, ratio requirements, and guidelines. These requirements dictated what interest rate they paid on deposits, who they lent to, their lending growth rate and the interest rates they charged on their loans.

Ratio requirements forced trading banks to invest a percentage of their assets, usually around 30% or more, in government or Reserve Bank securities and they had qualitative government requirements to give a high priority to sectors such as farming and exporters and a low priority to importers and speculators.

Prime Minister Robert Muldoon began to ease these restrictions in the late-1970s but when interest rates increased in late 1981, he reintroduced many of the earlier rules and regulations.

The optimism of the early Muldoon years had completely evaporated by the end of his reign. By mid-1984, most of the ground gained through deregulation in the early Muldoon years had been reversed and the banks were no better off than they had been in the mid-1970s.

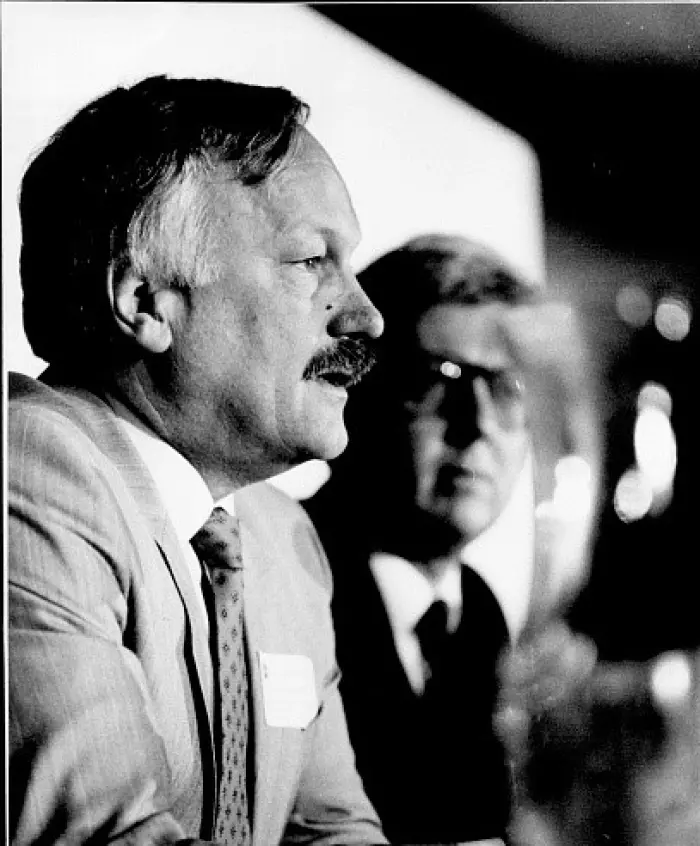

Roger Douglas

The election of the fourth Labour government on July 14, 1984, with Roger Douglas as Finance Minister, was a watershed event for the banking sector.

Two weeks after the election, Douglas removed all controls on borrowing and lending interest rates and on Aug 30, he got rid of the “30-day” rule which had prohibited banks from paying interest on deposits of 30 days or less.

On Nov 18, he removed all outstanding lending guidelines and on Feb 11, 1985, all requirements to hold government securities were taken away. Thus, less than seven months after the 1984 election, the Labour government had removed all trading bank controls.

The major trading banks now had unprecedented freedom to set borrowing and lending interest rates and to determine where they lent.

This seven-month blitz of banking deregulation has had a massive long-term impact on bank lending to the housing market, as illustrated by the following figures:

- In March 1984, just four months before the election, trading banks had total residential mortgage loans of just $0.9 billion, representing 13.6% of total lending.

- At the end of 2020, the banks had housing loans of $296 billion, representing 60.8% of total bank lending.

Massive bank lending has fuelled the housing market, although there have been other contributing factors.

Just think what $296b of lending to domestic sharemarket investors might have done, as the NZX is worth only $182b now compared with $18b at the time of the 1984 general election.

The role of banks

Banks are financial intermediaries; they take deposits from customers and on-lend to areas where they believe they will get the best return for the lowest amount of risk.

Unfortunately, our major, Australian-owned banks don’t seem to have much confidence in the New Zealand business sector as most of their lending goes into residential property as follows:

- 68.9% of ASB loans are on residential mortgages.

- Housing accounts for 67.1% of ANZ lending.

- 51.6% of BNZ’s advances are in the form of housing loans.

- Westpac has 62.3% of its lending on residential mortgages.

It is in the banks’ best interests to keep the residential market elevated, as any major downturn in house prices would have a material impact on their profitability.

The problem with this is who is going to fund the business sector as companies attempt to climb out of the covid-induced downturn?

Businesses will continue to be heavily dependent on the government as the banks, which are the country’s largest financial intermediaries by a wide margin, are now primarily focused on residential property lending.

Disclosure of interests: Brian Gaynor is a non-executive director of Content Limited, the publisher of BusinessDesk, and of Milford Asset Management.

[email protected]